The Biggest Mistakes Investors Make

I find that investors flushed with cash make the biggest mistakes when they feel an abundance of one of these two emotions – being scared or bored. So today, I will talk about the problem of being bored quickly as an investor. I find what makes someone good at early-stage investing is pattern recognition. For […]

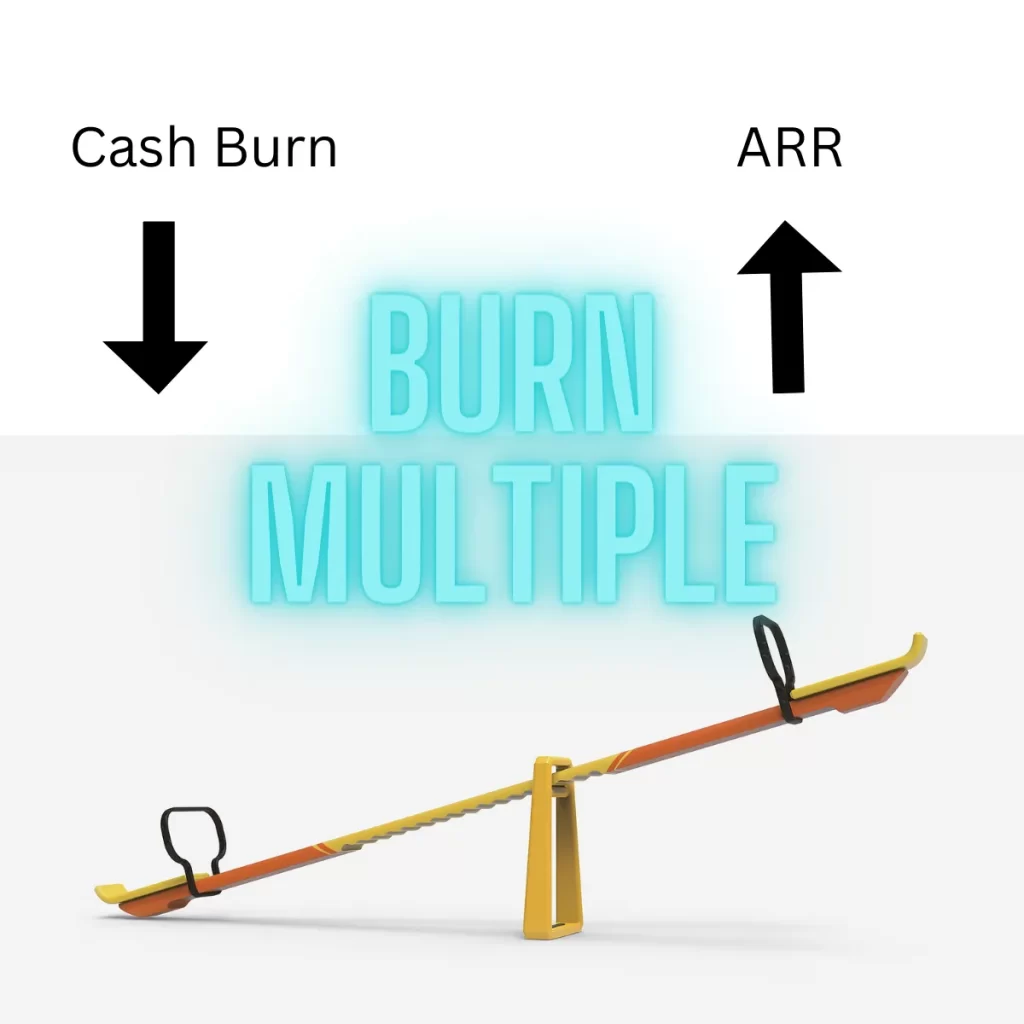

Why Investors Care About the "Burn Multiple"

7 Things I Learned about the Current Venture Market at the Dallas Investor Round Table

Yesterday I was lucky to be invited to the Investor Round Table event in Dallas. There were investors from around the country – including Chicago, San Francisco, and New York. These funds represented pre-seed up to later-stage growth equity. The purpose of this meeting was for investors to collaborate to talk about current market conditions, […]

