Founders: In Case Someone Didn’t Tell You…You Can Take Less Money

One of my favorite scenes in Silicon Valley is when the protagonist Richard asks a failed founder why he raised so much money at a big valuation that ultimately lead his company’s demise. The founder was puzzled and wondered what more he could have done. Richard replies “well you could of taken less money..” Comically […]

The Myth of Effortless Growth: Debunking the Bootstrapped Startup Fantasy

One of the biggest positive founder/company heuristics that was taught to me in my early days of venture investing was how big a company has gotten in correlation to how much capital it has raised. It was a litmus test to how gritty the founder was, as well as how much desire the product had […]

Tech Stack Trivia: Mastering the Art of Knowing Your Customer’s Digital DNA

Do you want to know how to really the quickest way to determine how much your founder knows about their customer? Ask them about their customers technology stack. What I mean by tech stack is the list of software companies their customer utilizes to complete their workflow. This seems like a super easy question to […]

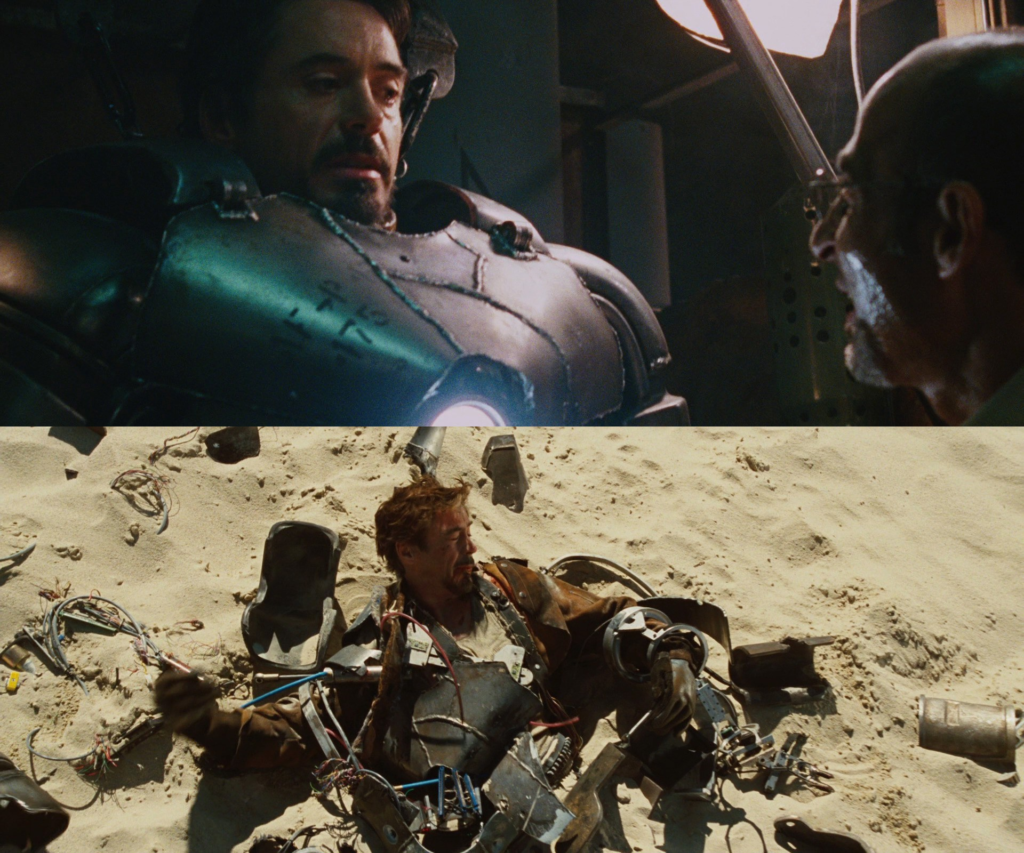

The Iron Man Analogy: Why Founders Are Tony Stark and Investors Are the Suits

Starting a business can be challenging, especially if you haven’t done it before. There will be ups and downs, good and bad moments, but in the end, your sweat and blood will be the driving force behind your success. As a founder, you are the hero of your startup journey. Your investors are there to […]

