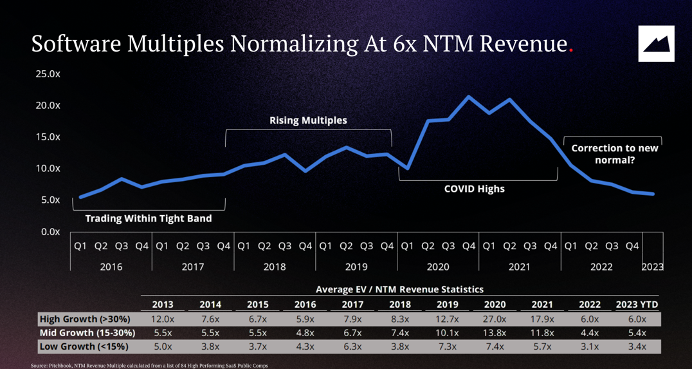

Q1 2023 Public/Private Market Outlook

//The following is an excerpt from my quarterly market intelligence memo that I send to DWP friends and limited partners. If you would like to have access to the entire letter, which includes information on deal flow pipeline and valuation ranges, please leave a comment and let me know. I’ll be sure to add you […]

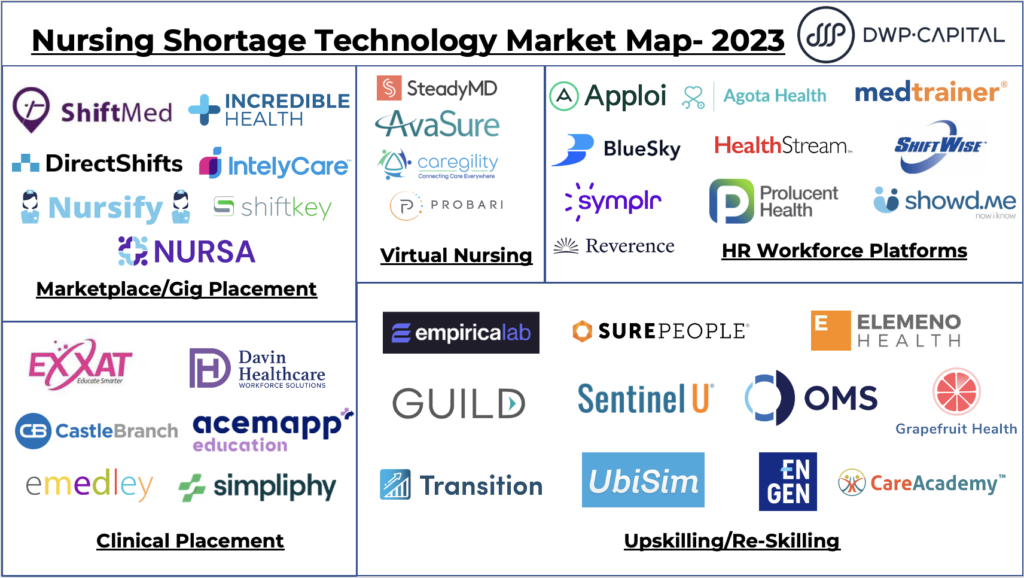

The Nursing Shortage Crises: A Serious Venture Opportunity?

It’s no secret that the United States is facing a shortage of nurses that has been growing steadily over the past decade. According to the American Nurses Association, the U.S. is short around 200,000 RNs and could be short as many as 1 million by 2030. But what if I told you that this shortage […]

Why We Invested in Statera

This month DWP Capital Invested in software-as-a-service company Statera Software, based out of Boston, Massachusetts. Statera offers a way to provide visibility, transparency, and engagement to provide compensation for corporately owned medical groups. The round was a $2.5M seed extension that will be used to accelerate the sales pipeline and continue to build out the […]

Happy Holidays from DWP Capital!

