Investors Helping Investors

I wrote a blog about Investor vs. Investor hating a couple of months ago. It shed light on how much shit talking goes behind the scenes in the capital-allocating world. To antithesis of this is Investors Helping Investors, which I will discuss as a valuable tool if used correctly. To put a framework around this […]

Investing in Features vs. Platforms in Early Days

One of my favorite things early-stage VCs say is when they pass on a deal because it is a “feature, not a platform.” Who comes to market with a fully-baked platform in the seed stage? Burn heavy, non-customer-centric founders that believe they know more than their customers, that’s who. Building best-in-class features to a larger […]

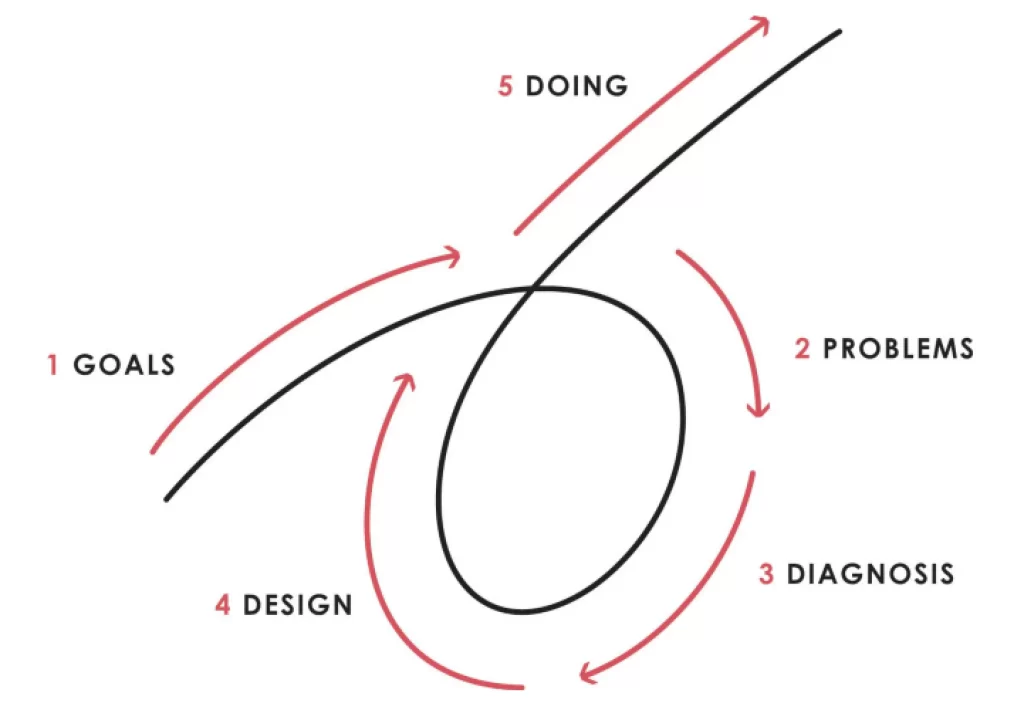

DWP Investing Principles: Do Not Talk Yourself Into Doing Relationship Deals.

I have decided to take a page out of Ray Dalio’s book Principles. I am actually taking the whole book. I have started documenting my investment and management decisions to see if my assumptions are correct over time. I am also going back to the previous conclusions that I have made that have resulted in […]

Does Anybody Else Have Shitty Deal Flow Besides Me?

No investor likes to admit this, but lately, my deal flow has been abysmal. I had previously chalked this up to taking a year off from my career at Canal Partners before starting DWP Capital. I would coach myself that building a brand takes time. There is no shortcut to creating a meaningful deal flow […]

Leveraging Social to Scale Intellectual IP

One of the bigger initiatives I have decided to do this year is to put myself out there content-wise on social media. My friend Ryan Edwards pointed out that I do it to stroke my ego. I can’t argue that that has something to do with it, but not all. The real inspiration came from […]

Elon's Economic Enema

At the All in Summit in Miami this week, we had the pleasure of hearing an interview with Elon Musk. The segment covered many issues, including politics, policy, immigration, the Twitter acquisition, plus more (you can watch it here). One of the biggest takeaways is Elon’s quote regarding the misallocation of capital. He stated, “It […]

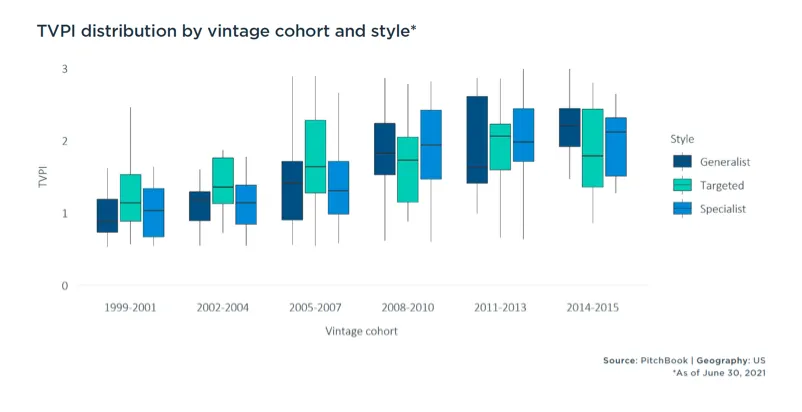

The Specialist vs. Generalist Investor- Who Outperforms?

Last week when I was in Miami, I had drinks with two of my favorite investors, Mark Groner and Jason Smith of Sopris Capital. Jason asked me off the cuff if I would ever consider specializing in investing in specific industries or verticals. The genesis of this question makes sense as Sopris Capital is highly […]

Three Attributes of the Most Successful VCs

Network, Network, and Network I listened to the Capital Allocators podcast with Ted Seides the other day. He was interviewing financial writer Sebastian Mallaby, the author of Power Law. In the interview, he spoke about what he gathered as the essential attributes of being a successful VC. He stated the first was the VC’s network, […]

Three Biggest Risks in Early Stage Investing in 2022

Over the last couple of years, VCs were piled onto each other to throw money at mediocre companies with inflated valuations. I reflect on the risks of early-stage investing in 2022 as I see the falling knife of public tech stocks. I have come up with three risk factors that I need to feel comfortable […]

Connecting Founders and Paying it Forward

There is no better feeling for me when I connect a successful founder that I’ve backed to new founders in our portfolio. As a non-operator venture capitalist, seeing the knowledge trust being transferred is literally like being in the front row of the super bowl. I had the opportunity to do this yesterday with Taylor […]