Everyone Is Getting Pucker Butt

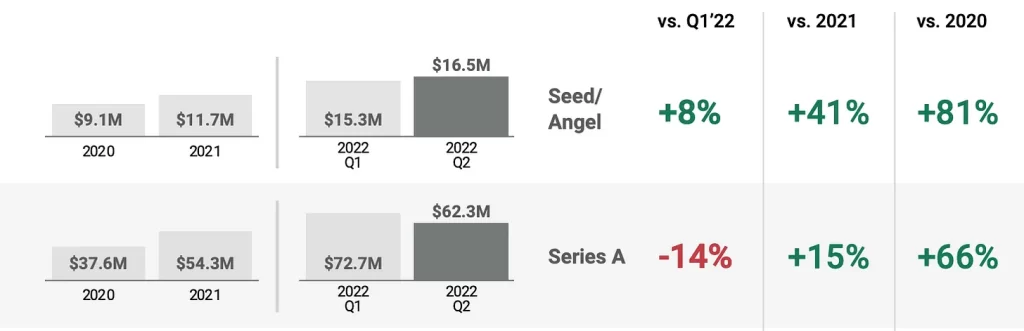

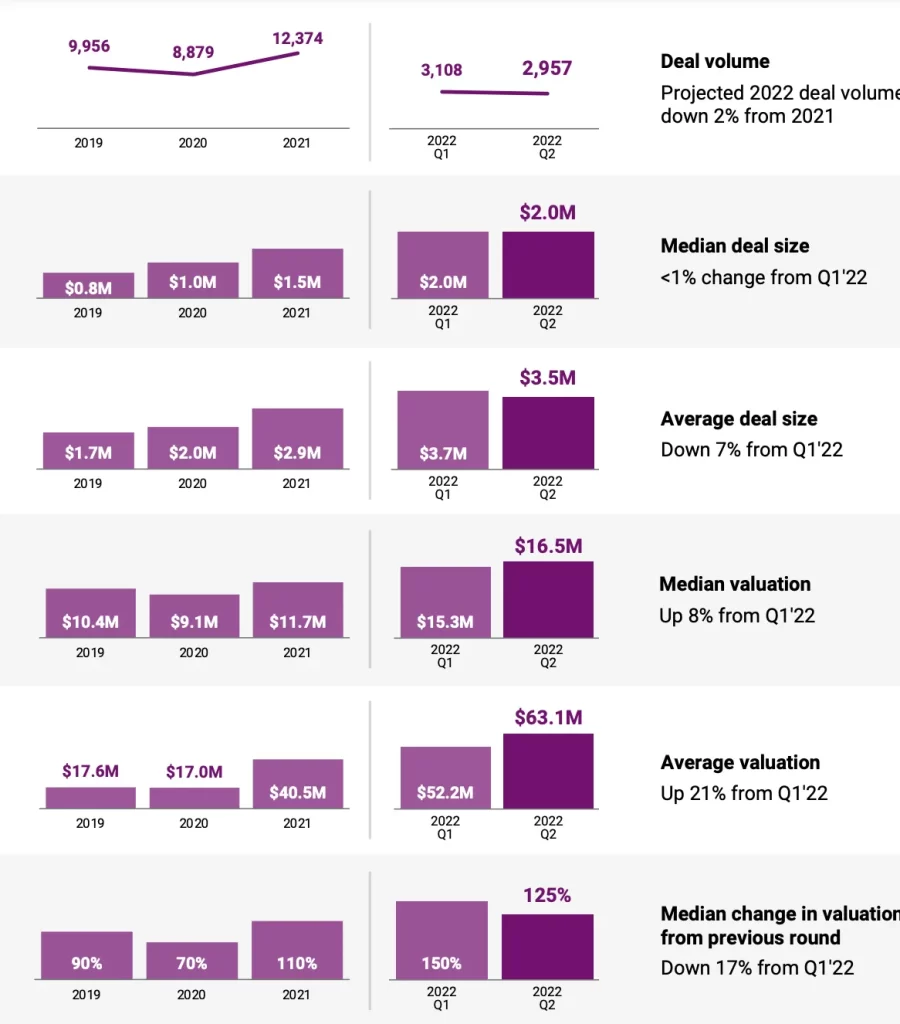

There are new valuation data hot off the press. Attached is the data from CB Insights- overall, I feel it is pretty accurate as I have seen comparable analyses from Carta and Pitchbook. I chose to highlight CBInsights as they have additional deal terms like liquidation preferences and dividends that I do not see in other reports. Here are the findings…

