The Problem with Seed Financings- "The Party Round"

Investing in seed rounds can be very challenging. Ultimately the biggest reason is the amount of risk investing in one of the first rounds of a company’s financing. All risks present themselves- technology, market, execution, ad infinitum. So why invest in such a risky stage- easy, it has the most significant return profile. One of […]

Investing in Adjacent Possibilities

The Way of the Thematic Investor I have been thinking a great deal about the thought process around investment themes and decision-making. As a generalist, I am a functional expert in nothing. I envy firms that emphasize themes and work around market outlooks before hitting the sourcing trail. This strategy is much more time-intensive but, […]

The Greatest VC Hack- Expert Networks

One of the most incredible VC hacks I stumbled across this year was the usage of expert networks. Expert networks are advisory firms with thousands of C-level executives in varying industries available for phone calls for due diligence and market research. I used Guidepoint, one of the largest networks, to diligence two different software companies. […]

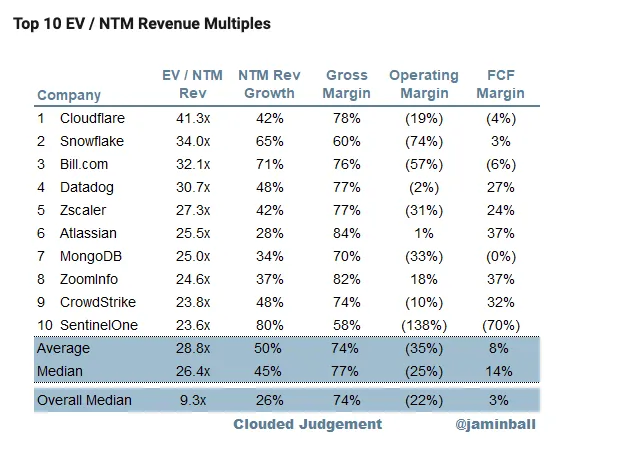

My Thoughts on Public vs Private Valuations for SaaS Companies in Q1 2022

Public Market Overview: To say there was a shift in the growth sector this quarter is an understatement. The Nasdaq has been hovering near double-digit correction territory. The $QQQ, mainly cloud stocks, is down 9%. Cloud stocks led the repricing with an overall valuation median EV/NTM at 9.3x down from 15.62x only a few months […]

The Massive Pull Forward of HR Tech.

You Cannot be a ShI$%y Boss Anymore Unfortunately, this prediction did not make my annual letter last year mainly because it was a half-baked theme in my head. However, now that the “Big Resignation” is on us, there is a massive market pull to empower employees. You cannot be a shi%%ty boss anymore. You need […]

The Fallacy of Non-Market Terms.

“That is not market” is a phrase that I hear many times from founders, who repeat their attorneys’ words. Luckily there are standards within deal documentation from the National Venture Capital Association (NVCA) that outline how documents should start, but often, this is merely an outline. The problem is that no company performs the same. […]

