Overview

Post Acute Care (PAC) and Senior Living Communities are two related sectors within integrated healthcare, a burgeoning ideology in medicine. Integrated Healthcare is one of the fastest-growing healthcare sectors, producing coordinated healthcare services to patients. It addresses the biological, social and psychological patient needs. Post Acute Care (PAC) provides services to patients post-hospitalization to help them regain their strength and return home, while senior living communities house elderly patients to provide them with close care.

Post Acute Care

The Post Acute Care Market has a $723.5 Bn US Market Size, over 6.8% CAGR from 2023-2032.

| By Modality of Care | Description | Market Size | Number of facilities in the U.S. |

| Skilled Nursing Facilities | Provides ongoing health care services for any health condition. Most likely to be opted for by the elderly population. | $151.0 Bn (2022) | 18,700 |

| Home Care | Offers healthcare services such as bathing, dressing, medication and monitoring in the comfort of the home. | $129.9 Bn (2022) | 426,820 |

| Long-Term Acute Care | Provides patients with severe health conditions requiring extended treatment post-discharge for a minimum of 20 to 30 days. | Over $300.0 Bn (2022) | 420 |

| Inpatient Rehabilitation | Therapy is offered to patients to boost their strength and coordination. | $221.9 Bn (2021) | 45,905 |

Assisted Living Facilities

There are ~ 36,600 senior living communities, with 1.2 m licensed beds

Importance of PAC in Medical Spending

PAC forms a substantial part of Medicare spending. In 2013, 42% of Medicare Fee-for-service (FFS) enrollees were discharged to a PAC setting following a hospitalization. In 2021, MedPAC estimated that PAC accounted for $60bn (15%) of annual Medicare spending alone.

Indeed, PAC is the single greatest driver of Medicare spending variation. The geographic variation of PAC access and quality accounts for 73% of the variation in total Medicare spending. Common conditions and procedures that lead patients to be discharged to PAC include total hip/knee joint replacement, sepsis, heart failure, stroke, pneumonia, urinary tract infections, COPD, renal failure, and cellulitis.

The Problem

The macro-economic headwinds for post-acute care market expansion

Over the next few decades, post-acute care and assisted living facilities can expect to see general market expansion due to the aging population, as already demonstrated by rising hospitalization rates. Moreover, as healthcare fee structures shift from fee-for-service to value-based care, there is an increasing demand for care that looks after patients in the long term.

Rising costs within the industry

Moreover, there are rising costs within the industry due to changes in regulations that generate pressure to reduce costs. These changes hit the bottom lines of payers. Furthermore, payers (our facilities) are now becoming their own providers for cost efficiency. When fixed and variable costs in the industry are also rising – due to at-home patient facility stays being shorter, patient volumes and acuity rising, reimbursement decreasing from public and private payers, dynamic workforce crisis spanning paid aides to family caregivers – there are immense pressures in the industry to reduce cost.

Patients want PAC in Senior Communities

Patients also increasingly prefer to recover in a home setting rather than a hospital setting, evidenced by surges in post-acute care instructions, and unprecedented labor shortages in home health agencies. Moreover, home-based care is an opportunity to lower PAC costs, which is an incredible opportunity to invest in given that SNDs (the alternative PAC provider) have been facing low demand coming out of the pandemic.

The need for innovation and integration

Finally, there are so many inefficiencies that exist in the technologies that are used in both PACs and ALF, outside of the headwinds and demand for cost reduction pressures.

There are incredibly high staff turnover rates in PAC and ALF (due to tolling working conditions), which represent an opportunity to innovate in practice and staff management within the industry.

The Opportunity in Post-Acute Care within Assisted Living Facilities

For DWP Capital, the post-acute care landscape within assisted living facilities offers substantial opportunities. The demographic trend of an aging population ensures a growing market for such services. Moreover, there is a need for investment in innovative technology solutions that can streamline operations, improve care coordination, and enhance patient experience. From telehealth platforms that enable remote monitoring to advanced analytics for predictive care, DWP Capital has the chance to back companies that can revolutionize the quality and efficiency of care. The following technologies represent opportunities where DWP Capital can deploy capital to accelerate the integration of post-acute care within assisted living facilities.

