by Varyam Gupta

Specialty pharmaceuticals refers to a branch of pharmaceutical care that deals with specialized, high-cost medications used to treat complex and chronic conditions. These conditions often require close monitoring, specific handling, and personalized patient support. They focus on providing medicine for treatments related to oncology, cystic fibrosis, arthritis, sclerosis, etc. Specialty drugs are often expensive and may require special storage, handling, or administration procedures and are injectable, infused, oral, or inhaled medications. Due to the nature of the medications it provides, specialty drugs are more expensive than normal drugs. In fact, on average, a specialty pharmaceutical patient incurs $50,000 in bills each year. This has made the industry a lucrative opportunity, making it the fastest growing segment under the pharmaceutical industry umbrella. Demand for specialty pharmacies is growing rapidly due to an increase in treatments available and patient life. The growing demand has incentivized larger players like CVS and Walmart to enter the market, making it much more accessible and easier for people across the country to access specialty pharmaceuticals.

The specialty pharmaceutical industry is expected to grow from $560 billion in 2021 to 861.67 billion in 2028 at a CAGR of 6.3%.

Over the past two decades, the specialty pharmacy landscape has evolved substantially. Many traditional pharmacies have transitioned into specialty pharmacies. These retail pharmacies can be broken down into three key types of providers: retail chains, independent pharmacies, and mail-order/online pharmacies. Retail chains include the likes of CVS Health, Walgreens, Kroger, etc. which have several stores across the country and have huge economies of scale. Independent pharmacies are smaller, local pharmacies that cater to a very specific region, while mail-order/online pharmacies are D2C firms that target convenience delivery to the customers. Retail chains are the largest of the three pharmacy types dispensing 138000 prescriptions annually, representing more than a third of stores and prescription revenues in 2021. Independent pharmacies, on the other hand, fill about 48,000 prescriptions per pharmacy per year. Mail-Order/Online pharmacies are still on the rise but have not seen a high penetration in the specialty pharmacy industry. While startups in this space have generated $3 billion in funding, they are facing competition from large retail chains like Walgreens who have created their own online pharmacies and integrated them into an omni-channel specialty pharmacy retail strategy.

Problem

The specialty pharmacy industry has seen increased market consolidation and vertical integration in the past decade. More importantly, the role of PBMs has increased significantly as they are vertically integrating specialty pharmacy retail businesses and gaining a stronger hold on the supply chain. PBMs have rapidly taken over retail pharmacies now and own over 70% of the entire specialty pharmacy market. This large inflow of investment has also allowed for more horizontal integration as the large PBM backed retail chains are acquiring smaller retail chains. For example, from 2010 to 2021, CVS and Walgreens acquired a total of nearly 5,000 pharmacy locations, including CVS’s acquisitions of 1,700 Target pharmacies and Walgreens’ acquisitions of 1,900 Rite Aid pharmacies. In such a scenario, it is becoming increasingly tough for independent specialty pharmacies to compete with the retail chains.

Independent specialty pharmacies are a fragmented market, making it even more difficult for them to provide ample competition to large retail chains. Many of these pharmacies, due to increased competitive pressure, have remained viable only through effective collaboration with other independents and wholesalers. This cooperation has taken the form of administrative, operational, and other business management support from wholesalers, pharmacy service administrative organizations, and group-purchasing organizations. These methods, while effective, are not sustainable in the long run. Instead, the key for independent specialty pharmacies to compete in this industry would be to minimize cost and increase efficiency, while at the same time differentiating themselves by providing more personalized care. In contrast to the national chains, independent pharmacies can bolster their position by further personalizing care, especially for high-touch consumers. While their smaller scale may have traditionally been seen as a challenge, independent specialty pharmacies have the opportunity to leverage technology and software to improve their operating margins and build upon their moat of differentiated personalized care at the same time.

In addition, it seems like consolidation in this market has peaked as these retail chains are also shifting their focus to improving operating margins. Companies are announcing plans to reduce their footprint, for example, in 2019, Walgreens said it would close 200 US stores and in late 2021 CVS announced that it would “reduce store density in certain locations” and close 900 stores by 2024. This gives independent specialty pharmacies more room to grow and target regions where their competitors are unable to expand into.

