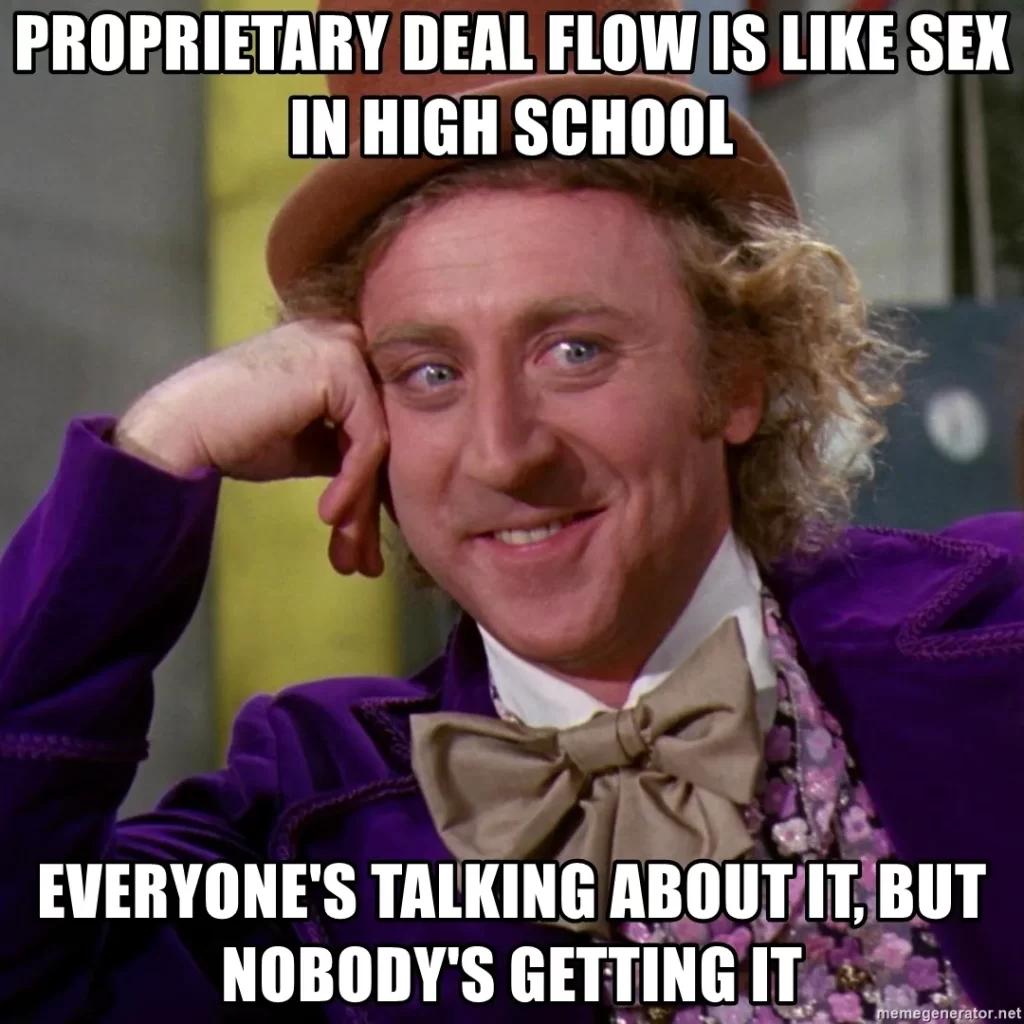

No investor likes to admit this, but lately, my deal flow has been abysmal. I had previously chalked this up to taking a year off from my career at Canal Partners before starting DWP Capital. I would coach myself that building a brand takes time. There is no shortcut to creating a meaningful deal flow pipeline.

I spoke to a fellow seed investor about my sourcing issues, and he commiserated with me and said he had had the same problems. He told me that from what he has heard from his investor network, this is a function of where we are at in the market cycle.

This flurry of cash has elevated mediocre companies to the desk of every seed investor. These same companies would have never gotten this far if it wasn’t for this artificial capital force buoying them up from failure.

Hopefully this market correction will cut the fat. The fat of both mediocre companies and mediocre investors.

This conversation has made me feel better – onwards.