How To Identify Existing Scalable Business Opportunities

Does your startup have what it takes to identify strong business cases, have ready-to-go customers on the products, and have high margins? In this episode of The Capital Stack, we have Will Caldwell, Co-founder and CEO of SnapNHD, a leading provider of natural hazard disclosure reports and real-time flood determination certificates. Will saw a business […]

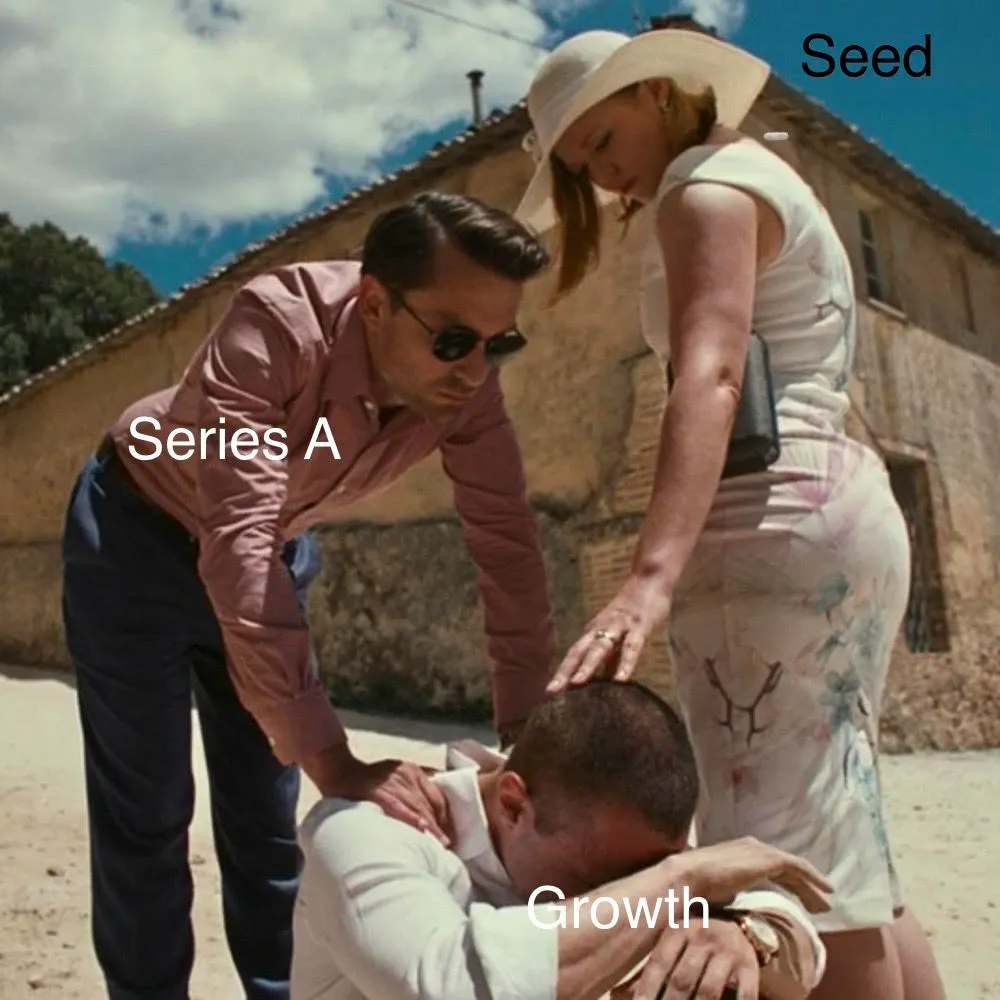

Mike Becker of Vocap Partners on The State of The Venture Capital Market

David Paul is joined by fellow venture capitalist Mike Becker, the managing partner of Vocap Partners, a Series-A firm based out of Atlanta and Florida, on this episode of The Capital Stack Podcast. David and Mike discuss how to pick and choose ideal companies for deals, the importance of VC / founder balance in value add, and […]

New Template Newsletters Blog Test With Link

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Dallas Bound and Institutional LPs (Are you in the IRR or AUM game?!)

I am sitting at the gate for my departing flight to Dallas at the Phoenix airport. This is my first trip to Texas this year and I am excited to see what the Dallas startup scene is all about. So happy to not have to wear a mask. I also bought a water at a […]

DWP at LIFT AZ (Institutional Investor Conference)

I took a suggestion to attend a conference this morning for institutional investors in Arizona last minute this week. I had to clear my existing schedule because this was the first chance to understand what limited institutional partners are looking for in fund managers. Raising institutional capital is not an immediate plan for DWP Capital, […]

Brian Parks of Bigfoot Capital on Early Stage Debt

I have a firm believe that early stage credit is going to be a feature not a bug in the next 18-24 months for growth stage companies. Valuation multiples are getting compressed and companies are going to need additional runway to get them to their next financing rounds or to profitability. I had a good […]

Buffet Gloats, Public Markets Abysmal, and Craziness in the Private Markets

The Berkshire Hathaway annual meeting occurred last week. Berkshire is up 7%, while the rest of the S&P is down 14%. From what I read, there was a lot of gloating going on. They criticized the retail investors as gamblers and identified Bitcoin and other cryptocurrencies as evil. But, as I like to say- everyone […]

Great Reads on 2022 Valuations

As a guy that listens to market “signal,” I find it fascinating how disjointed market consensus is on venture valuations. Everyone is in the opinion business, and it seems it is very much bifurcated. Some great reads on this have been from Mark Turck on the “The Great VC Pullback” and Tomasz Tunguz “The Three Eras of […]

Heading to San Diego to Deal Source and Network!

Today I am flying to San Diego for the Five-Ten-Thirty Cool Company Event. It is so good to get on a plane and travel for business. I have no idea how VCs were able to allocate capital doing zoom meetings during the pandemic. I’ve got a target list of companies I want to speak to, […]

VC, Angel Investing, Startups, Finance, Family Office

Welcome to Ramblings from David Paul by me, David Paul. I invest in growth companies. Sign up now so you don’t miss the first issue. In the meantime, tell your friends!