My Insecurities as a VC

I have insecurities on my relevance as an investor compared to the successful SaaS operator turned VC. It isn’t very comfortable to admit that I’ve got insecurities around that, but it is true. The “been there done that” is a hard story to compete against. The other investor persona is the once investment banker, or […]

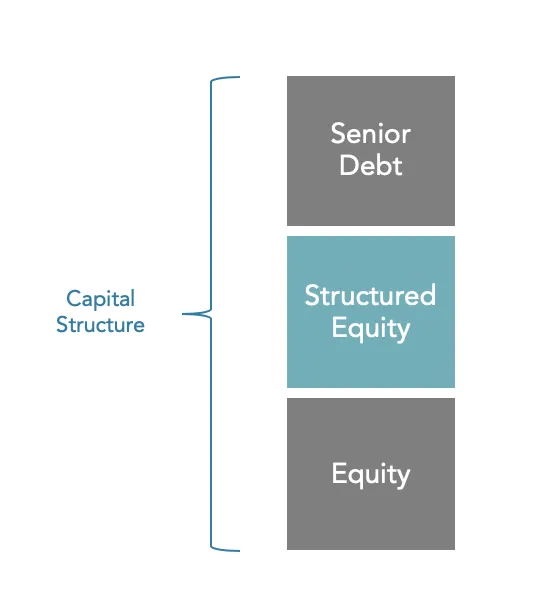

Structured Growth Equity – a Definition

I was talking to an independent growth equity sponsor a couple of weeks ago, and he dropped a term on me that I have never heard before – he told me that he provided “structured growth equity.” He told me it was growth equity with features baked into the financing, such as participating securities and […]

The DWP Perfect Deal Diagram

This week, I wrote a blog post about being frustrated about not finding a deal in 6-months that I wanted to do. I love writing because I can clarify my thinking and come up with essential principles or heuristics (my new favorite word) when it comes to evaluating and investing in early-stage companies. This concept […]

Finding the Right Deal Is Frustrating

It has killed me that I haven’t done a deal since August. I haven’t even issued a term sheet. Well, maybe half of a term sheet in a structured growth round (will explain in a later post). Our deal sourcing activities at DWP Capital are bearing fruit – we are seeing tons of stuff. In January, we […]

The Real Real Reason I Prefer To Sit on Company Boards

It is because I don’t want to get fu@#cked. I recently wrote an article about the “Real Reason I like to Sit on Companies Boards.” In the article, I spoke about how the knowledge of the company at the board level gives me insights on how to add value to the company through introductions, partnerships, […]

What Mike Prince From Billions Taught Me About Investing

Understanding My Impulses I watched the new Billions series the other day, and I heard a great line by fictional character Mike Prince. He said this statement while trying to corral his new employees of the once Axe Capital- “One of the secrets to being a great investor is recognizing the impulses that may lead […]

