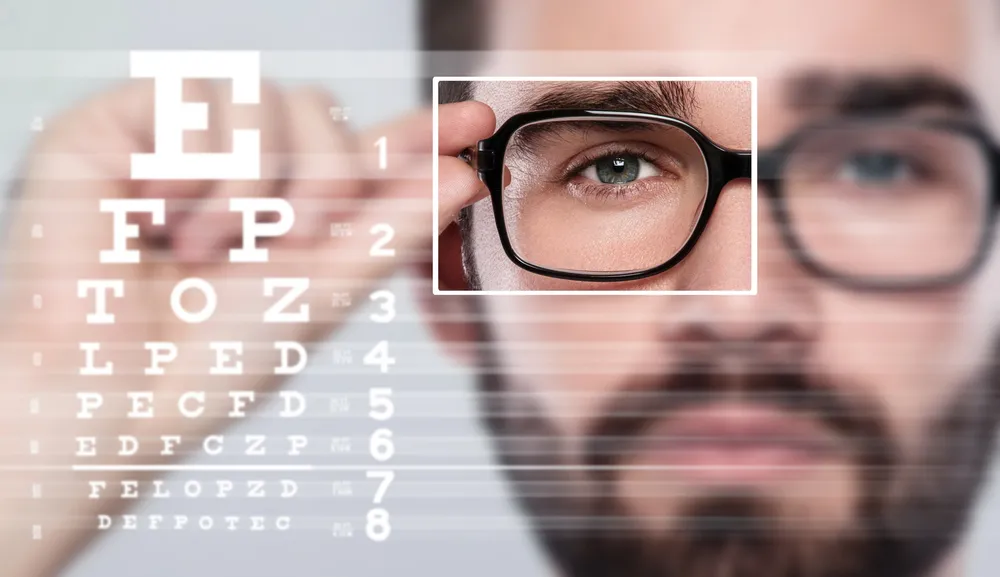

We all need a new lens.

Cloud stocks are down 30-50% in the public markets. Private valuations have not yet been corrected, and the seed capital going into companies is at historic highs. Anecdotally I have heard that private equity re-caps and strategic M&A are ranging from 8x-10x. If this is true and seed entry points are in the teens, then this is the most challenging asset class to make money.

As an investor that invests partially in seed deals, I find it very difficult to evaluate early-stage opportunities. I need a new lens to look through this layer of fog in the seed market. It needs to be a codified prescription to evaluate opportunities while blocking all the external funding noise.

I am going to go heads down in building this evaluation tool. I’d love to get feedback on this type of methodology from investors or founders out there.