There is is no such thing as “value buying” SaaS today.

“What are interest rates going to do?” That is the question I hear from my investor colleagues. Whether it be in technology, public equities, real estate, or crypto, it seems that everyone is concerned about the macroeconomy. However, the same people will also tell me that you cannot time the market, which appears contradictory. If you are a professional investor, you need to transact in good times and bad times.

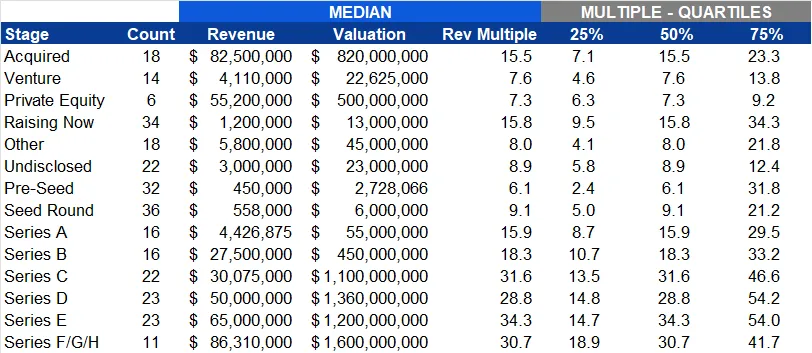

You cannot be a value investor in a growth company in today’s market. Below is a snippet of private SaaS valuation data published by Nathan Latka and aggregated by “Ben, the SaaS CFO.” These guys did an incredible job.

This reminds me of what Chamath Palihapitiya said in a recent episode of the All-In Podcast. To paraphrase he said, “Just because you aren’t investing at a ‘value’ price doesn’t mean you aren’t investing in a valuable asset.” What is more valuable than a highly scalable growth margin business that creates cost efficiencies? If you were investing in value stocks in the S&P 500 for the last 10-years, you missed out on the biggest runs of all time.

I aim to get into exceptional companies for reasonable valuations instead of reasonable companies for exceptional valuations.