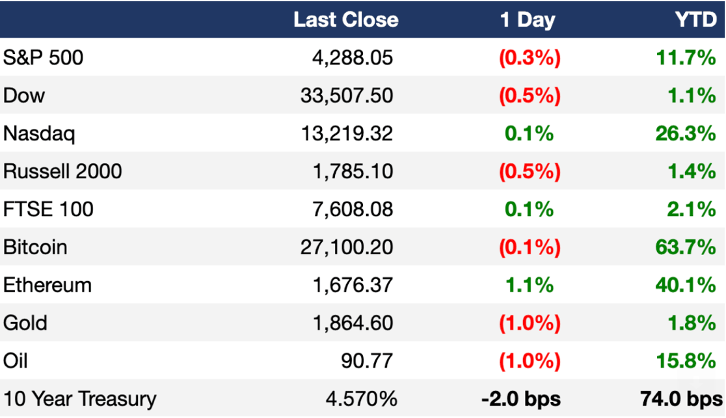

Public Market Overview

In the world of public markets, these are turbulent times. Macro volatility and the Federal Reserve’s ever-shifting stance on interest rates have everyone on edge.

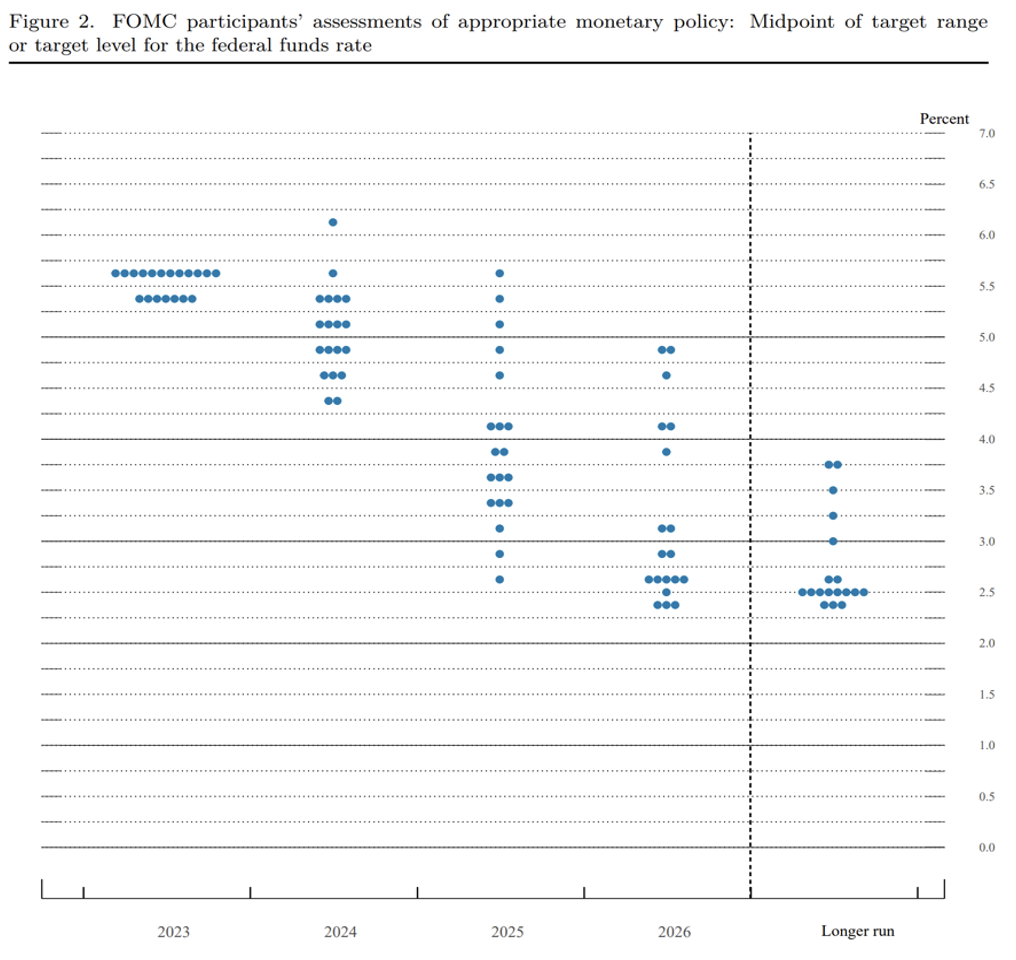

Q3 brought a surprising surge in GDP, clocking in at 4.9%, well above expectations. However, doubts persist about the effectiveness of interest rate policies. Jerome Powell, the master of saying much while revealing little, keeps us guessing. The 10-Year Treasury yield dances around 5%, and predictions on rate cuts remain divided. Check out the dot chart below for the FOMC’s take on rates through 2026.

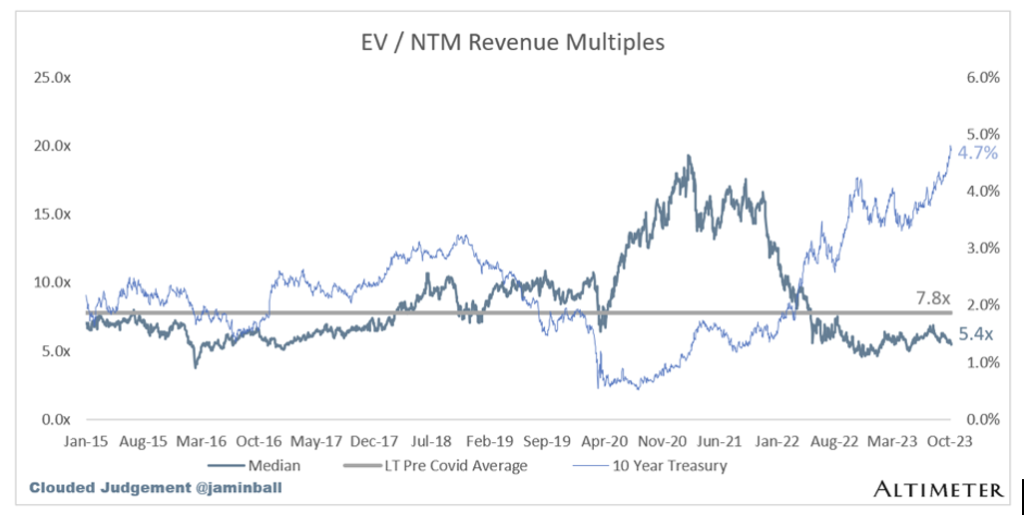

Q3 earnings, particularly in the cloud sector, unveiled a continuing slowdown in cloud spending. Enterprises are tightening their belts, aiming to optimize spending and streamline vendors. While many tech giants believed they were emerging from this phase last quarter, it’s clear that they’re still in a contraction cycle. Valuations, too, feel the squeeze. Inflation and higher interest rates are hard to ignore.

Regarding SaaS valuations, the median EV/NTM now stands at 5.4x, down from 6.0x last quarter—a nearly 30% discount from the seven-year average of 7.8x EV/NTM. Most of these software companies aren’t turning profits and aren’t the primary drivers of NASDAQ growth. Instead, giants like Apple, Facebook, Nvidia, Google, Microsoft, and Tesla have been holding up the fort. Yet, even these giants are showing signs of vulnerability.

