Are Geographic Focused Funds Really Valuation Sensitive? Let's Find Out!

Geographic focused funds have been taking the investment world by storm over the last 5 years. With their focus on non-coastal companies, these funds promise better valuations, but is that really the case? As an institutional investor, it’s important to understand if these claims hold true. So, after doing some digging, I’m here to shed […]

My Takeaways from HiMSS '23: A Founder and VC's Perspective

This week, I had the opportunity to attend HiMSS ’23, the largest healthcare IT conference in the world, held in Chicago. As a venture capitalist (VC) focused on healthcare startups, I was eager to learn about the latest innovations and technologies shaping the industry. And, as expected, the conference didn’t fail to impress! From exploring […]

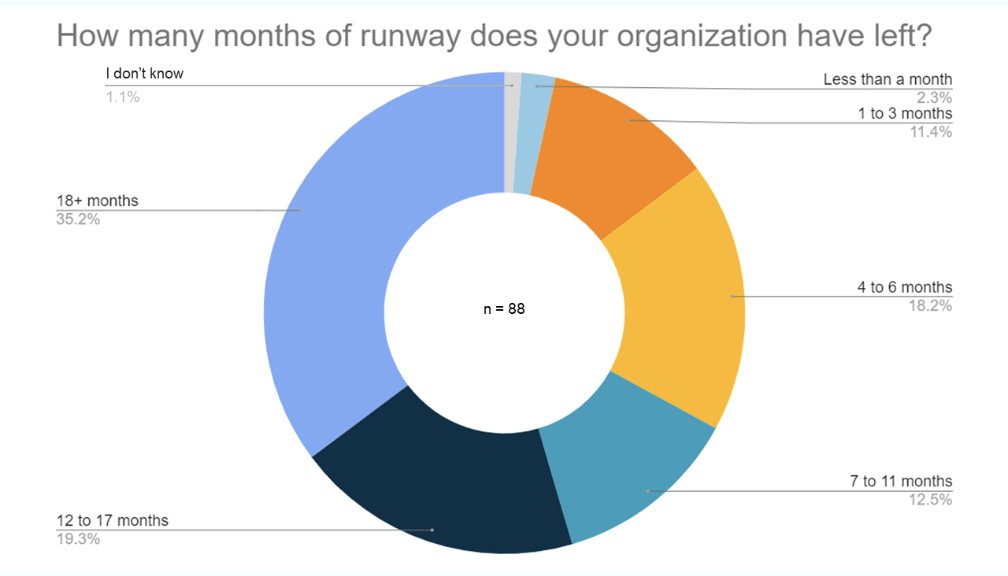

The Bridge to Nowhere- The Problem with Technology Companies Seeking "Bridge Rounds"

In the world of startup funding, it’s not uncommon to see companies seek out “bridge rounds” to secure the capital they need to move forward. I wrote about this recently in a blog $5M in with $1M in ARR. Typically, these rounds are used to bridge the gap between larger funding rounds and help companies […]

Don't Get Full on the Salad Bar- The Good Assets Have Yet to Avail Themselves

I have spoken to several investors over the last 18 months regarding the quality of their deal flow. They have all universally told me that it is mediocre at best. This is because all the good assets took huge rounds in 2021, and if the CEO was smart, they leaned out to grow into their […]

The Secret to Being a Good Venture Capitalist

The other day, I spoke to an investor colleague, Howard Lindzon, about being a venture capitalist. What he told me I found to be quite profound- he said I don’t know what a venture capitalist means anymore today. It is about networking, reading, writing, and being myself. – Howard Lindzon This breakdown got me thinking about […]

Deal Sourcing 101: Light on the Network? Go for the Pain!

In 2023 I decided to develop an outbound deal sourcing motion. To do this, I had to create critical themes I wanted to explore. More established Venture Capitalists have stables of operators in which they have invested that can point them to earlier-stage innovations that are solving pain points. How does an emerging manager without decades […]

VC Secrets: Deal Pregnancy

I’ve never met a founder that didn’t have a sense of urgency when closing a growth financing round. “We just want to move fast” is generally the mantra that keeps repeating in their heads. However, once the term sheet is consummated between both sides of the table is where the trickery begins. A great deal […]

My Failures as a Fortune Teller

In a previous post Calling Your Shot, I spoke about the amount of weight investors put on themselves and others regarding predictions. I see investors constantly pontificating on what they see in their tea leaves on twitter, blogs, and podcasts. I tried my hand at being a fortune teller in my Annual 2021 Investor Letter […]

Nothing is Easy Anymore

The other day I heard my friend speaking to someone on the phone about go-to-market strategies. He stated, “Nothing is easy anymore; all the low-hanging fruit has been picked.” That statement gut-punched me. How true that is in the software world from all angles. Money has been bountiful over the last couple of years. “Best […]

Calling Your Shot

Breaking Down Investor Predictions Investors put a great deal of emphasis and importance on predicting trends. They spend a great deal of time contemplating and writing about them. They will also be the first to call out when they get one right. The more I read work from other investors, the more I see this […]