I hope everyone had an incredible holiday. Our family was blessed with mountains of worthless plastic toys and sugar. It is the most wonderful time of the year. Now we are in the doldrums between Christmas and New Year, where people are supposed to be working but are not. Despite the reluctance to jump on […]

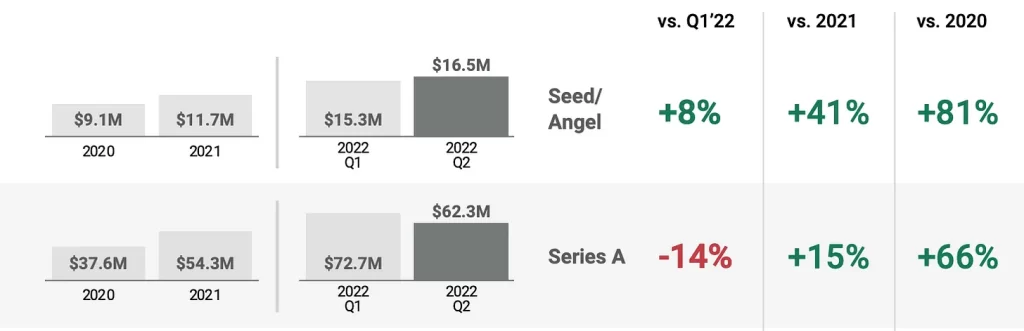

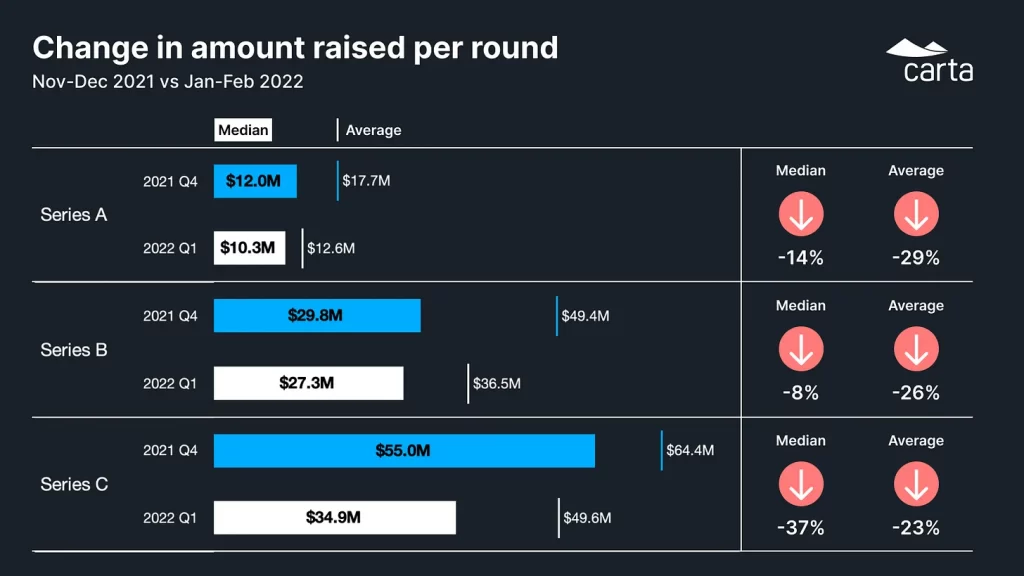

Q2 2022 Private Valuation

Everyone Is Getting Pucker Butt There are new valuation data hot off the press. Attached is the data from CB Insights- overall, I feel it is pretty accurate as I have seen comparable analyses from Carta and Pitchbook. I chose to highlight CBInsights as they have additional deal terms like liquidation preferences and dividends that […]

Deal Sourcing H2 2022

Well, Two of my three kids are sick with some stomach bug. I guess washing the kid’s hands after the park and school is essential. Nothing feels as helpless as a parent trying to make your kid feel better when sick. Hopefully, they turn around today. Onward. This week will be busy as we are […]

Q1 2022 Valuations Contracting

I find myself fortunate that I have been sitting on my hands from investing in the last 6-months. I wish it were to say that I am a market-timing genius, but I’m not. This year, I came very close to investing in some companies – trying to be a price taker and pay “market prices.” […]

2021 Private Market Outlook

Excerpt form my 2021 Investor Letter Below below is my excerpt from my 2021 Shareholders Letter. If you’d like to read the whole letter please just reach out to me directly. After writing this it is making me really think about how I need to look at Seed investing in 2022. I will be writing […]

2022 Predictions and Themes from my Annual Shareholders Letter

There is nothing worse than a waffling investor. A true capital allocator has to have conviction in the future and be willing to be wrong. Below is a list of trends and themes for 2022 from my annual shareholder’s letter. If you’d like to read the full letter, please respond and let me know. Vertical […]

Why I Invested In Datum

Datum is a sourcing solution for space manufacturers. They connect original equipment manufacturers (OEMs) to the fragmented CNC market. The current process for sourcing aerospace parts is time-consuming, nontransparent, and inefficient. The result of the current process results in quality issues, late deliveries, and high costs. Additionally, the CNC shops have no way of being […]