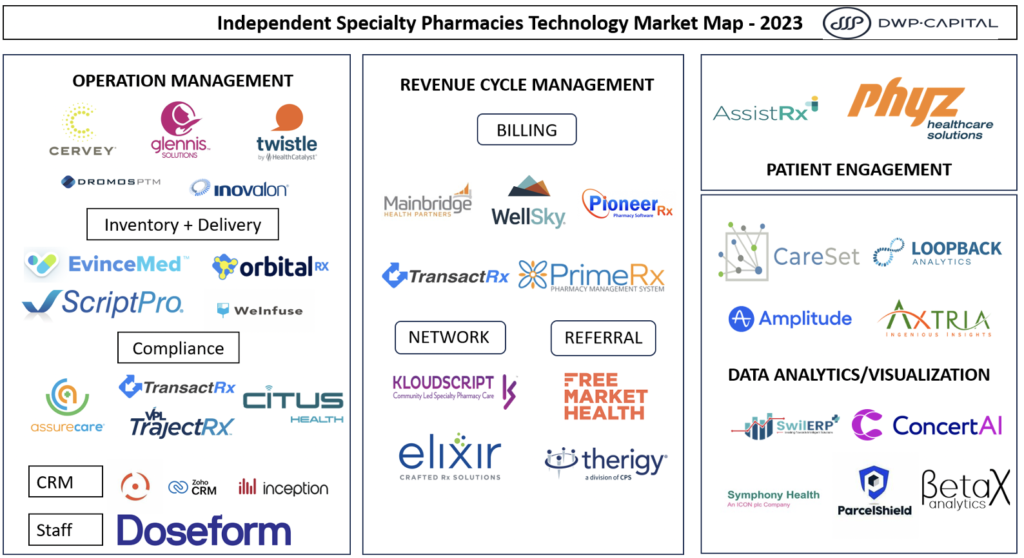

Software Stack

EHR

Electronic Health Records (EHR) are digital forms of patients’ paper charts. Within the post-acute care setting in assisted living facilities, EHRs are incredibly important as they provide real-time, patient records to authorized users that are instantly and securely accessible. They improve patient care by allowing healthcare providers to quickly access their records, better coordinate care amongst the healthcare team and track data efficiently over time. EHRs can also alert staff to potential changes in a patient’s condition or remind them of patient-specific instructions, crucial in both assisted living and the post-acute care setting as elderly patients may have complex medical needs.

Some examples include:

- Enable Healthcare Inc.: Their main product is an EHR

- Experience Care: Provides comprehensive EHR systems for long-term care facilities. Also includes financial and revenue cycle management. (also patient management)

- Lauris Online: Marketed as the most customizable, flexible behavioral and mental health EHR in the industry.

Patient Care Management

Care Management technologies are technologies that enable staff to coordinate care, manage medications, and track patient progress towards goals by directly gathering data from patients. They differ from Electronic Health Records in that they are focused on managing the communication and coordination between healthcare staff, rather than managing patient information. Moreover, they may have the additional capabilities of communicating with residents, family members and other healthcare providers to ensure seamless and integrated care.

Some examples include:

- CarePredict, Inc.: Uses wearable technology to predict potential health issues, which aids in care management.

- K4Connect: Provides a technology platform that combines various aspects including patient monitoring, analytics, and resident engagement.

- Foresite Healthcare: Offers predictive analytics and resident monitoring to capture patient data.

- Zemplee Inc.: Provides AI-driven solutions to passively monitor patients. They pride themselves on preserving the privacy and dignity of patients.

- Medtelligent: Known for the ALIS software, which is used for care management such as managing compliance as well as full eMAR management and drug counting, and integrated assessments in assisted living. (also compliance)

- myEZcare: Provides a care management platform that hosts telehealth, electronic visit verification and adult day care software.

Data Visualization/Analytics

Data Visualization and Analytics tools enable staff in assisted living facilities to accurately and efficiently interpret complex data sets vis-à-vis patient care, operational efficiencies, and compliance. This can be done by transforming data into visual formats like graphs and charts, revealing patterns, trends, and correlations that might go unnoticed in raw data. In the post-acute care context, such capabilities can inform better decision-making around patient care and resource allocation.

Some examples include:

- Illumination Analytics: Creates a database from inputs of residents and their medications, which helps manage patient information and encrypts it to make it HIPAA compliant.

Compliance

Compliance technologies allow assisted living facilities to adhere to regulations and standards subjected to healthcare facilities, such as HIPAA for patient privacy, ACA for healthcare standards, and various state and federal guidelines. Such technologies may automate the tracking of changes in regulations, and manage documentation and reporting requirements. This is crucial as compliance not only affects legal aspects of assisted living facilities but also the reimbursement rates of these facilities.

Some examples include:

- AOD Software (now part of MatrixCare): Their software assists with various aspects of compliance management in assisted living facilities. They also offer practice management functionalities such as billing, scheduling, payroll management etc. (also practice management)

Patient Experience

Under patient experience, we see two major types of technologies: virtual reality and patient events. Virtual reality is a growing field that facilitates patient rehabilitation. They provide immersive, engaging environments for patients to stay mentally active, or safely perform physical, cognitive or occupational therapy exercises. Patient Events technologies manage and track patient events to coordinate aspects of a patient’s life in the assisted living setting. Some key functionalities can include scheduling activities, appointments, social events, and therapy sessions.

