Investment Thesis 1.0

DWP Capitals Investment Thesis as of Oct 27 2021 In a previous post, I mentioned that I am applying to the Kauffman Fellows program. The enrollment application had me think deeper about how I invest, and as a result, I decided I needed to clarify my investment thesis. So, after many iterations and feedback loops, […]

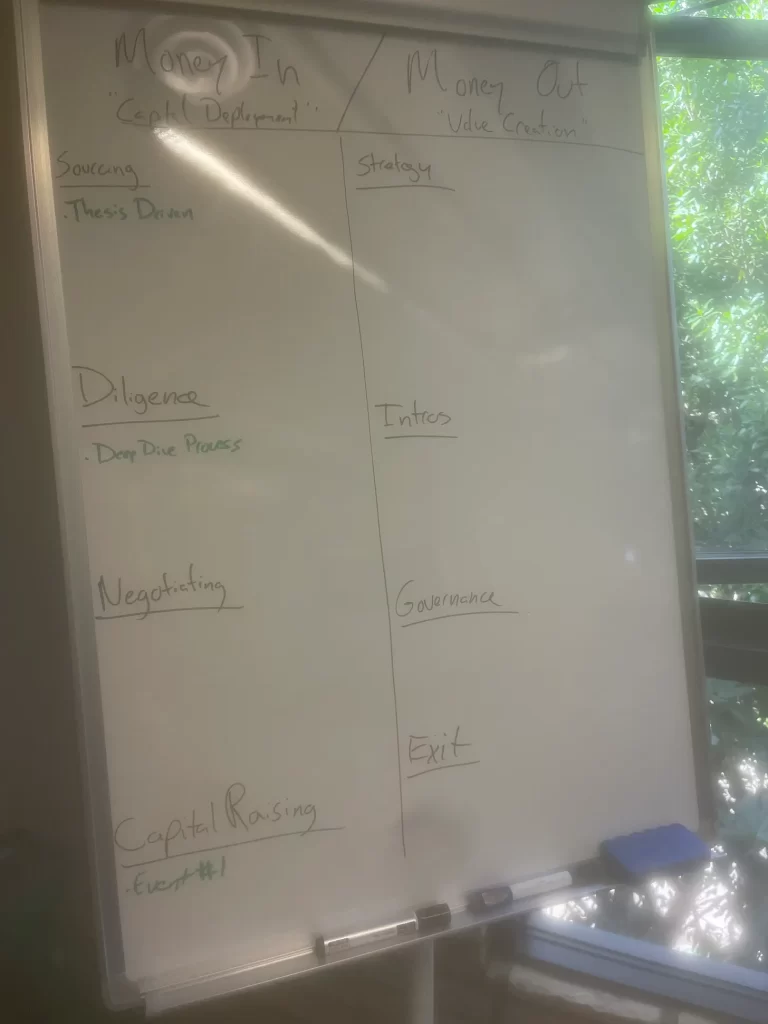

Money In and Money Out

The only thing you need to worry about in venture capital/growth equity investing. Starting a new venture firm is hard. I’m not talking about getting “flow,” winning competitive deals, or raising capital either. Instead, I am referring to the act of keeping myself organized and deliberate. This is a challenge because I am the only […]

Great Resources to Help an Investor Narrow Their Investment Thesis.

In my previous blog post, I spoke about how I felt that my investment thesis was shallow and poorly thought out. And as a result, my sourcing strategy was unfocused. So, I decided to sharpen my pencil and rewrite it. I have gone down the rabbit hole in researching what makes an outstanding investment thesis. […]

Going Back to The Drawing Board on My Investment Thesis

I’m in the midst of applying to Class 27 of the Kauffman Fellows program. KF is a two-year fellowship designed for venture capitalists, built around professional development and connecting with other investors. The goal is to create an environment where participants can become the best versions of themselves. The first question in the […]

Investing in "B Deals" as an Investment Thesis

Can you invest in SaaS companies cheap and make money? I have always worked for firms that considered themselves “value” investors. We would invest in companies with reasonable or discounted multiples compared to the market. We avoided the hype. Seed stage investing for us was typically $1-$2.5M rounds with single-digit valuations. Recently, achieving these terms […]

My 'Theranos-Like' Story

The 4M Dollars of Money Gone Yesterday I was listening to my favorite pod, “The All-In Podcast.” This week the first topic discussed was the trial of Elizabeth Holmes, CEO of Theranos (Raised $900M with a $10B valuation). She was infamous for creating fraudulent claims of the company’s technological abilities and its financial forecasts. At […]