The only thing you need to worry about in venture capital/growth equity investing.

Starting a new venture firm is hard. I’m not talking about getting “flow,” winning competitive deals, or raising capital either. Instead, I am referring to the act of keeping myself organized and deliberate. This is a challenge because I am the only person working on the firm full-time.

When I opened my doors in January, I booked time to meet with everyone and anyone. I listened to deals from all stages and sectors, even if they were not my areas of experience. I needed to become relevant as my deal flow dried up when I took a break from the industry after leaving Canal Partners.

I decided I needed to be more organized with how I will spend my time. First, I needed a framework to build my firm. My thoughts immediately went to an investor colleague of mine – Jon Kaiden of Baleon Capital. Jon told me once- “David, there are only two things you need to worry about in this business- its money in and money out.” I love the simplicity of this concept. The only thing I was responsible for was getting money into companies and then making sure I got it back out at a profit.

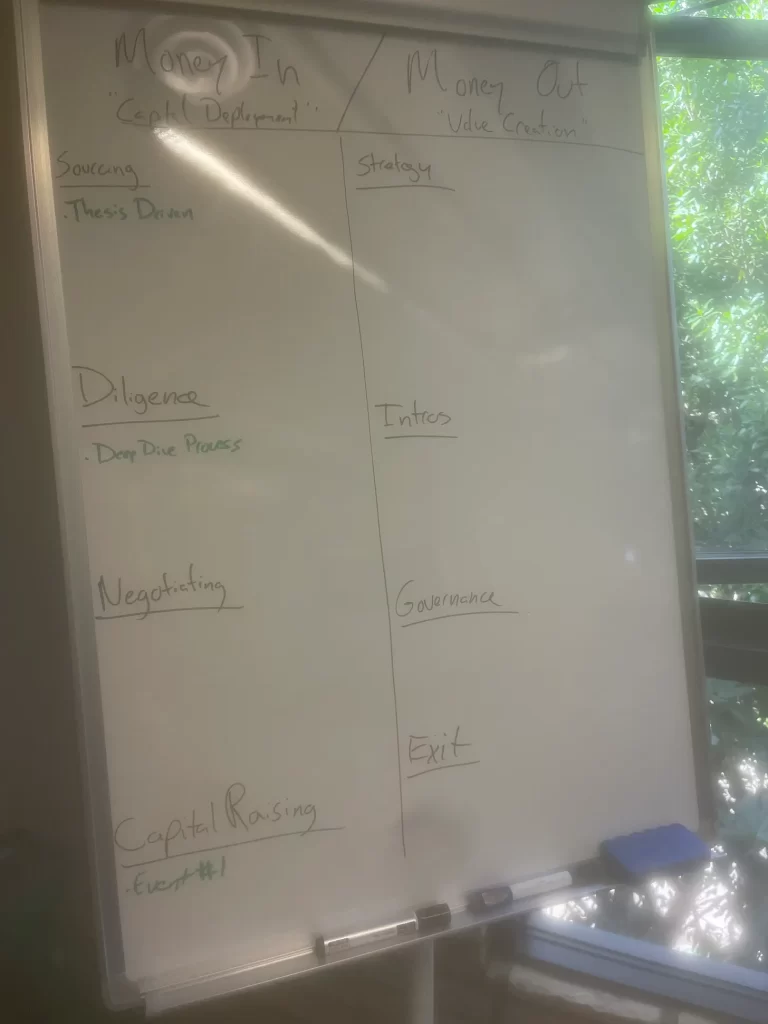

I used the “Money In/Money Out” framework to plan my Q4 initiatives. First, I listed all of the subdomains for both categories on my whiteboard. Forgive the blurriness- my camera lens cracked.

Money In (Capital Deployment): Sourcing, Diligence, Negotiating, and Capital Raising

Money Out (Value Creation): Strategy, Intros, Governance, and Exit

Knowing I couldn’t do everything all at once, I decided to go deeper into sourcing, diligence, and capital raising. I assigned directives and dates for these deliverables. These actions will help structure the firm to have a little more scale than running around like a chicken with my head cut off.