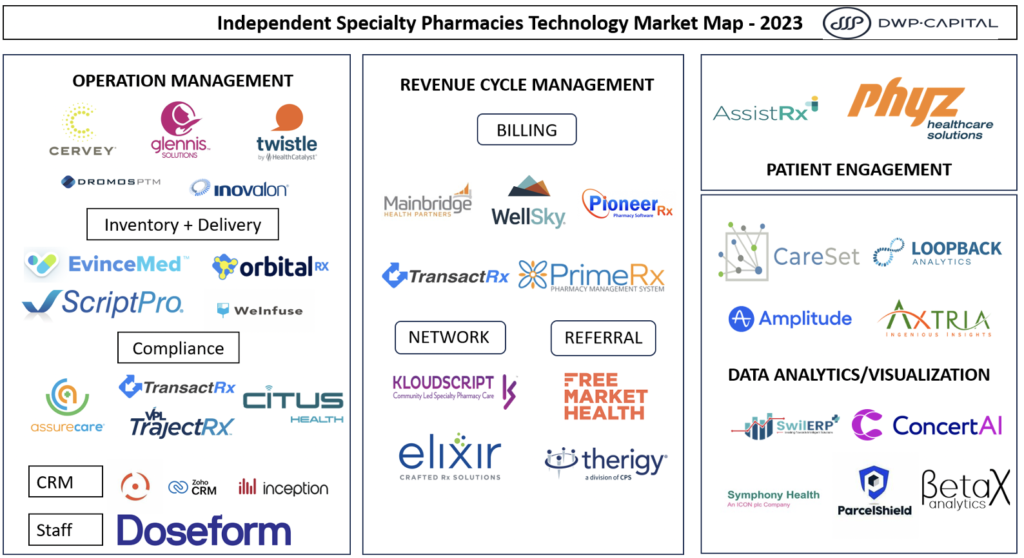

Capabilities

The B2B SaaS firms that are solving the key pain points of independent specialty pharmacies provide capabilities that can be defined under three categories: patient engagement, operation management, business intelligence/analytics, and revenue cycle management. Many of these SaaS companies lack a direct focus on one certain issue, rather they tend to bundle many capabilities as services they offer in packages. Therefore, a multitude of these companies offer a similar set of solutions in their bundle but have been categorized in terms of which solution they provide is unique from one another.

- Patient Engagement

These services help the pharmacies engage with the patients through online chat bots, telehealth visits, and interactive survey and feedback forms. Patient engagement can be further divided into two sub-categories, however, most players provide both services on their platform.

- Enrollment: the process of enrollment has traditionally been very slow and complex, resulting in a high attrition rate for pharmacies. This is why software firms like AssistRx and Phyz Healthcare Solutions focus on reducing the time it takes to onboard a patient.

- Post-Enrollment: these could be considered a roll-on service as they focus on ensuring that the patient is satisfied and has someone to reach out to if they need any immediate assistance. This solution is used specifically by mail-order/online pharmacies.

- Operation Management

This capability refers to the ability of helping the pharmacies manage their day to day operations. The focus is on maximizing efficiency and running operations without significant delays. Operation Management is an overarching capability, which can be further divided into subcategories. There are various firms that provide two-three of these sub-capabilities, however, there are very few that provide all of these.

- Compliance: softwares that helps independent pharmacies get accreditation and maintains the same. Some softwares also help in quality control and management, ensuring that the specialty medicines are handled correctly.

- Inventory: assists in ordering and maintaining inventory of specialty medicines. Since inventory is tricky for specialty pharmacies, companies like ScriptPro and WeInfuse provide it as one of their service components. However, there seems to be no specific firm targeting inventory management for specialty pharmaceuticals specifically.

- Delivery: is usually a B2C software that can be employed by pharmacies to customize and provide to their customers to help them order their medications at ease. On the B2B aspect, there are softwares that manage the delivery quality and speed.

- Staff: A niche capability with Doseform as the only large player, which helps match independent pharmacies looking for staff with trained pharmacists.

- Data Analytics and Visualization / Intelligence

Uses data, analytics and algorithms that gather data and disseminate it to understand the inefficiencies of operations, customer choices/behavior, and areas where the pharmacy can grow. Also ties in with Revenue Cycle Management, as most firms that provide this capability also help analyze revenue sources, cost breakdown, and profit margins.

- Revenue Cycle Management

This capability focuses specifically on managing the finances of the independent specialty pharmacy. Another key component of this capability is the partnership with PBMs and insurance providers that help co-pay the bills of the customers. It falls on the independent pharmacies to maintain tie-ups with these organizations to ensure that they can attract more customers by providing them better payment options and support. These can be further categorized into three:

- Billing: Mainbridge Health Partners, TransactRx

- Network: TransactRx, KloudScript, Elixir

- Referral: Free Market Health, Therigy

Conclusion

Hence, the market is witnessing a shift in focus from expansion to improving operating margins among retail chains, creating opportunities for independent pharmacies to grow in regions where their larger counterparts are scaling back. This strategic advantage allows independent specialty pharmacies to cater to specific local needs, ensuring a more tailored approach to patient care.

The emergence of B2B SaaS firms offering solutions in patient engagement, operation management, business intelligence/analytics, and revenue cycle management provides essential tools for independent specialty pharmacies to streamline their operations and enhance their services. By embracing these capabilities, independent pharmacies can not only survive in the competitive landscape but also thrive by delivering exceptional patient experiences and maintaining a strong foothold in the evolving specialty pharmaceutical industry. As the industry continues to evolve, the successful integration of personalized care and innovative technologies will be key to the sustained growth and success of independent specialty pharmacies in the years to come.

In the short term, operation management seems to be the most impactful capability that is available for independent specialty pharmacies as it will help them improve their operating margins. Patient engagement is a useful capability, but it may be more applicable to mail-order/online pharmacies who are unable to provide personalized services. Since independent pharmacies are built on the principle of personalized care and contact, patient engagement solutions may only be additive and not transformational for them. In the long term, however, it may be prudent for independent pharmacies to utilize business analytics and revenue management services. This is because it will help them further understand their customers and improve on their personalized care, generate more leads for partnerships and collaborations, and reduce administrative staff.

Ultimately, the specialty pharmaceutical industry is poised to grow with more treatments and complex medications coming in. As consumers are becoming more aware and open to the idea of specialty medicine, the demand will definitely increase in the coming years. While retail chains dominate the market, independent pharmacies are a fragmented, untapped market that is definitely here to stay. As these independent pharmacies are facing increased competition, they are being forced to look at software solutions that can help them remain competitive. Thus, it is a viable and lucrative investment opportunity to look at B2B SaaS companies that can help service these independent specialty pharmacies.