Private Market Overview

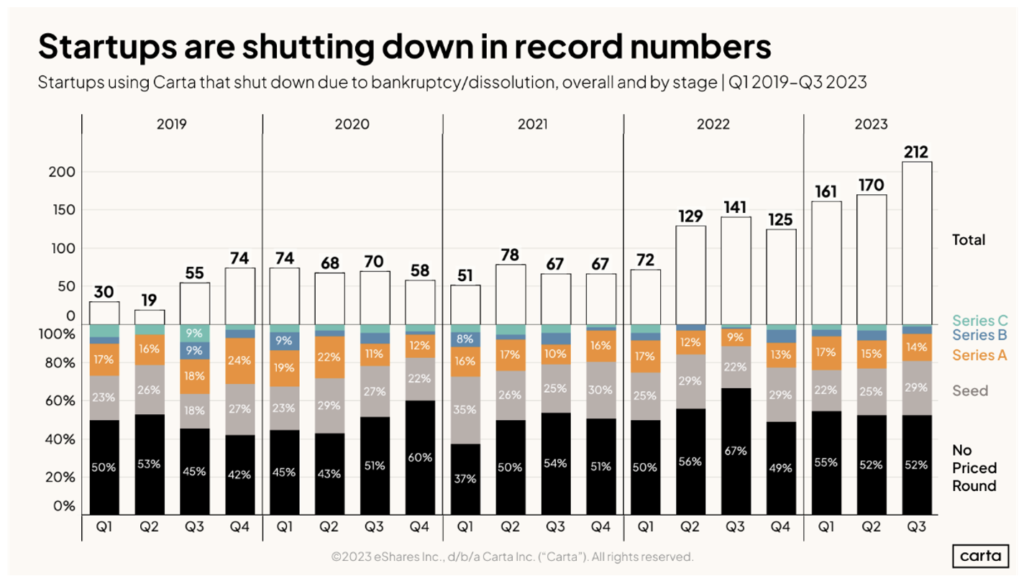

Valuations have reset across the board, with the exception of the hottest “ventury” generative AI deals. Carta has noted a significant uptick in startup closures, and companies are warming up to down-rounds and structured equity to manage the realities of mismarked stock prices in the private market. Two data points caught my attention:

- Compared to the first 9 months of 2022, total fundraising in the first 9 months of 2023 is down 52%.

- 543 startups using Carta cap table have shut down through the first 9 months of 2023.

The private limited partner market is also feeling the pinch due to a lack of distributions. The absence of recycled funds is hampering new fundraising efforts. Many high-net-worth individuals I’ve spoken with are in “harvesting mode” and aren’t eager for net-new deals, especially when cash can yield 5% via 10-year treasuries.

What compounds the startup market’s challenges is the scarcity of deals despite committed capital. Most investors I’ve conversed with are anxious about the milestones needed for the next round of financing.

