By Tristan Lee

Ambulatory surgery, also called outpatient surgery, refers to a surgical operation that does not require the patient to stay hospitalized overnight. Ambulatory surgery centers, or ASCs, are facilities where these surgeries are performed. ASCs may perform surgeries in several specialties or dedicate their services to one specialty, such as orthopedics, eye care, etc. The medical field continues to make strides in advancements in technology, and surgeries are becoming less invasive than ever. With these advancements and continuing innovation, ambulatory surgery is becoming more normalized and popular than inpatient surgery among patients.

The main drivers of growth for ASCs in recent years are the opportunity for patients to have a procedure done at a remarkably lower cost, as well as the ease for patients to not be hospitalized overnight. This is made possible through minimally invasive surgery (MIS). Minimally invasive surgery does not involve the cutting of muscle, but rather the dilation of muscle and splitting of fibers. Therefore there is minimal damage to soft tissue, allowing patients to, for example, walk out of an ASC on the same day of a full hip or knee replacement.

There has been a significant shift in healthcare in recent times, in the form of hospital cases, also notated as inpatient cases, being shifted to ambulatory, outpatient cases. This has become more normalized as both payers and patients are able to get equal, if not better care for a fraction of the cost of the same procedure being done in a hospital setting.

Following this gain in popularity, the ambulatory surgery market size is projected to reach nearly $60B by 2028, with a CAGR of around 7%, in contrast to 2021’s market size of ~$37B. With more eyes on this space than ever before, there is significant demand for innovation and growth in the solutions to ASC’s key problems.

The Problem:

Hospitals have primarily been outcompeting ASCs for their workforce benefits, therefore leaving many ASCs facing understaffing issues. ASCs are challenged with locating skilled doctors and nurses, as well as scheduling/billing personnel. Understaffing has been the most recent and detrimental issue plaguing the ASC market space. With the recent market shift, payers are making severe changes to what procedures can be performed outside of a hospital setting, therefore creating a higher demand for ASC care. This shift, along with the shortage in staffing has compounded to create a large problem set many ASCs are challenged to solve.

Supply chain backups and setbacks have been affecting nearly every industry for the last few years, and the ASC space is no different. In previous times, ASCs would be able to order nearly all of their required equipment from a single supplier, but currently, most of these suppliers do not have the same stock of equipment as before. In addition, prices have risen due to this change, largely causing ASCs to have to source their equipment from multiple suppliers rather than one. This pricing change has forced ASCs to shop from supplier to supplier, thus becoming very time-consuming and difficult to record for inventory purposes. The shortage of supplies leaves many ASCs to shortage game, ordering materials in excess rather than on an on-demand basis.

In recent years, with the payer shift in procedures to be allowed in an ASC setting, being out-of-network with payers is mainly proving to be unprofitable. Payers have as well begun legal battles with ASCs for previous reimbursement payouts, as payers have previously overpaid for procedures in contrast to current reimbursement rates. As this recent market shift occurred, payers began tying their out-of-network reimbursements to what Medicare’s reimbursements are for similar or the same procedures, and at a much lower rate than current inflation rates. Therefore, this has caused a collapse in out-of-network facilities, forcing them to become contracted with payers or to close their doors entirely. Becoming contracted is a major challenge as well, as being in-network with an insurance provider generates good patient volume, however, their reimbursement is sometimes below Medicare rates. Furthermore, surgeons must treat more patients in the same amount of time to make a profit, significantly reducing the quality of care. Ultimately, this leaves ASCs to enter long and often fruitless negotiations with payers for acceptable contracts, or to join a management group with existing contracts that take a 5-7% fee of ASCs net operating revenue. Contracting with management groups generally provides ASCs with a steady flow of clients.

ASC Ownership Breakdown

Capabilities:

