The Berkshire Hathaway annual meeting occurred last week. Berkshire is up 7%, while the rest of the S&P is down 14%. From what I read, there was a lot of gloating going on. They criticized the retail investors as gamblers and identified Bitcoin and other cryptocurrencies as evil. But, as I like to say- everyone is in the opinion business. More on the Woodstock of Capitalism here. Onward.

April had a terrible month in the public markets. Rising inflation misses in revenues/earnings, and still, no end in sight to the Russia/Ukraine conflict has everyone at the edge of their seats. Additionally, indices identifying the US people’s savings have also gone down 6%. I believe the Fed is in a tough place right now. Raising interest rates in a contracting economy is not an excellent formula. In last week’s episode of the All-In Podcast, David Friedberg said that he believes the quarterly numbers posted might be misleading as people still have desires for goods and services. Still, companies cannot book the revenue to supply chain constraints. I can buy that to an extent.

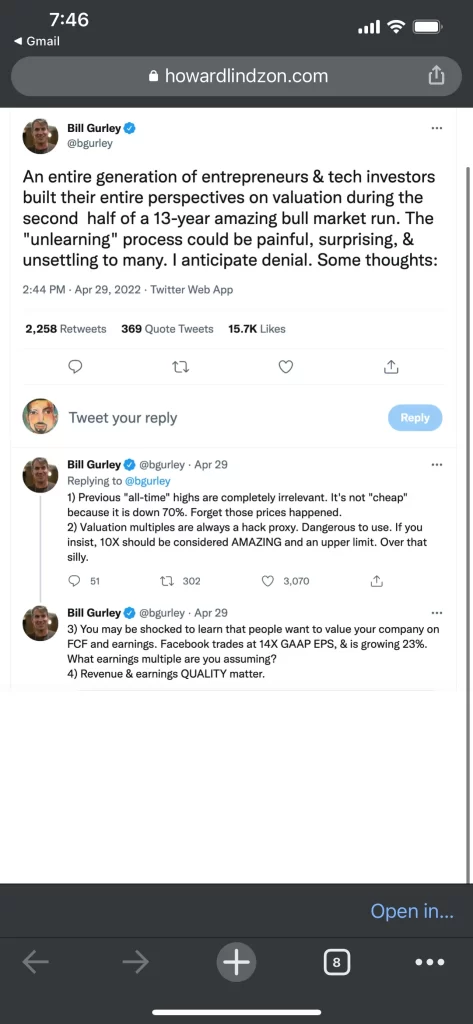

In regards to the private markets- there is absolutely no consensus. It seems half the VC world thinks there is going to be a great reset while the other half believes the abundance of capital will keep companies going through these bad times. Here is a great tweet by Bill Gurley that was captured by Howard Lindzon.