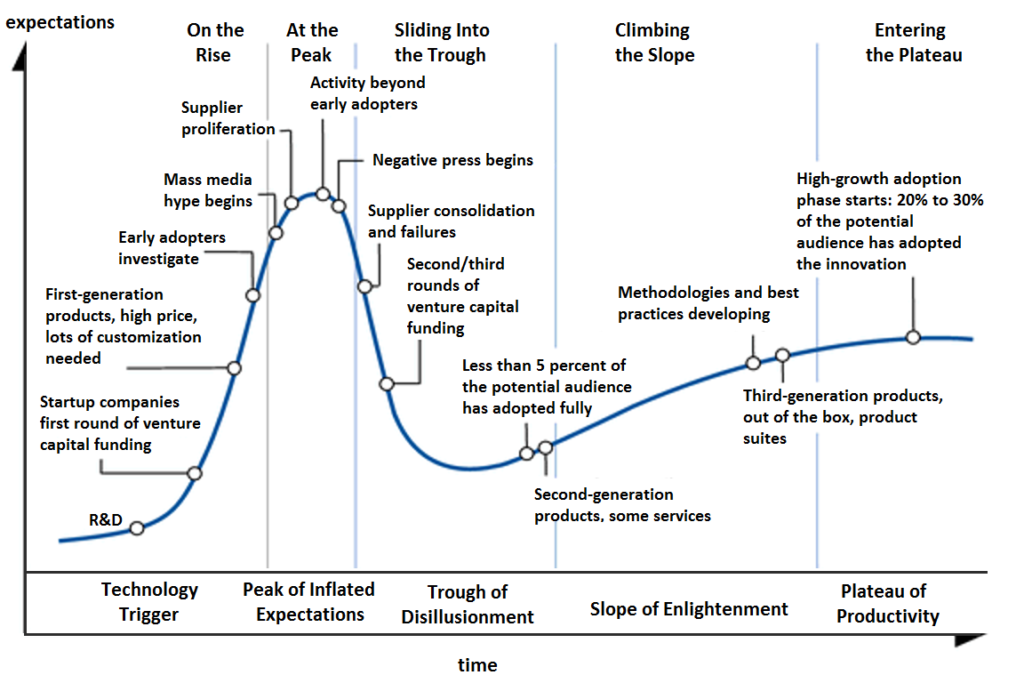

What is a Hype Cycle?

Going into 2023 I wanted to brush up on my understanding of the fundamentals of Gartner’s “Hype Cycle.” The hype cycle is a graphical representation of the maturity, adoption, and social application of specific technologies. The purpose of this exercise was to figure out where I wanted to spend my time looking for opportunities. Seeing […]

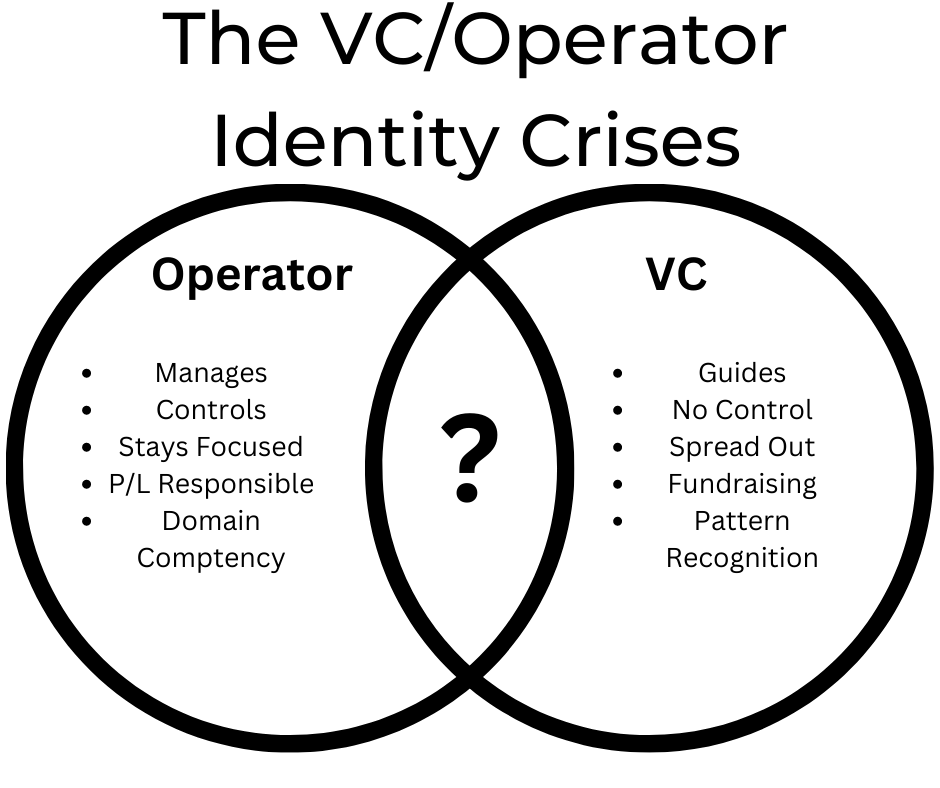

The VC/Operator Identity Crises

Over the last couple of years there has been great wealth creation for operators. After years of hard work they have finally cashed out and made their bones. The novelty of cashing the big check eventually wears off for these entrepreneurs and the jones to find the next thing comes into effect. Now that they […]