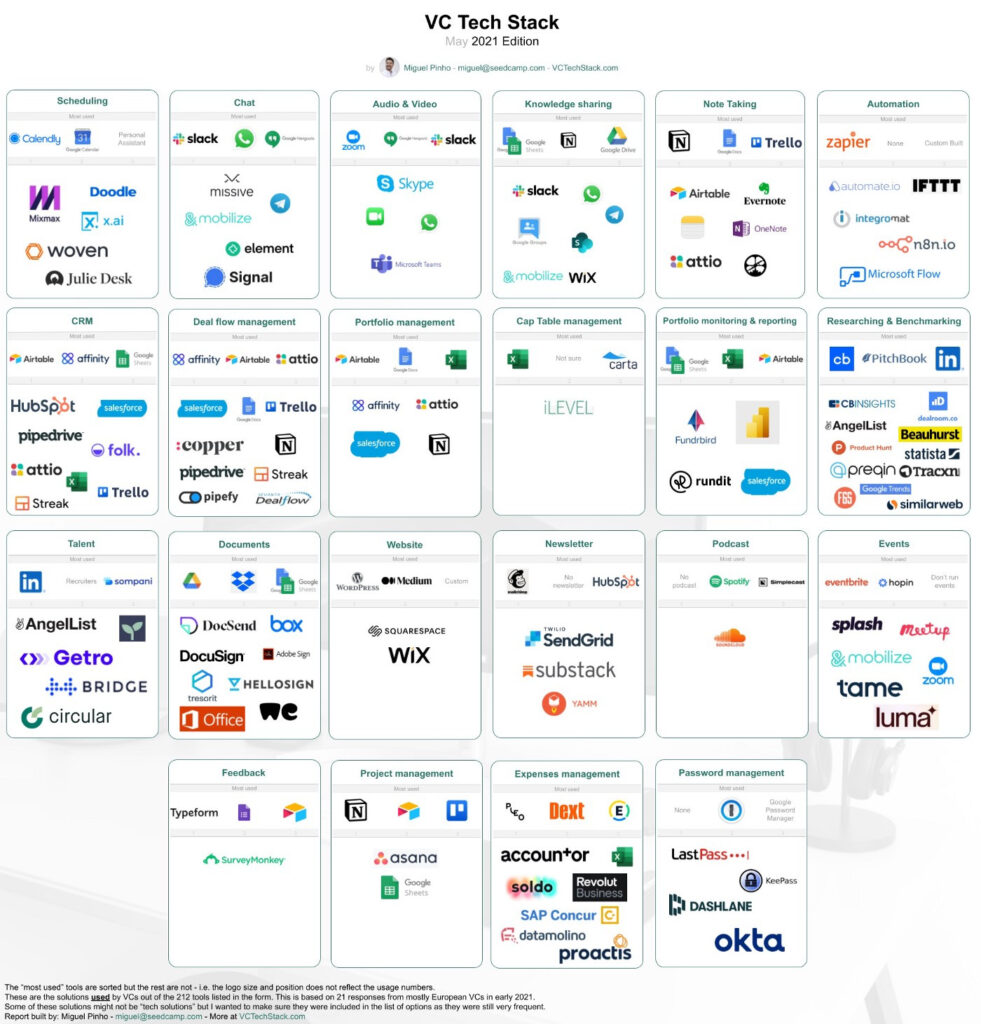

VC Tech Stack (DWP's)

Being a solo GP is very difficult. We at DWP need software tools to help leverage my time in order to be able to source at the velocity that we do. Below is the list of our tech stack that we find to be working. Sourcing: Affinity: VC-specific CRM. Its best feature is its gmail […]

Famous Last Words For Investors…

“They Won’t Let it Go to Zero” I often hear investors speak to each other about opportunities they are evaluating or currently in. They say of the merits and risks of the founder, risk, and market. However, there is usually one attribute that I feel these investors put the most weight on, giving them a […]