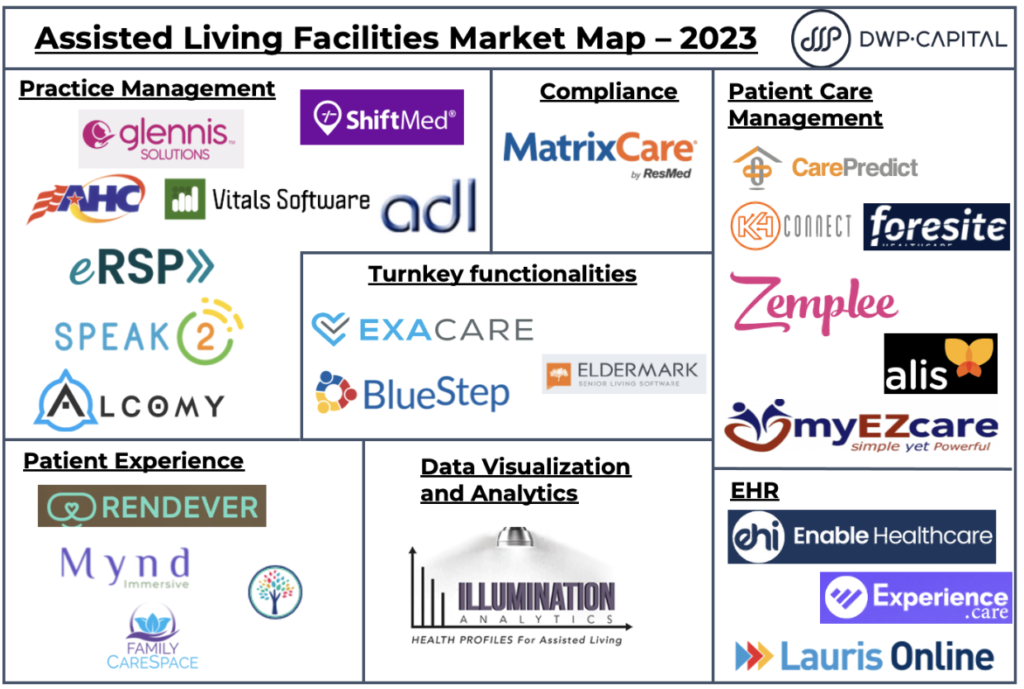

ASCs are continuing to gain more momentum and popularity among patients and payers, there is a significant demand for growth, with many companies eager to capitalize on them. In my market map above, I have segmented companies that are solving the key pain points of ASCs into five categories: practice management, revenue cycle, inventory management, and business intelligence. Many of the companies lack a direct focus on one certain issue, rather they tend to bundle many capabilities as services they offer in packages. Therefore, a multitude of these companies offer a similar set of solutions in their bundle but have been categorized in terms of which solution they provide is unique from one another.

Practice Management:

The way in which many of the issues surrounding the staffing shortage are being solved is by putting more of the scheduling and communication work in the hands of the patient, automating the process, and taking the coordination work out of the hands of the ASC. This also includes the automation of EMR/EHR communication between the patient and the provider, allowing for rapid translation of vital information. Great examples of this patient engagement and management tool bundles are Surgical Information Systems, Surgimate, and Steer Health which are incorporating AI in their solutions. These are just a few examples of great tool sets offered to automate and simplify ASCs workflows.

Revenue Cycle:

The way in which the revenue cycle is completed now is through the automation of billing, rather than having a staff member create and send an invoice to a patient. This is eliminating the aspect of human capital, solving the issue of understaffing in this sector, and creating more time for ASCs to focus on providing care for patients. This has been implemented in the way of having a central dashboard for ASCs to view invoices that have been sent to patients and track the progress of payment. Graphium Health, Medical Healthcare Solutions, and Ulrich Medical Concepts are platforms that specialize in this and look very polished from my perspective.

Inventory Management:

Ordering materials and supply chain management have been recent issues hindering ASCs, as expansive inventory is difficult to properly notate and therefore order accordingly. This system is now becoming more automated to limit material lag and bookkeeping issues. Currently, this is being implemented by having a configurable database that is able to be utilized by both the ASC and the supplier, therefore allowing the supplier and ASC to have a shared record of inventory. Inventory services such as CapExpert, Symmetric Health Solutions, and Procurement Partners offer well-rounded services for ASC inventory management and ordering.

Credentialing/Compliance:

Compliance has been an ongoing issue as it is a monotonous task that the recent staffing shortage has only amplified. Companies have been automating the logging of information to combat this issue. Compliance logs were previously organized and accounted for in a paper format, and are now shifting to an automated, digital format that is reducing time and allowing ASCs to be more efficient in their operations. With credentialing and compliance shifting to a more efficient method, HealthStream, and ASC Logs are a couple of providers leading this change.

Data Visualization/Analytics:

The way in which data is configured and consumed is shifting from the previous paper method to a digital charting format. The way in which supply chain, inventory, patient relations, and more are changing to a more digital setting. The solution set includes dashboards in which ASCs can view nearly every aspect of billing, ordering, and/or patient notes. Providers include platforms like Provation, HST Pathways, and ASC Data which is specialized in this space. These providers include different tools in their services, therefore ASCs have multiple options to find the best solution suited for them.

Conclusion:

After reviewing the companies and solution sets provided for the ASC issues described, I believe that scheduling, billing, and inventory management automation is here to stay. The problem of understaffing does not seem to have a clear solution as of yet, therefore, the old paper systems of logging and the human capital of scheduling and billing seem to be out the door. By ASCs placing more work responsibility in the hands of the patient in a streamlined, automated format, ASCs are able to be more efficient financially and able to cut the lag time of patient-to-provider communication.

Ordering and supply chain communication are making leaps and bounds over the previous, limited communication, ways of ordering and reporting. Having software to automate communication and inventory management cuts out a long-time issue of inventory management that ASCs and countless companies in other sectors have previously been struggling to solve.

However, I have been unable to find a solution that streamlines payer contract negotiation. There are companies available that do simplify billing procedures with payers, although a solution that directly addresses quick payer and ASC contract negotiation would be a very in-demand product.

Ultimately, this market space is rapidly evolving, and there is a race for innovation to solve the ever-constant issues that are arising. The way ASCs operate will continue to shift and change as payers make changes in the ways in which they operate. In turn, this leaves the door wide open to new companies with fresh perspectives and solutions to make breakthroughs in the ASC space, it has been and will continue to be an interesting ride to follow along with.

If you have information you would like to share about the ASC or see added to the market map please contact David Paul at david@dwpcapital.com.

Airtable of all ASC Software/Service Vendors here.