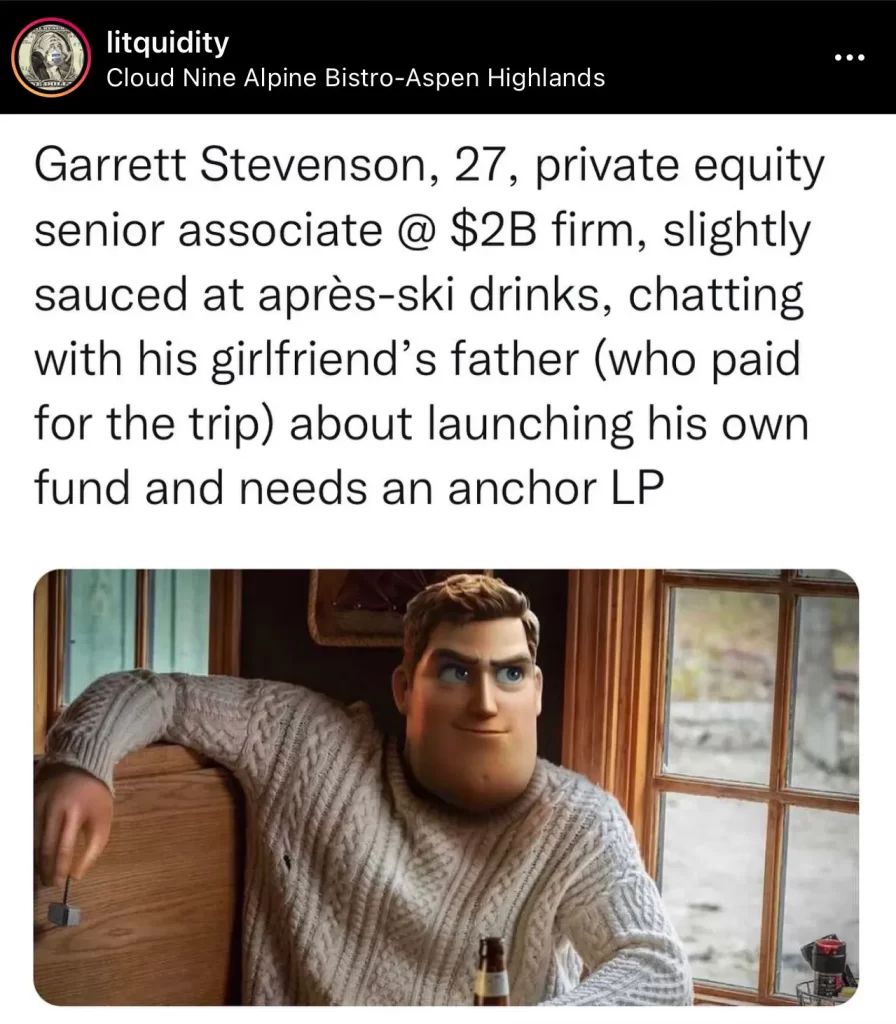

Beware of Bull$%it Venture Fund Returns

Venture capital financings and the number of new funds that have been raised is staggering. I see tons of emails requests on my desk to see venture funds LP pitches. Sometimes I get sneak attacked by someone I thought was trying to collaborate on deal flow, and then I get ambushed into hearing an LP […]

The Three Ways I Have Won Deals

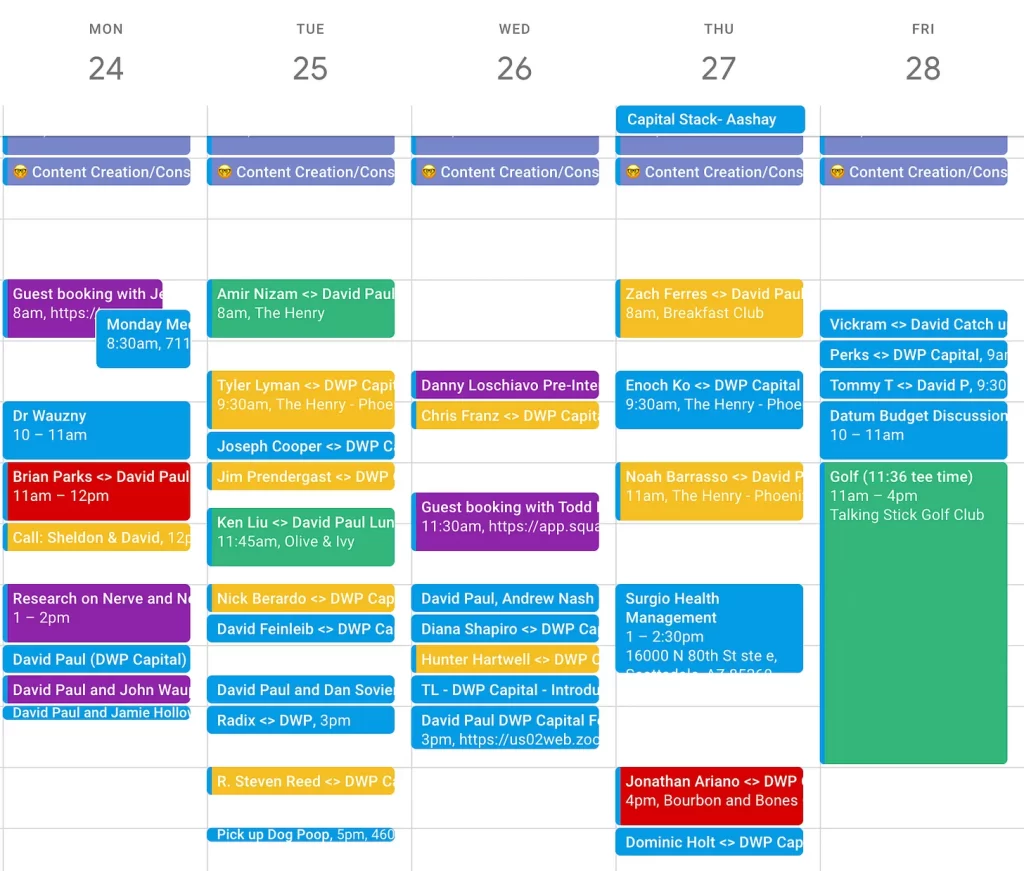

I have learned that sets and reps are the keys to my success. Everyone wants to look like a bodybuilder, but no one wants to go to the gym consistently. Consistency and staying power have served me well. In that sense, I am optimistic for the future of myself as an investor and the wealth […]

Managing Deal Pipeline

One of the most significant focus areas as a solo GP is pipeline management. It is super easy for me to let my eye off sourcing and business development efforts. It is so easy to lose focus because there are so many other plates that I need to keep spinning to keep the firm operating. […]

Investor vs Investor Hating

One thing that I have noticed in the world of venture capital is “investor hating.” Investor hating is when one group of investors has a natural inclination to disenfranchise another investor. Admittedly, I have also been a perpetrator of this behavior. Symptoms of investor hating include measuring other investors’ track records, their ability to raise […]