Some examples include:

- Rendever: Specializes in VR experiences for the elderly to overcome social isolation, which can also be used in assisted living for cognitive therapy and engagement.

- MyndVR: Provides VR experiences designed to be a low-intervention solution to age-related challenges such as Alzheimer’s/Dementia, isolation, and depression.

- TSOLife: Focuses on documenting resident data, events and communications, which can be used in patient engagement and events.

- Family CareSpace: Provides a platform which includes contact tracing, giving stay-at-home solutions and alerting, posting and location services that could be useful for managing patient events and activities.

Facility Management

Finally, practice management systems help assisted living facilities manage their business. They may be responsible for administrative and billing tasks, appointment scheduling, document management, and other back-office functions. This is important to assisted living facilities as it helps them streamline operations, reduce administrative errors, ensure timely billing and reimbursements, and ultimately devote more resources and manpower to patient care.

Some examples include:

- ShiftMed: Their staffing solution allows workers to manage their schedules while assisting in supervising patient medication programs.

- Glennis Solutions: manages the full resident lifecycle – sales and marketing, leasing and billing, and resident engagement – through their senior living software. Also has eMAR – which has financials and business insights.

- Kaleida Systems Inc: Offers eRSP, a home care and care management solution. Also helps schedule, bill and payout staff.

- American Health Care Software: Simplifies billing procedures, expense tracking, as well as tools to document care of care receivers for nursing homes, assisted living and other health care providers. (also patient care management)

- Vitals Software: Offers a complete suite of tools for operating senior living communities for practice management with a proven track record of increasing occupancy.

- Alcomy: Specializes in software solutions for senior care for practice management, which also offers a smartphone application with a 95% adoption rate.

- ADL Data Systems, Inc.: Provides comprehensive software for managing long-term care facilities such as managing invoicing, claims, Medicare, Medicaid, insurance and private payers. Also has an administration dashboard.

- Speak2 Software: Creates engagement software that targets the staffing crisis in senior living by streamlining staffing and capturing services.

Companies that fit into multiple capabilities:

- ExaCare: Manages a suite of patient functionalities from resident onboarding, EHR, assessment tracking, ADL management, incident tracking and resident compliance tracking along with other staff management functionalities. ( also compliance, EHR, patient care management, practice management)

- Eldermark Software: Offers solutions for EHR, analytics, resident engagement, marketing and billing within their suite.

- BlueStep: Their Bridge platform offers a wide array of services that include EHR, care management,

- and compliance.

Risks

Regulatory Changes: The healthcare industry is heavily regulated, and changes in regulations can significantly impact the operation and reimbursement rates of post-acute care facilities. Keeping up with these changes and ensuring compliance is crucial.

Reimbursement Challenges: Medicare and Medicaid policies often change, affecting the reimbursement rates for post-acute care services. Shrinking reimbursements can strain the financial viability of senior living communities, especially if they heavily rely on government-funded programs.

Staffing Shortages: Finding and retaining qualified healthcare professionals, including nurses, therapists, and support staff, is a perpetual challenge in the healthcare industry. Staff shortages can affect the quality of care and, subsequently, the reputation and financial stability of the facility.

Medical Liability: Healthcare facilities are vulnerable to medical malpractice lawsuits. Adequate insurance coverage is necessary, but rising premiums can significantly impact operational costs.

Changing Consumer Preferences: As the preferences of seniors and their families change, the demand for certain types of post-acute care services might fluctuate. Communities need to adapt to these changing needs, which can be costly and challenging.

Conclusion

I see there being 2 main areas for high potential investments: 1) technologies that address the ever increasing high unit economic costs in assisted living facilities and 2) technologies that tackle practice-based problems.

To the first point – we see there is a great opportunity for solutions to the impending influx of patient volume and disease acuity in the future. Technologies such as illumination analytics, which creates a database from inputs of residents and their medications, to manage their information would tackle the high volume of patients and their data. Moreover, as patients increasingly prefer home-based care, solutions similar to Glennis Solutions which automate the sales, marketing, leasing and billing of residents become extremely valuable to assisted living facilities that need to cope with the higher patient volume.

To the second point – a direct and key flow-on effect for greater patient volumes is even greater labor shortages in assisted living facilities. The greater demand for healthcare services alongside already high staff turnover rates in assisted living facilities means that facilities will be looking for technology that manages their staff – for example, ShiftMed and Speak2 Software. Moreover, compliance management software that reduces the human capital to ensure regulations are met would also perform exceptionally (Illumination Analytics and AOD Software). Finally, technology that generally addresses healthcare coordination between staff and practice directly reduces the burden on staff, so communication platforms under practice management would continue to rise in demand.