Capital Stewardship and Cash Burn

Venture Capital is a high-risk, high-reward game. Everyone knows that. That being said, there is an intangible trait that the best founders have, and that is being a good steward of capital. Founders either have this trait, or they don’t. There was a great piece written about capital stewardship by @Kyle Harris in his substack Investing 101. […]

Communicating with Founders is like Handling Cats

My first job when I was younger was as a veterinary assistant. The job consisted of walking dogs, cleaning kennels, and holding animals on an exam table while the doctor poked and prodded at them to treat their ailments. The days were long, but many valuable lessons were learned. One skill I learned that I […]

Beware of Building Products of Overstating Problems

I often see founders in vertical SaaS that go deep into the weeds about a problem within their industry. These founders appear very fundable as their industry knowledge is so attractive it might seem hard to resist. However, the problem the founders are describing seems so abhorrent you are shocked that no one has thought […]

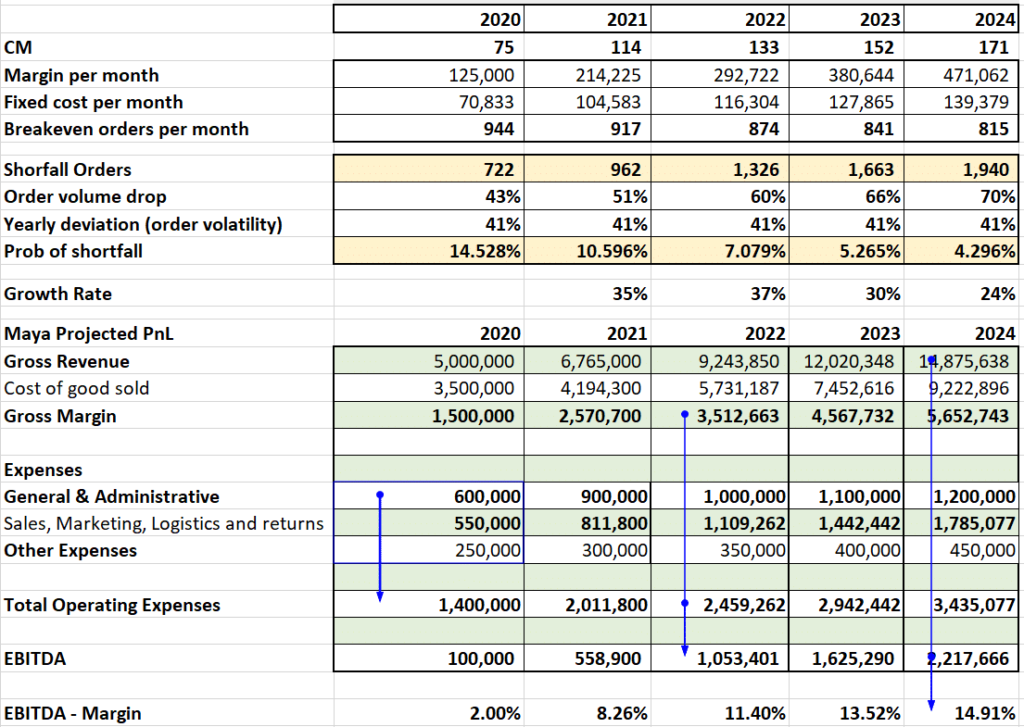

Three Reasons Why Building Financial Models in the Seed Stage is Essential

I am a big financial model guy. They are essential to building, especially in the early stages. However, when I request them, I get tons of eye rolls from founders because they state, “there are just too many unknowns.” I, of course, agree with this; however, there is a reason to spend the time to […]

The 6 Startup Board Member Personas

Several personality types present themselves during board meetings. I have classified them into six categories. I have been all of them, depending on the time and experience. Ball-Buster: The one who finds mistakes in your financial model and purposefully looks at old board decks to see where you fell short of calling on it. They can […]

4 Ways Founders Can Manage Knock Out Risk

One lesson I have learned in early-stage investing is to eliminate knockout risk. KO risk is when there is one single point of failure for the company that could quickly bring it to zero. Most people would argue that all early-stage companies have knockout risks. I beg to differ. I believe there are ways for […]

What Investors Think When Reading a Pitch Deck

Yesterday I had the pleasure of doing a Linkedin Live session with Phillip Pipkins entitled “What Investors Think When Reading a Pitch Deck.” . The title pretty much sums up the content. I also kissed him during the presentation to get more clicks The TL;DW is-

HR Tech Companies are Solving for 2021 Problems not the Future

I am seeing many companies that appear to be solving COVID-era stimulatory problems around people. Such issues include employee recruitment, training, and engagement. These solutions are all tied to solving the great resignation problem that seems to be affecting many industries. I am having a hard time understanding this labor shortage issue. I also do […]

6 Reasons Why VCs Suck

There is a ton of angst around venture capitalists from founders. You can see it all around twitter. Horror stories of capital providers slamming their fists on the table, firing founders, and ramming companies full of capital are bountiful the startup world. In essence you can identify the reasons why they suck in two buckets […]

What Game are You Playing? Valuation or Value

There is a big difference between valuation and value game. Neither are wrong, but it is very important to understand what path you are on and realizes the pluses and minuses of each. Go through these lists to identify for yourself. Valuation Game: Value Game: It might be clear that I am biased towards value […]