What is the line here?

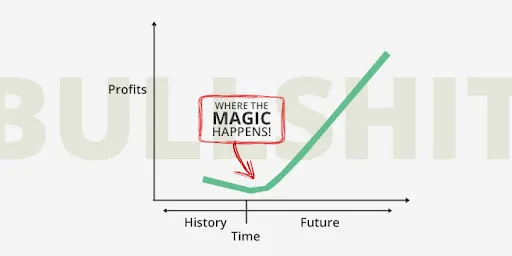

In my seven years of investing in early-stage companies, I have heard many pitches. They all contain hockey stick projections of revenue to show investors of the incredible growth and scale opportunity. Of course, no one believes the growth projects, but we still expect to see them.

If I am serious about a company, I only dive into 12-month projections. Anything more is just mental masturbation. I then check out their historical performance, measure the growth assumptions with how they think about it, and check to see the validity of detail on their pipeline.

If you want a good resource on how to validate a financial forecast. It would help if you listened to – David Sack’s, MD of Craft Ventures, who speaks well financial forecasting in “Sacks on SaaS- Episode 1” podcast via Callin.

So what is the difference between “promoting” and “lying?” There was a great Crunchbase article about this paradigm. In my opinion, the difference is what you can substantiate in diligence.

Historical financials can be reconciled with the bank account statements.

Customers can be validated with contracts.

Product usage can be validated with a technologist.

If you do not do the work and get bamboozled, then that is your fault as an investor. I learned this the hard way with my “Theranos like” story.

If the CEO is creating false invoices and historical financial statements, well, that is just fraud. It will be interesting how the court systems are going to rule with the Elizabeth Holmes trial. How much of her narrative is proven fraudulent vs. investors that did not do the work.

I think that the outcome of this trial will alter how founders create their pitch decks.