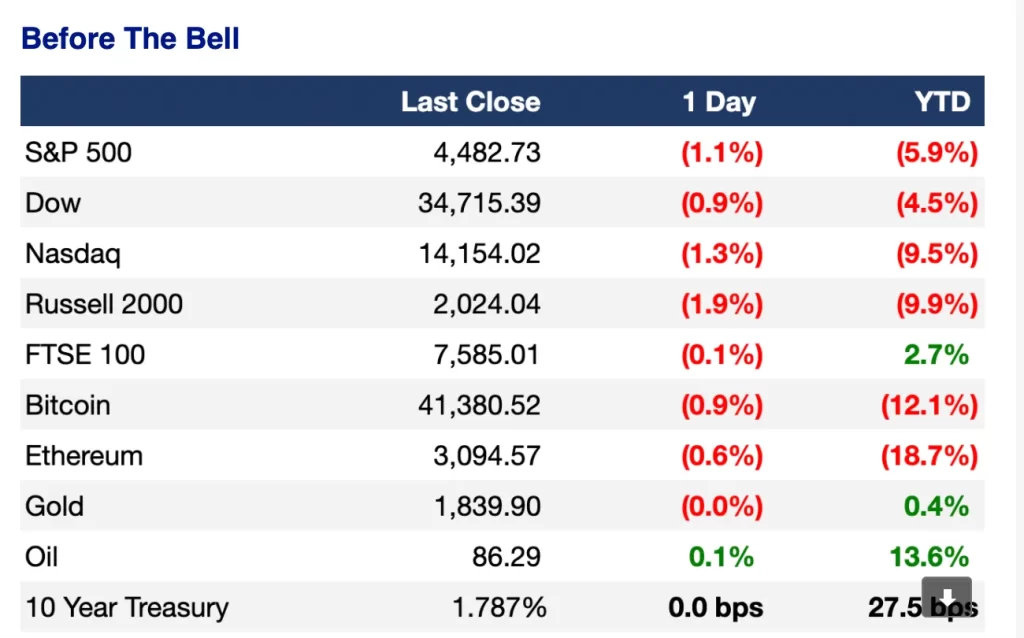

Ooof- Nasdaq in Correction Territory

Picture below from the Litquidity Newsletter. God giveth and God taketh away…. That at least is the current sentiment of growth stocks. We have seen some incredible volatility and sell-offs in everything technology-related. Where is money flocking? – it looks like Oil and more popular value names. I don’t believe that Charles Schwab and Exxon […]

Public Tech Re-Rating and Private Markets

There has been a big sell-off in tech in the first couple of weeks of 2022. Commentators are re-rating the risk of owning growth at the record-high multiples they displayed in 2021. This market volatility does not scare me away from tech in the slightest. The fed has to combat now 7% inflation, and the […]

Seed Investing Methodology in 2022

We all need a new lens. Cloud stocks are down 30-50% in the public markets. Private valuations have not yet been corrected, and the seed capital going into companies is at historic highs. Anecdotally I have heard that private equity re-caps and strategic M&A are ranging from 8x-10x. If this is true and seed entry […]

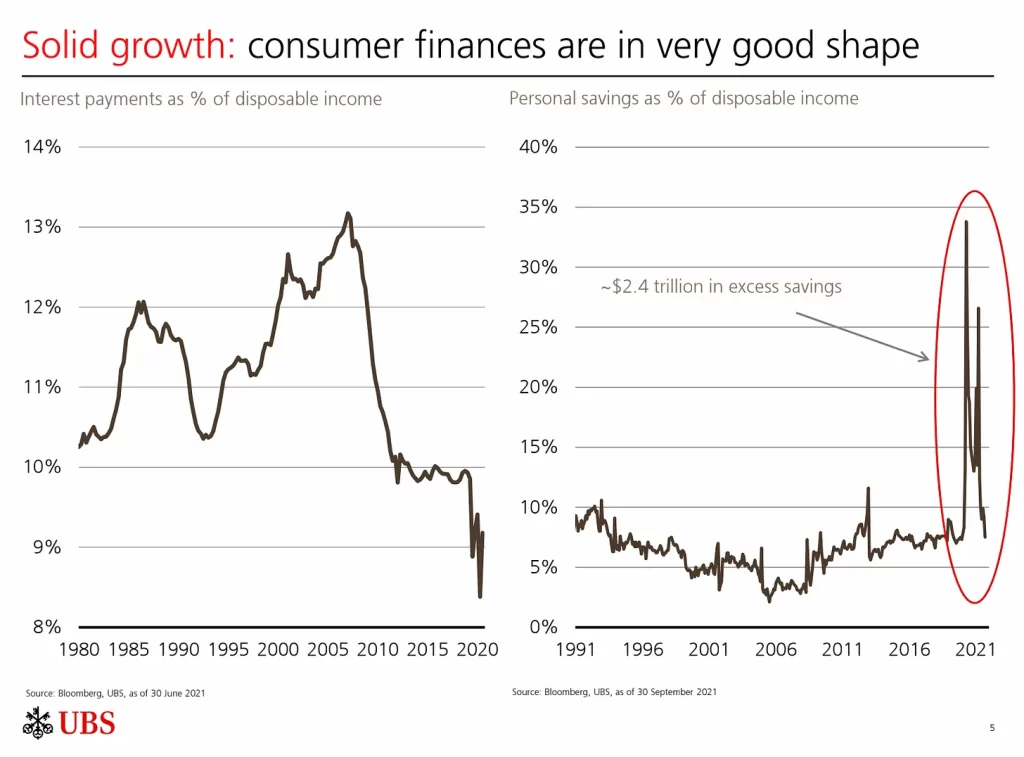

Breaking Down My 2022 Outlook from UBS Research

Despite what Yahoo Finance’s daily click bate articles say- I am bullish on the macroeconomy in 2022. But, first, I wanted to break down Goldman Sachs, and UBS analyst reports. Tons o’ Cash Consumers and businesses have massively deleveraged. The amount of savings and liquidity on the sidelines is staggering. This discretionary capital will result […]