Despite what Yahoo Finance’s daily click bate articles say- I am bullish on the macroeconomy in 2022. But, first, I wanted to break down Goldman Sachs, and UBS analyst reports.

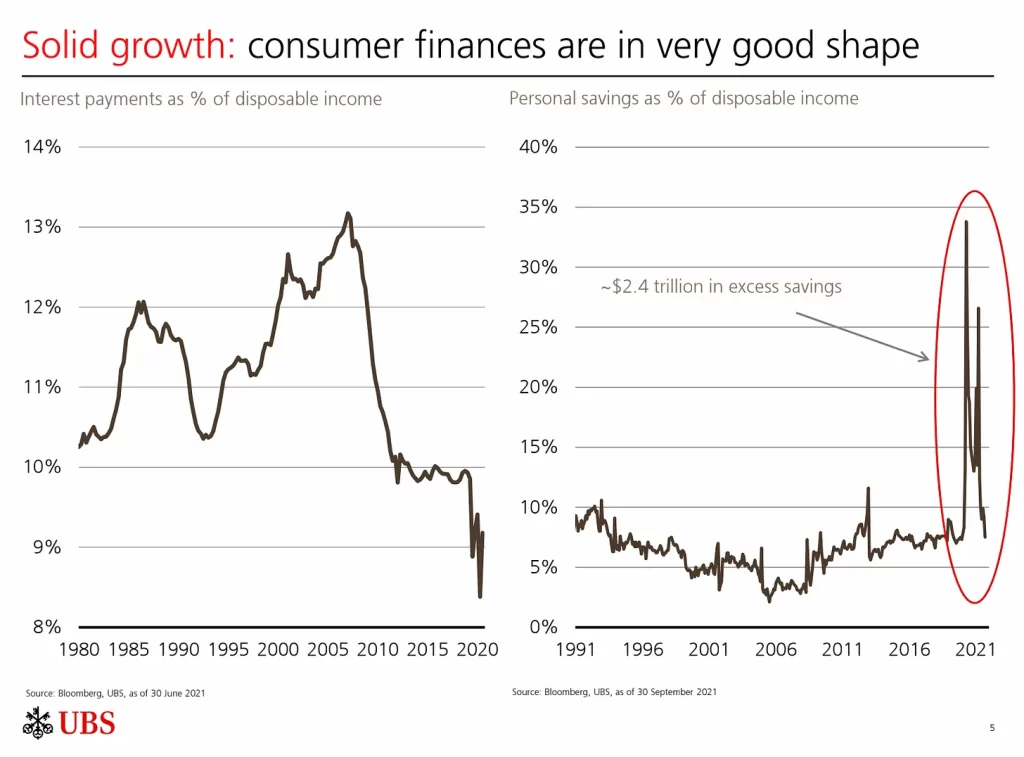

Tons o’ Cash

Consumers and businesses have massively deleveraged. The amount of savings and liquidity on the sidelines is staggering. This discretionary capital will result in people buying goods and services – hence companies still making money.