How to Give Founder Feedback – The Two Lenses

I have learned much from working with founders over the years—most of which is learning how to communicate effectively to drive the desired outcome. I honed this skill by making several mistakes over the years. However, my biggest strength in this journey has been my self-awareness. When surrounded by the greatness of founders, I feel […]

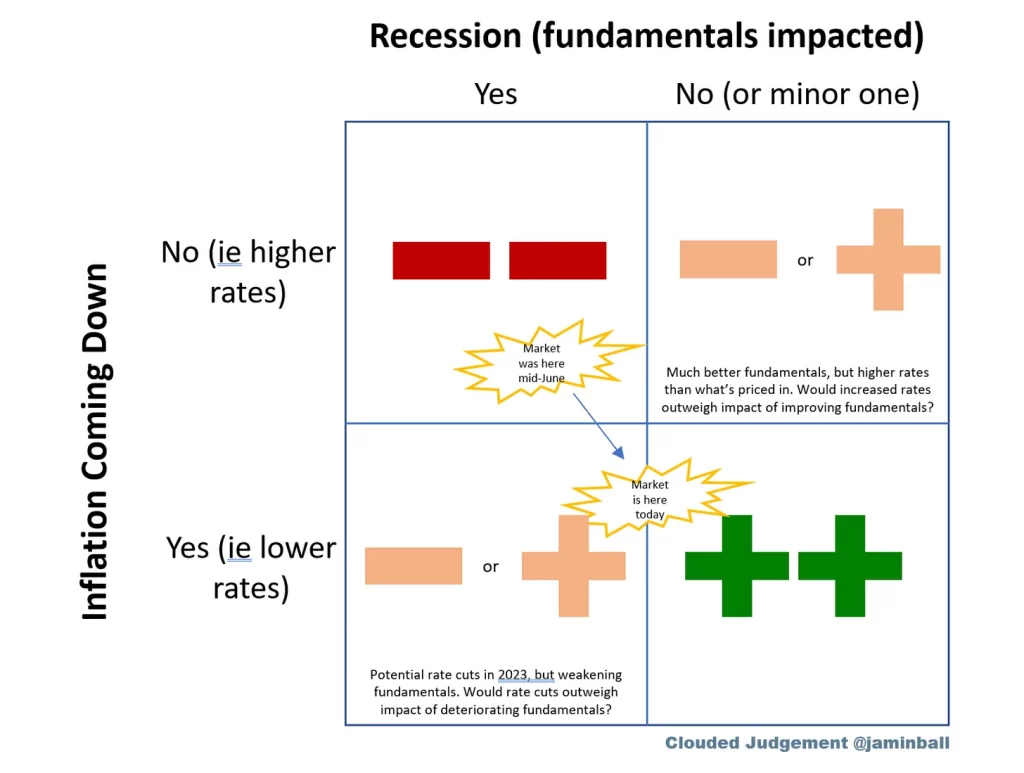

Bear Market Rally or Soft Landing?

It is another beautiful morning in northern San Diego. I have a visitor from Arizona, Cory Berg, who has come to get out of the heat. Cory and I have had a great history of being friends after we experienced a dumpster fire of an investment at Canal Partners. As we walked down the Batiquitos […]

Everyone is Feeling Less Rich

I previously spoke about the difficulty for GPs to raise in this economic climate. All in all, I believe it is because high net worth people feel “less rich.” If they were heavily invested in equities in a diversified portfolio, they could see a 25%-30% haircut to their net worth. That is a good case. […]

The "R-Word"

It is official. We have two-quarters of consecutive contracting GDP. So, of course, everyone is debating what constitutes a recession, even though the definition is pretty straightforward. I feel that people don’t like using the “R-word” because everything in the media gets catastrophized. As of yesterday, the median SaaS NTM revenue multiple is 6.2x, and […]

DWP Investing Principle 3.0: Don't Trust the "Smart Guys."

Often when I ask someone why they invest in a particular opportunity, I hear part of their thesis include that someone else also invested that is smart and accomplished. As someone who has lost a lot of money doing this, please hear my words, don’t do it. Just because someone has been successful in their […]