This week, I reflected on the angel investments I made earlier in my career. These opportunities were before I started writing much larger checks and raising money from limited partners.

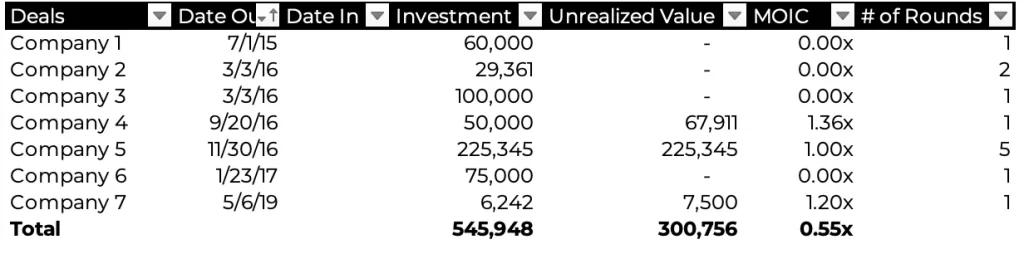

My angel investment performance is abysmal, reaping 0.55x unrealized MOIC. There, of course, is a story behind each of the companies, but I could say there is one primary reason I invested in them – they were “relationship deals.”

I define a relationship deal as an investment decision that I have made that was based more on my desire to be “in” with the lead investor more than the actual merits of the company. As you can see by the list of companies, the results of this strategy speak for themselves.

Though they were terrible investments, I feel like they were my entry point to better deal flow, capital sources, and experience. Of course, there is nothing strategic about losing money, but this was my path to the venture capital profession.

Today I do not have the luxury of making bad decisions as my “track record” proves my value to limited partners. This is why I do not do relationship deals through angel investments. Primarily for the following reasons

1) I get lazy if I am writing small personal checks

2) It is a distraction from putting more considerable capital into companies and making a much more significant impact.

Luckily I’ve got a much better performance today in my VC portfolio- sitting at a 2.12X MOIC in five years. As long as I stay focused, disciplined, and stay out of relationship deals I believe I can get it to over 3.0x by year 10.