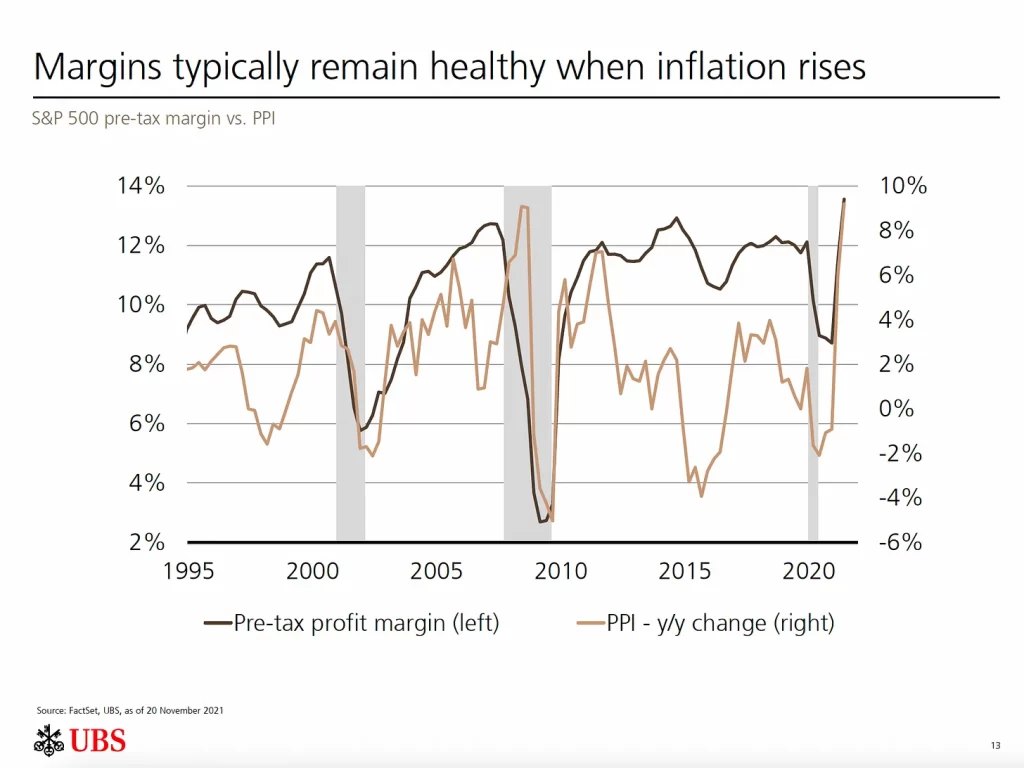

Rising Tides Floats All Boats

Historically speaking, margins have remained intact during inflationary periods. As a result, goods become more expensive, but people are also getting paid more to afford these goods in services. The worry is stagflation- where goods and services become so costly that people do not want to buy them, and there is no growth. Data today shows that people are getting cost of living adjustments to their take-home wages to combat inflation.

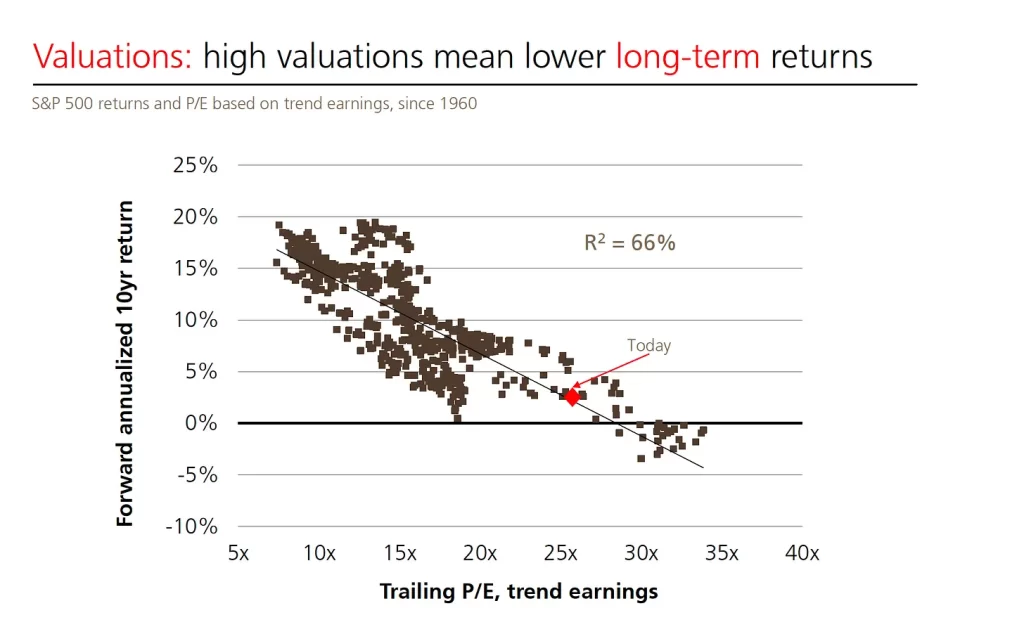

Valuations: Where else are you going to put your money?

Valuations are high, but the markets appear to price in interest rates hikes. If you pull away from the mega-companies like Apple, Tesla, and Microsoft, the NASDAQ has seen pullbacks for more prominent growth names this year. Equities valuations remain high but are still less expensive than bonds. Overall I believe that the return profile for equities alternatives will be yield lower returns due to entry prices.