Early Stage:

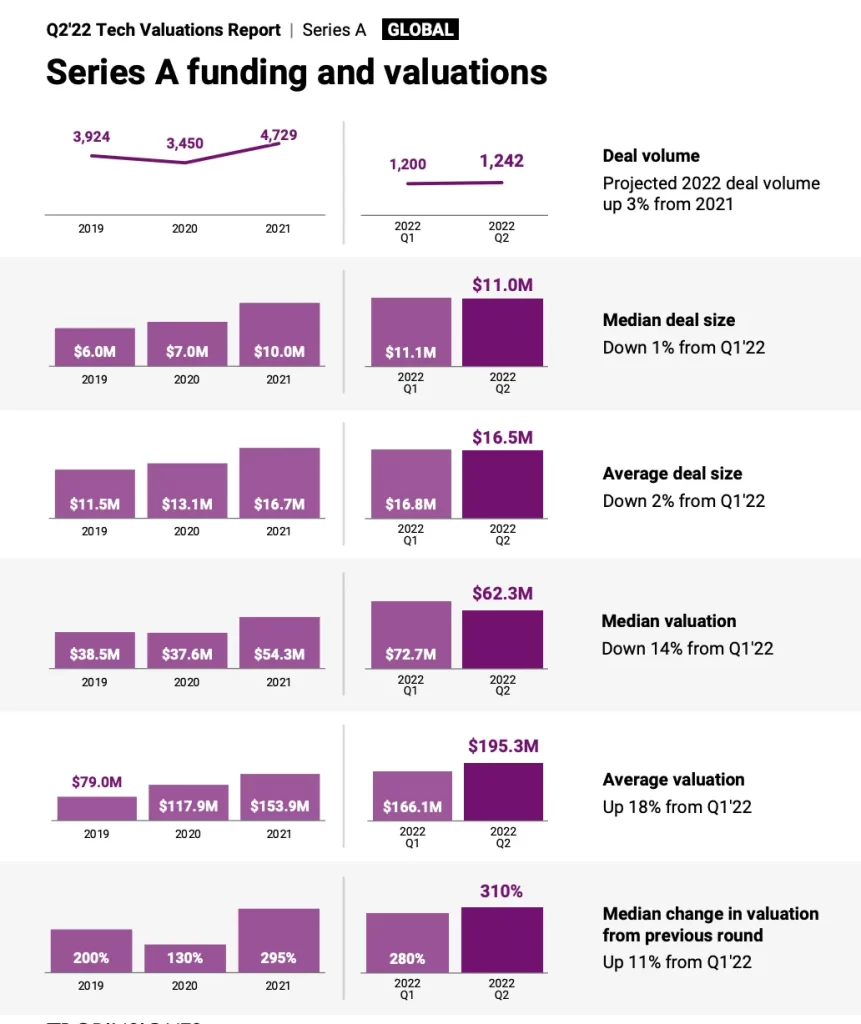

There is disjointing of raising activity and valuations in the early stage of venture investing. Overall Seed rounds are up marginally from Q1 of 2022 and up considerably from 2020 and 2021 numbers. At the same time, Series A has seen a more significant 14% pullback in median valuations.

Seed:

If we double click into seed, you will see that despite round valuations going up slightly- there is a correlation with round size going down by the same amount. One of the biggest highlights is the decrease in valuation change from Series Seed to Series A, which went down 17%.

Series A:

Median Series A valuations fell by 14% in Q2 from Q1 2022, while average valuations went up 18%. This is due to the non-distributed outcomes of ventures with more minor data points having much larger valuations bringing the average up. For conservatism in my investments, I always look at the median over average. As a result, the medium and median deal sizes remained relatively flat in Series A.

Takeaway:

Series A feels the effects of the late-stage pullback, and Series Seed is soon to follow. Despite the comments that “there is so much capital out there.” Everyone is feeling much more pucker butt.