How Founders Pick Which Advice to Follow

Everyone is in the opinion business. This is especially true in the ego-heavy startup world where many archetypes give advice – former founders, venture capitalists, software execs turned advisors, etc. As a founder, it is essential to gauge who to listen to and trust. Ultimately, there is no one on the planet that you should […]

Mistakes Founders Make at Board Meetings

Despite what an investor says in the dating phase – they have yet to learn what it is like to be in your shoes. They aren’t talking to your customers or working with your team. So it cheapens your experience to say they have “been there and done that.” The only thing an investor has […]

The Lie Founders Tell Themselves About Selling to SMB

Last week, I had an interesting discussion with a friend of mine – Branon Hanono of Petvisor- about selling SaaS subscriptions to SMBs. It is well-documented that smaller customers (SMBs) churn out quicker than larger customers. The most obvious reason is that smaller companies statistically go out of business much easier than larger companies. In […]

Why I Partnered with In Revenue Capital

I recently had the opportunity to co-invest with emerging managers Justin Gray and Josh Wagner at In Revenue Capital. They participated alongside us for the Seed 1 Financing of Statera based in Boston, Massachusetts. Working with these gentlemen has been educational for me, and the amount of portfolio support to the company is unparalleled. The […]

The Problem with Giving Advice to Founders

I am empathetic about conversing with founders on how to operate their businesses. Giving operating advice takes time to gauge. It is generally difficult for founders to hear operating advice from investors. Concurrently it is tough for investors to understand that their advice isn’t taken entirely without question. The reason for this is context. Investors’ […]

IX: Investor Experience – Onboarding

One of the areas I like to speak about is the Investor Experience (IX). IX is the overall founder’s journey with their investors from the first meeting to the exit. The area I am going to talk about today is onboarding. Onboarding can happen in the later stages of diligence before the deal is funded. Everyone […]

The Mount Rushmore of Phoenix Tech

Just INYMI! I had the pleasure of having a Linkedin Live session with Todd Belfer of Brookstone VC and Phillip Pipkins of Prospeq on was on their Mount Rushmore of Phoenix Tech. Each head of the Mount Rushmore represented the following categories: Vision, Scrappiness, Charismatic, and Value Creator. The selection had to be current founders […]

Number 1 Mistake VCs Make with Founders Post Close: Hint-Words Matter…

Being a minority investor (VC) puts you under limited control. You are not operating the company and represent a voice on the board and shareholder level. Ultimately you live on the whim of what the founders (usually the majority) want to do with the company post-close, except for protective provisions and board rights if you […]

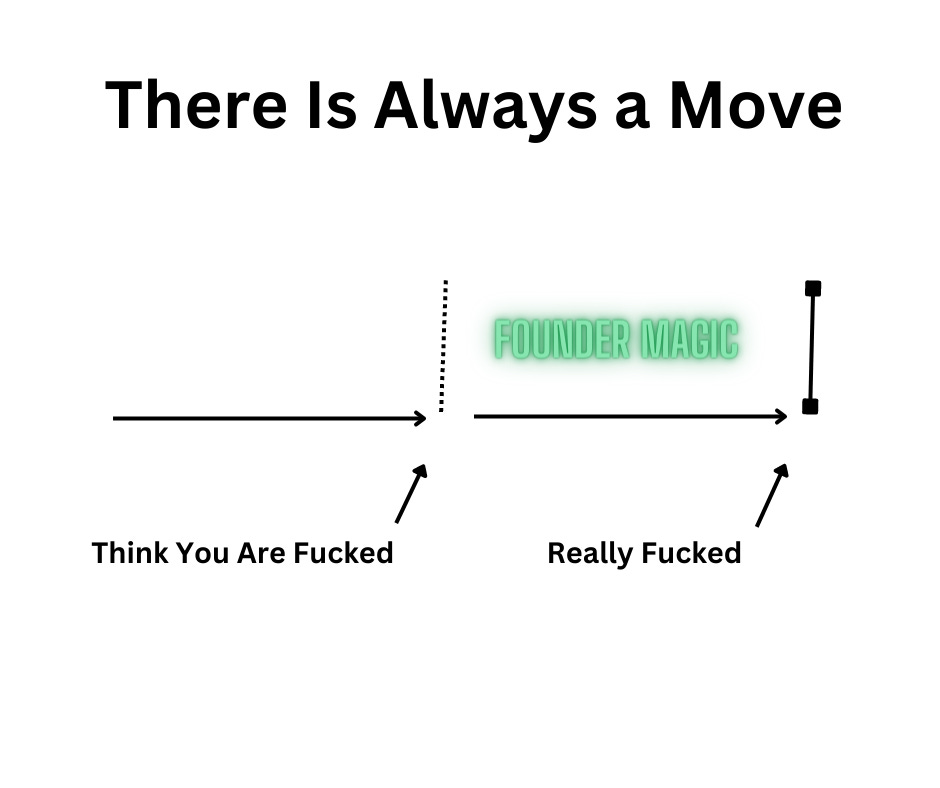

Two Lines: Failure and Real Failure and Founder Magic

I was interviewing Brad Thomas of Evercast yesterday, and he spoke about Ben Horowitz best selling book – Hard Things about Hard Things. It is a wonderful collection of stories of the hardened silicone valley founder’s trials and tribulations through the internet boom. In one chapter, he goes into depth about founders always having one […]

The Upcoming 2023 Churn Tsunami of Companies Serving as "Capabilities"

In the age of abundance of capital, there has been an onslaught of waste in the last couple of years. Founders with good intent started to build standalone tools with more capabilities and less platform or vision to become a platform. This is separate from a company that begins as a feature, as all companies […]