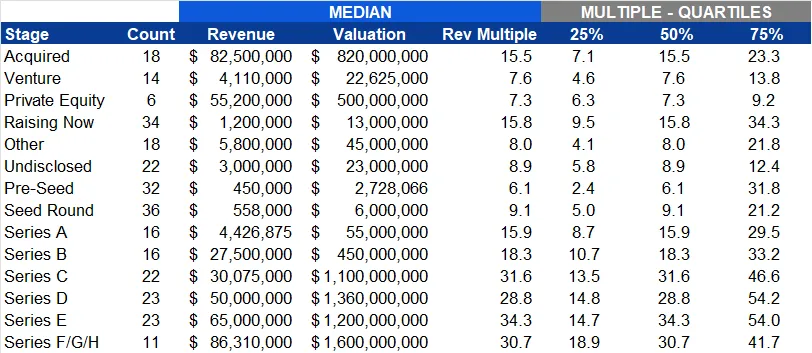

2021 Private SaaS Valuations

There is is no such thing as “value buying” SaaS today. “What are interest rates going to do?” That is the question I hear from my investor colleagues. Whether it be in technology, public equities, real estate, or crypto, it seems that everyone is concerned about the macroeconomy. However, the same people will also tell […]

How Important is it for an Investor to Have "Skin in the Game"

One of DWP’s main value propositions is the significant amount of GP Capital (my money) I put in every deal. The idea is that if I am willing to put a large bet on a company, then it would stand to believe that I am aligned with investors who would put their capital aside mine. […]

Do You Want a Top Tier Network? Target Operators

Operators are the New Investors Last week I was listening to Howard Linzon’s Panic with Friends Podcast. In the podcast, he made a sidebar comment about how important it is to have operators in one’s network. This simple statement made me think deeper on the subject. In the past, having deep relationships with investors showed […]

