Raising Capital from LPs

I had the pleasure of hosting a good friend Ryan Edwards my place in San Diego this week. Ryan is an emerging manager for an early-stage credit fund called Prospeq, in which I am also an investor. He is currently trudging his way to fundraising his first fund, which is a task that every fund […]

Deal Sourcing- Execution vs Strategy.

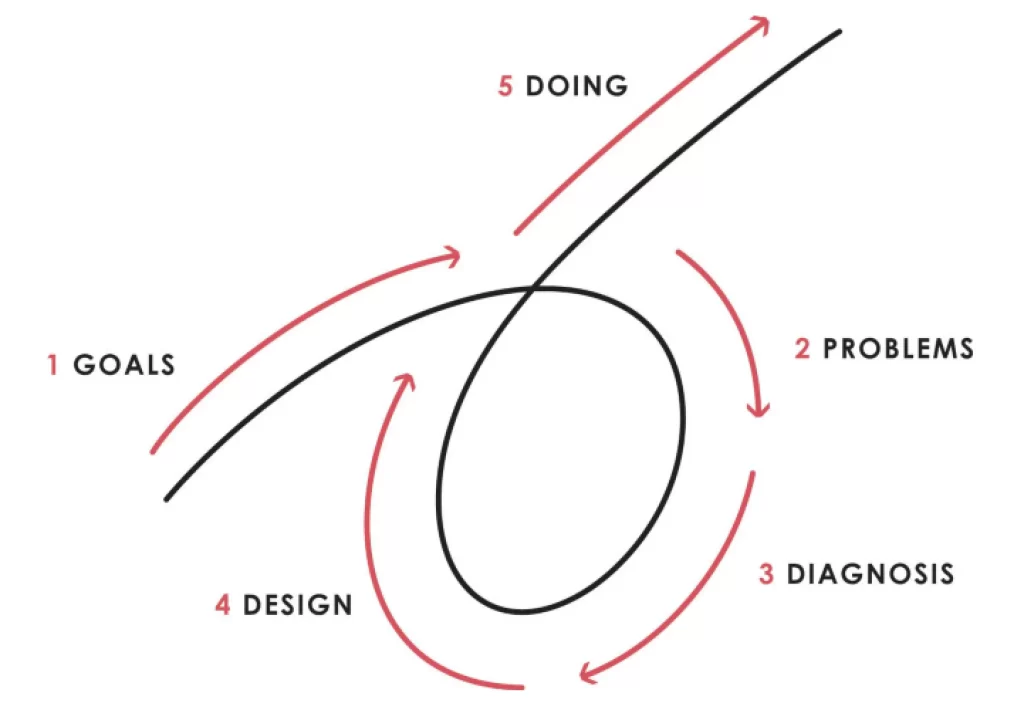

We screened 280-something deals in the first half of 2022. So we are ahead of where we need to be to achieve our goal of screening 500 deals for the year. The problem we face is that we have a culture of filling our calendars with meetings before really understanding who we are talking to […]

Inflation Data and Todays Markets

There was some big news yesterday- inflation data posted at 9.1% above last year’s numbers. These headlines were pretty jarring to people watching the news. However, it did not reassure anyone that Jerome Powell or President Biden had a handle on the economy. I spoke to a colleague at UBS yesterday, and he shed some […]

Themes I am Exploring Amid a Downturn

In the last seven years, the amount of B2B SaaS solutions that have come into the market is staggering. Operating companies are getting solution fatigue with all of the different platforms and point solutions thrown at them via sales and marketing. Does the world need another SaaS solution in a world where belts are tightening? […]

DWP Initial Diligence Questions

I hear from many founders what types of due diligence we look for when evaluating companies. So before we dive into a term sheet, we send out a high-level DD list that encompasses mainly business points that help us understand growth, customers, margin, and general business economics. Here is the list for your viewing pleasure. […]

Excitement > Data

If I were to say that all my investment decisions are data driven, I would be lying. As someone who considers them entrepreneurial, I feel that my emotions towards a founder, market and opportunity sometimes trump the data by a factor of 2-3x. My brother Andy, a prolific healthcare investor, states that his excitement and […]

How I Sourced Two Product Hires for a Portfolio Company

This post is not for me to boost my ego on the “value add” I bring to my portfolio companies. It is more about two unconventional scaling methods as a solo GP to help bring in some key hires. But did I mention how valuable I am as an investor ?. Anyway…. The first is […]

The Falling Chainsaw of 2022

Some people would call this market a falling knife. I would call it more of falling chainsaw. There is nothing more unnerving than this much negative sentiment and uncertainty. I’m putting my head in the sand and not looking at any of my statements. I am afraid I am going to do something too emotional. […]

Chasing the Startup High

I have had several tech operators that I would love to bring on as a partner at DWP Capital. They are knowledgeable people with great instincts and would be fantastic capital allocators. However, they all have said the same thing that has given me the reason not to pursue the relationship. “I want to work […]

DWP Investing Principles: Don't Ignore Negative Founder Behavior During Diligence

I have decided to take a page out of Ray Dalio’s book Principles. I am actually taking the whole book. I have started documenting my investment and management decisions to see if my assumptions are correct over time. I am also going back to the previous conclusions that I have made that have resulted in […]