The Most Important Founder Trait- Hint: Its not Vision or Tenacity

I have seen several pieces of content out on the internet about what makes founders great. On top of most of the lists are vision and relentlessness. For me, these are must less critical. Instead, I would tell most founders I meet have great ideas and tenacity- these qualities within themselves can pull founders away […]

Famous Last Words "and then we can raise our Series A…"

One thing that is a red flag for me as an investor is founders that build their company around valuation instead of value. I am seeing it more and more as I practice the art of early-stage investing. The narrative goes like this…. This is usually when I see the founders. The company has a […]

What the Biggest Questions VCs want to Know when Investing in Horizontal SaaS

I have been writing a great deal about the woe of horizontal SaaS lately. TL;DR Horizontal SaaS is Extremely Difficult in Todays Market because That said, I found another data point to support my case in vertical SaaS. The anecdote came from a colleague launching a “bundling” of capabilities in the Data Lake space. Think […]

The Investor Experience (IX)

Customer experience (CX) is the sum of customers’ perceptions and feelings from interactions with a brand’s products and services. After 7-years of speaking to founders through good times and bad times, I have realized a type of CX can be applied to my work as an investor. A rough definition could be a sum of […]

Bipolar Founder Relationships

I have been hearing tons of feedback from entrepreneurs regarding their current investors. I’ve noticed how quickly someone can say how much they love their financial partner until they don’t. Inevitably I believe the investor experience (or IX – new idea for blog post) a founder goes through ultimately depends upon the performance of the […]

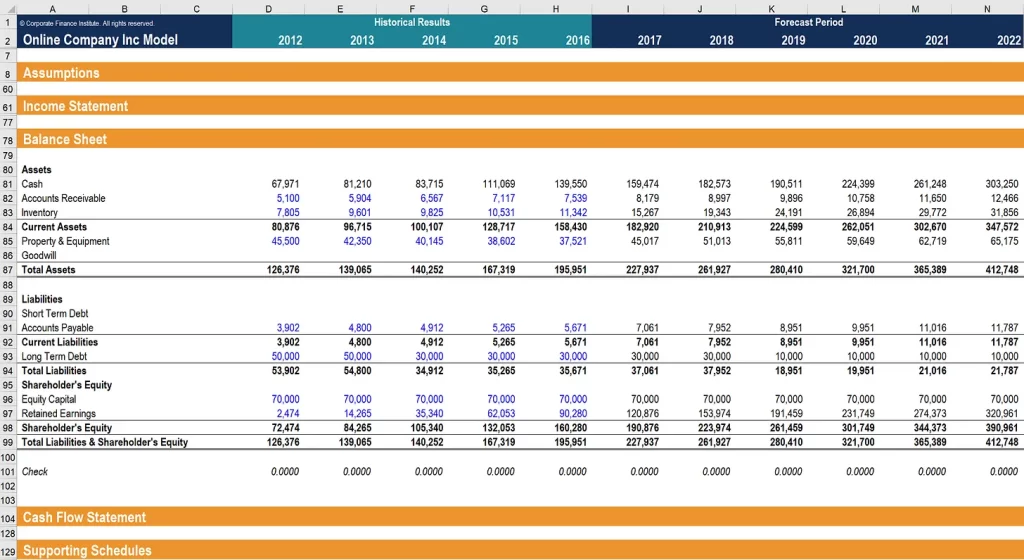

The Three Most Important Parts of Building a Forecast

Clarity, Assumptions, and Levels of Certainty I spoke to Tori Barlow, VP of Marketing at former portfolio company Allbound on their podcast this week. We discussed how to secure channel budget from the board of directors in forecasting. It made me think about the essential pillars around forecasting that make for the best outcome. Clarity, […]

Founders Asking For Feedback

I have noticed that founders generally want feedback after being denied further investment consideration. However, most of the time, I find that despite what seems like an honest desire to use this as a learning experience – they try to use the feedback as a platform for exercising a rebuttal and how I got it […]

Death of Companies Over $7M of ARR

I was speaking to a good friend and former portfolio company executive yesterday. We have long since sold the company to a private equity roll-up, and since then, the company has started slowing in growth. When I asked him what he attributed it to, he told me it was because the technology that was rapidly […]

Valuations, Capital Amounts, and Sideline Money

I have now seen several cases of companies I have previously passed on due to valuation coming back and want to revisit financing with us. What is odd about this is that they claim they have millions on the sideline waiting to put in and just need a lead investor. I see that founders are […]

You Can Only Burn a Dollar Once

Over the last couple of weeks, I have had several startups claim that they are super scrappy and capital efficient. Yet they have raised approximately $10M and have only about $1M or recognized ARR. I hate to tell you – that is not capital efficient by any definition. I empathize with early-stage founders when they […]