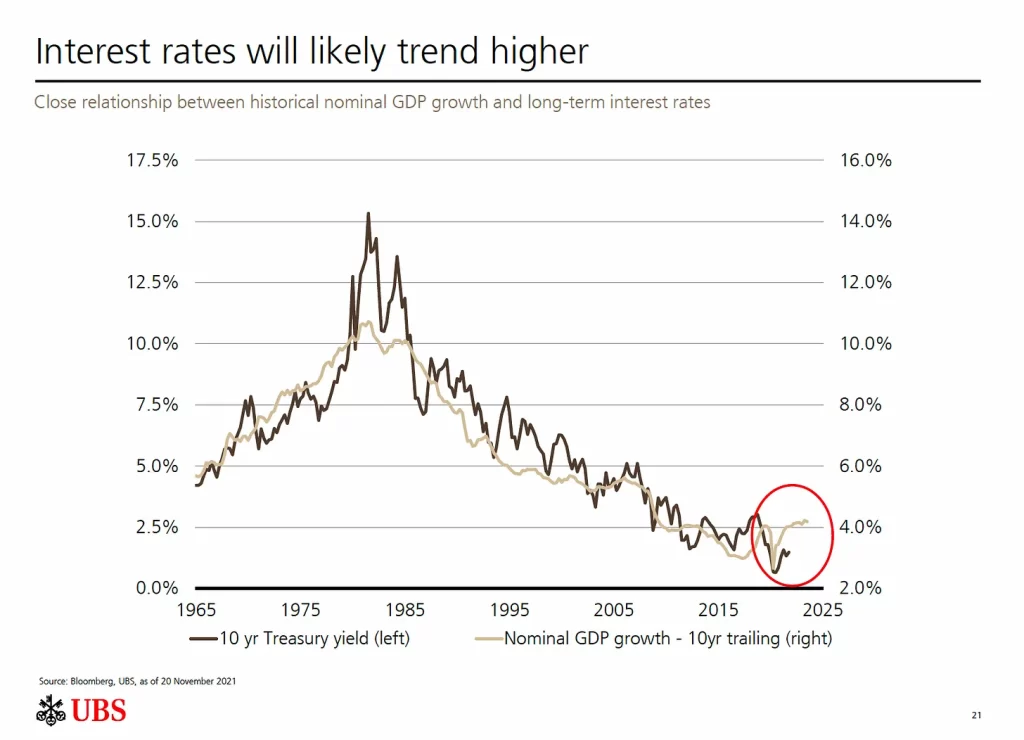

Interest Rates

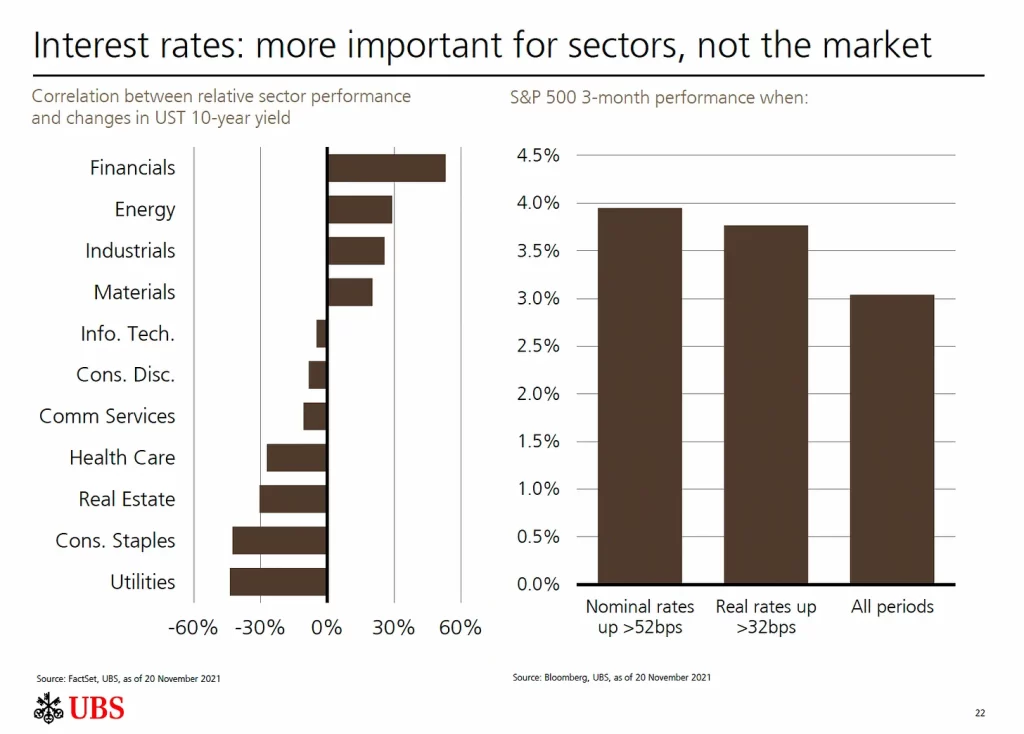

Interest rates will go higher as they should to combat inflation. Rate hikes will cause a pullback in some growth names where people are betting on 10-year forward-looking earnings and into more value-based sectors like financials and energy. The chart below also shows that interest rates affect sectors more heavily than the overall market.

In today’s climate, the word we need is moderate or centrist. People are sick of polarizing views on politics or the economy. Goldman Sachs did a phenomenal job wordsmithing their outlook below.

“Our baseline forecast is that the global economy gradually transitions from a highly unusual pandemic recovery to a more normal expansion starting in 2022. During this transition, demand slows while supply rises, growth shifts from very rapid to merely solid, activity rebalances from goods (and in China housing) to services, and inflation moderates. Monetary policy shifts from highly accommodative to slightly more normal, although the normalization speed varies greatly by economy.

Despite all this, we are unlikely to revert fully to the pre-pandemic macroeconomy. New monetary policy frameworks, more ambitious fiscal policy, green investments, and healthier household balance sheets all point to stronger aggregate demand for a longer period. Stronger demand, especially for investment, along with the uptick in inflation expectations due to the pandemic inflation shock, suggest that we are on a long road to higher nominal interest rates relative to the post-GFC world.”

Is there going to be a recession? Absolutely. That is like saying the sky is blue. My prediction is that what is going to cause a market-defining recession is with some type of conflict with China or when our countries party system wants to start politicizing the national debt. The latter was interesting speculation brought by Howard Lindzon in one of his weekly publications.

Onwards and upwards to modest growth in 2022 with some volatile swings both ways!