Our Evolution to Outbound Sourcing

The early-stage investing business used to be much easier. No more than five years ago, all we had to do would be visible lead seed investors that and companies that were growing would just come to us. Founders knew we could execute on a term sheet, and they could stop fundraising and start building again. […]

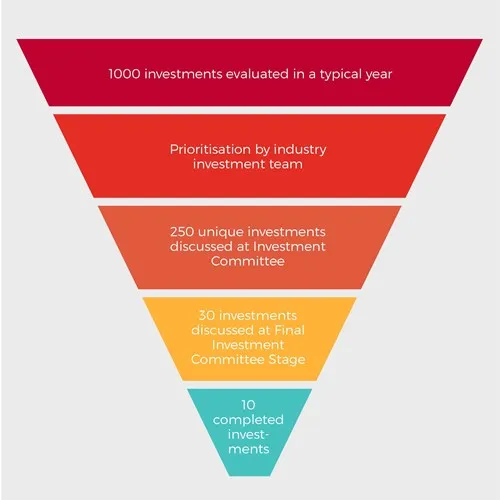

Three Things I learned After Evaluating 500 Companies in 2022

I had a goal of deploying $3M in 2022. I actually deployed $0 in 2022. It was very humbling to say the least. It was not for a lack of trying as we at DWP Capital had screened over 500 deals. If I was to summarize three things that I have learned it would be […]

Two Deal Sourcing Strategies that Failed This Year

The business of investing has gotten a lot harder. It used to be that being a lead investor in an undercapitalized market was a differentiator. All you had to do was plant your flag and meet with some lawyers and bankers, and you would get all the flow. In the 2020-2021 era, that strategy proved […]

The Dominos are Tipping and Things Are Finally Making Sense

Things have finally been starting to make sense to me in the market. Empires are falling. My news feed is full of articles consisting of big portfolio markdowns, angry LPs, and leveraged crypto companies conducting fraud. Tiger Global- the firm that attempted to index late-stage venture, has marked their book down -8% TVPI. This is […]

What are the Red Flags ?? when Pitching to Investors?

I had the pleasure of conversing on Linkedin Live with one of the most intelligent investors I know – Sara Omohundro, yesterday. We spoke about typical red flags that investors see during pitches with founders. We covered in depth the red flags and why they are troubling in the domains of” a founder describing: market, […]

Les Craig of Next Frontier Ventures on transitioning from CIA to VC, Sharky VCs, and Investing with a Regional Focus Investments Thesis

Today I am interviewing Les Craig of Next Frontier Ventures. Les is a Montana man who went from being a CIA spy to Venture Capitalist. He is stupid smart and has an empathetic heart for entrepreneurs. Learn his story about being a founder and having sharky VCs, being founder friendly, and being a part of […]

The Most Misunderstood Factor in Performing Due Diligence in an Early Stage Company – Understanding the Problem and Solution Set

When you are an early-stage investor, you see pattern recognition in the technology landscape. What I mean by pattern recognition is that you start to see a recurrence of companies that are attacking a specific problem. Let us think of the problem these companies are trying to solve as the Death Star. A prominent, seemingly […]

Where is the Tech Bottom?

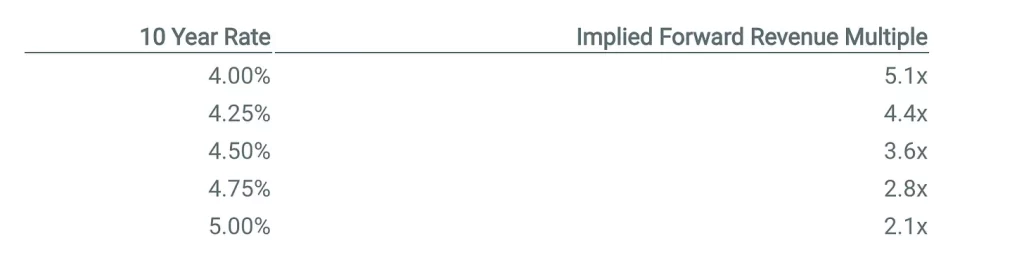

Tomasz Tunguz wrote a great article on the correlation between tech multiples and rising interest rates. He used the 10-year treasury as a proxy, which would be the antithesis of the growth market. The article can be found here. He stated that 2.1x NTM revenues if the 10-year treasury reaches 5%. It fell to 3.3x in 2016, […]