I find myself fortunate that I have been sitting on my hands from investing in the last 6-months. I wish it were to say that I am a market-timing genius, but I’m not. This year, I came very close to investing in some companies – trying to be a price taker and pay “market prices.” Unfortunately, my ego also was getting the best of me as I was very frustrated that I hadn’t written a check.

With inflation on the rise with no natural end in sight, the fed is ready and equipped to make some rapid rate hikes over the next few years. In an episode of the All in Podcast, Chamath Palihapitiya said that the median valuation for high-growth SaaS companies had been 7-8x over the last 10-years. He also pointed out that these valuations were priced at a near 0-interest rate environment. He proclaimed that one could argue that there can be a 30% correct in multiple for every 100 bps of increased interest rate. These statements, in my opinion, are pretty sound logic.

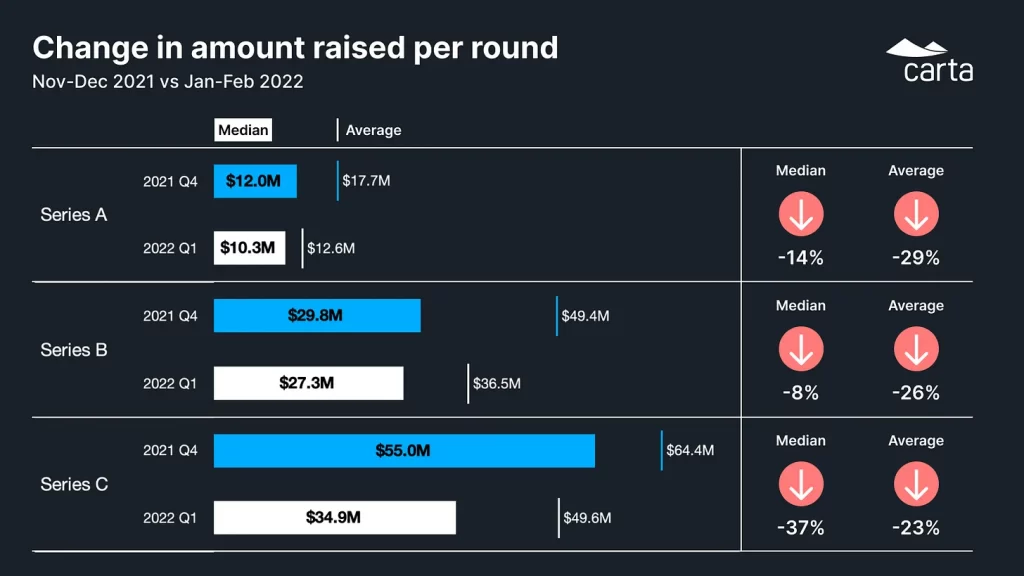

In Q1 of 2022, we are seeing a substantial pullback in valuations. Below is a chart is shown by Carta- full article here.