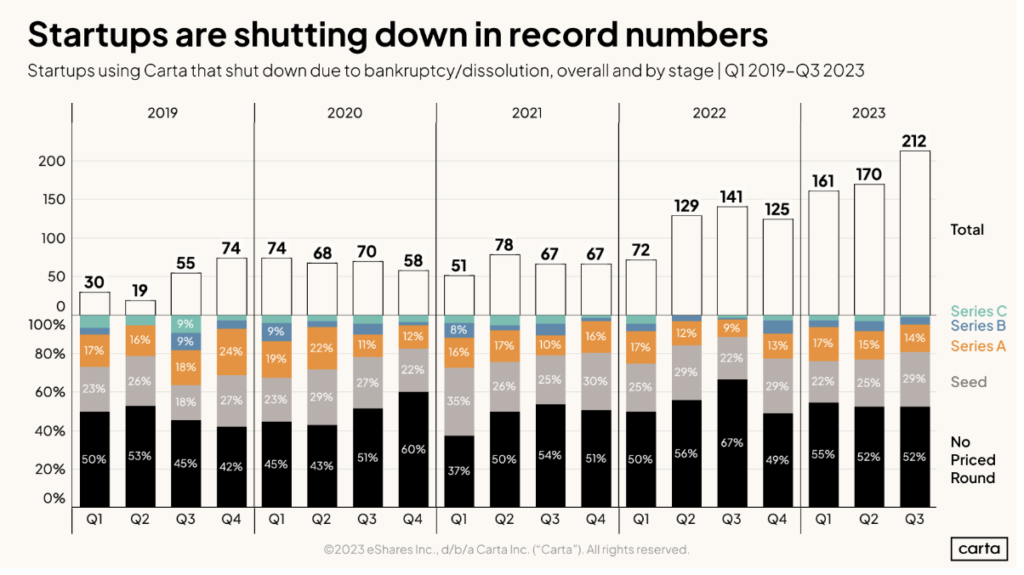

Rising from the Ashes: Surviving the Startup Apocalypse of 2023

2023 is turning out to be a tough year for startups. Recent data coming out by Carta has shown the number of startups shutting down accelerating over the last couple of quarters. This is due to the slow down of venture capital deployment, which is forcing everyone to play their hands very tight, taking an […]

The Rise of “Early Growth Equity”: A Game-Changer for Startups

As a founder, it is imperative to understand the different types of early-stage capital available, the return requirements of each capital stack, and the success metrics set by investors. Many early-stage VCs have similar requirements, pushing for a return of 100x on each deal. However, a new category of early growth equity has emerged, enabling […]

The B2B SaaS PMF Spectrum: Are You Weak, Strong, or Somewhere in Between?

For a founder, achieving product-market fit (PMF) is a critical milestone in their entrepreneurial journey. It marks the point where the product’s potential market niche, pricing strategy, target customer, and sales and marketing tactics align, resulting in strong customer demand and growing revenue. But determining whether you have achieved PMF is not a straightforward yes […]

Building a Team or Planting a Time Bomb? The Reality of Multi Co-founder Startups

Starting a successful business is a dream of many, but the journey is not always smooth. One of the decisions that can make or break a startup is the choice of co-founders. While having someone to share responsibilities and workload is comforting, multiple co-founders also come with inherent risks that can derail a startup. In […]

Building Software that Sells: The Interplay of Features, Capabilities, and Products

Last week I had breakfast with one of my favorite people Pete Colligan. He has been a lifetime product and engineering leader at SAP and is one of the most intelligent and thoughtful people that I know. Over eggs and bacon I had him tell me about what the difference was between features and capabilities. […]

Navigating the VC Jungle: Debunking the Myth of "Sharky Deals"

The venture capital market can be a difficult place for founders. Recent data from Carta has shown that there have been significant down-rounds and funded deals with unfavorable terms over the last quarter. Many founders feel like they are being disenfranchised as the market appears to have turned on them. They feel that they are […]