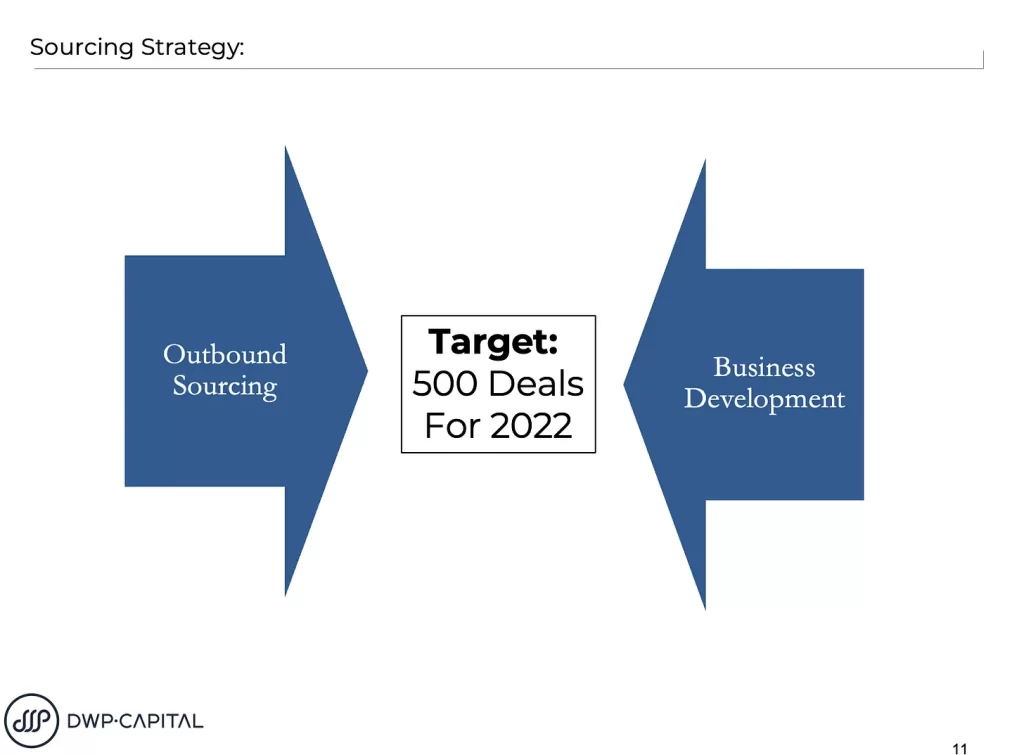

2022 Deal Sourcing Strategy

Needing More “At-Bats” The following are excerpts from the 2022 Strategic Plan as it pertains to my sourcing strategy. This was a great exercise for me to do to get super clear and deliberate on how I am going to spend my time next year. I first had to look at this years data. The […]

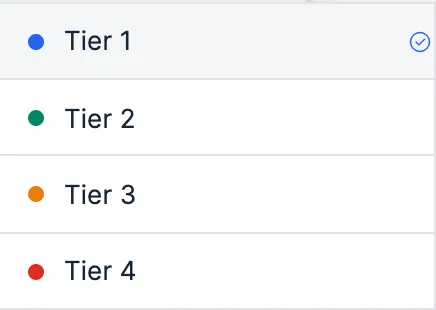

Quantifying My Relationships

I proclaimed that “I am in the Relationship Business” in a previous blog post. Relationship building is a significant component in my deal sourcing strategy for next year. But how do you quantify a relationship? What is the difference between a contact and a relationship? Those are the questions that I thought deeper on when […]

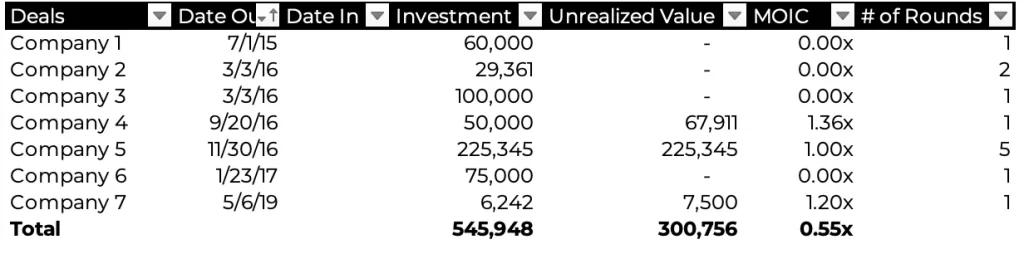

“Relationship Deals and my Abysmal Performance with Angel Investing”

This week, I reflected on the angel investments I made earlier in my career. These opportunities were before I started writing much larger checks and raising money from limited partners. My angel investment performance is abysmal, reaping 0.55x unrealized MOIC. There, of course, is a story behind each of the companies, but I could say […]

I am in the Relationship Business

How I “Finagled” My Way Into Aashay’s Life Last week I had two golf games scheduled. Nothing makes my wife angrier than me leaving the house wearing my golf outfit. She told me sarcastically, “Oh, you are playing golf twice this week?” I responded, “Honey, I am in the relationship business!” There is nothing that […]

Phoenix Deal Flow Deficiency

This weekend, I had the great privilege of taking my wife on to LA to celebrate our fourth anniversary. We were supposed to go to a tantric yoga intimacy retreat, but it got canceled because of COVID. They wanted to do zoom instead. So we opted for a refund and went to LA anyway. […]

Reasons for Having an Investment Thesis

Pattern Recognition and Conviction My friend Cory Berg asked me, “why is an investment thesis so important.” This question reminded me of a podcast I listened to last week (Acquired- Part II on a16z). The host stated that “if you have been a VC investor for over 5-years, then you effectively become a functional […]

Supporting My Investment Thesis

We are not okay with zeros. The second question on my Kauffman fellows application was how I uniquely support my investment thesis. To me, this is the underlying difference in my business model compared to traditional VCs. “The most significant factor supporting my thesis is education, as most founders do not understand their investors’ business […]