Deal Flow Update

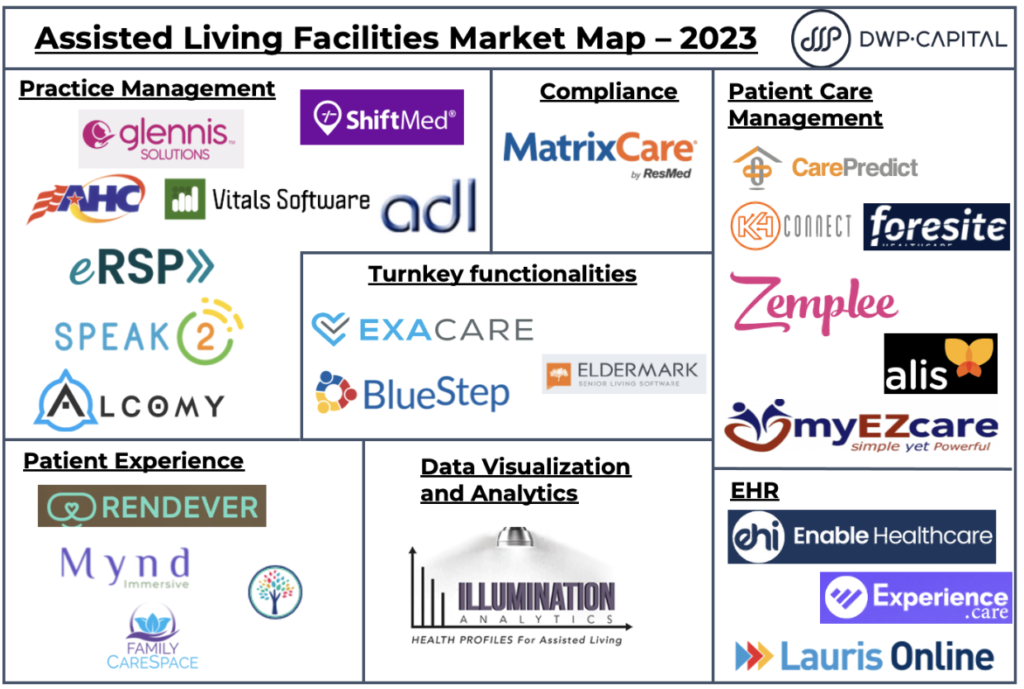

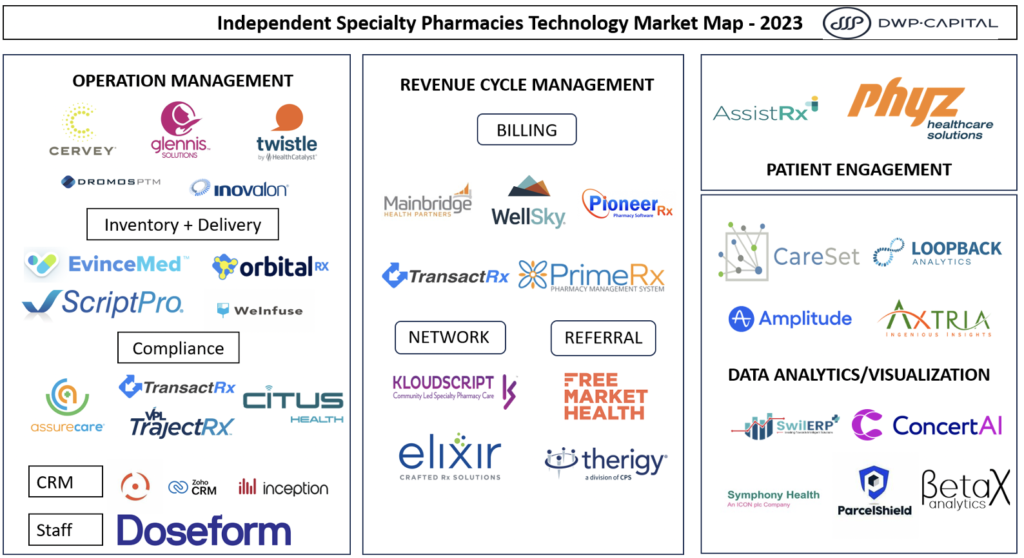

We’ve previously discussed two key thematic areas—the aerospace and defense supply chain market, and the ambulatory and in-home infusion industry. To bolster our insights, we’ve launched a rigorous 90-month internship program with talented Ivy League undergrads, focusing on market analysis and mapping. So far, this initiative has yielded significant value.

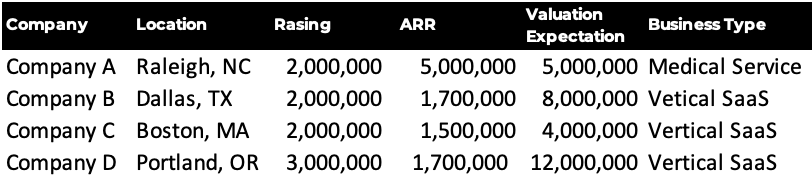

Deal flow is gaining momentum, and we’re encountering higher-quality opportunities that align with realistic valuations. In Q3, we screened 52 opportunities, with five still in active engagement or follow-up. Below, we highlight some companies currently undergoing due diligence.

Despite these market fluctuations, our unwavering goal remains unchanged: we aim to become long-term, multi-decade generational investors. We are dedicated to uncovering the most promising companies and delivering substantial returns to our limited partners. We see market volatility as an opportunity to discover hidden gems that others may overlook.