By Tristan Lee

The aerospace and defense industry (A&D), which encompasses the development of aircraft, spacecraft, and military equipment, has been on an upward trajectory, particularly with record highs in United States defense spending spurred by global tensions and conflicts like the ground war in Ukraine. Advanced development, such as the integration of 8k imaging systems into drones and focused development of hypersonic missiles is a reflection of growing technological demands in the field. The global A&D market has witnessed substantial growth from $700 billion in 2021 to $855 billion in 2023, marking a compound annual growth rate (CAGR) of 7.5% during this period. Projections further anticipate that the market will reach $1076 billion by 2027 with a CAGR of 5.9%, highlighting both the industry’s continued innovation and the impact of geopolitical factors on market expansion.

In 2022, the United States held the largest defense budget globally, reaching $740 billion, and it is projected to grow at a CAGR of 3% per year. A significant portion of this allocation is dedicated to the military fixed-wing aircraft sector, which accounts for over half of the allocated capital. The increase in defense spending is attributed to the United States’ involvement in the war in Ukraine and heightened tensions with China; therefore causing a desire amongst global leaders to modernize their militaries.

Trends

Positive Drivers

Driving growth in this industry is an increased defense expenditure worldwide. The escalating defense expenditure in the United States can be interpreted as a strategic response to the shifting geopolitical landscape, predominantly fueled by China’s rapid military modernization and territorial assertiveness in the Indo-Pacific region, along with Russia’s continued invasion of Ukraine.

Hand in hand with the rising defense expenditure, there’s been a substantial demand for the development and production of advanced military aircraft and weapon systems, marking a significant focus on maintaining military readiness and superiority. Concurrently, the commercial aviation sector is also witnessing a resurgence. Following the decline in air travel caused by the COVID-19 pandemic, the industry is seeing a strong recovery, with airline ridership in 2022 reaching 94% of the levels observed in 2019 (United States). With the economics of this sector returning to stable levels, there is now a large market that must be satisfied.

Technology is advancing in many sectors, and artificial intelligence (AI) and machine learning (ML) are revolutionizing the operational landscape, especially in aerospace and defense. These technologies minimize risks and streamline costs by providing predictive analytics for maintenance, which reduces unnecessary expenses and downtime. Additionally, AI and ML are enhancing defense by aiding in threat detection and strategic decision-making within supply chains. Therefore, the A&D industry is witnessing a significant transformation, with these technological advancements spearheading the innovation of increased efficiency, enhanced safety, and superior capabilities.

Negative Drivers

The aerospace and defense industry, despite its growth, is not immune to significant challenges, particularly in supply chain-related functions. A Gartner survey revealed that 47% of A&D companies faced a supply chain disruption in the past year, with each disturbance costing an average of $184 million. The primary causes for these disruptions were identified as demand volatility, transportation interruptions, and supplier bankruptcy. These findings spotlight the complex and delicate nature of the supply chain within the A&D sector and emphasize the urgent need for effective strategies to manage and mitigate these prevalent issues.

Aerospace and defense companies are facing significant challenges in attracting and retaining skilled manufacturers. These manufacturers are often older individuals and are retiring with few new manufacturers to replace them. With a limited talent pool and heightened competition, fulfilling and retaining employees for these roles is becoming increasingly difficult. Employees in the manufacturing field often possess specialized skills, and it is critical to secure top-tier talent in order for these companies to build their specialized products. However, due to competition from other sectors and within the industry itself, there is substantial pressure to offer competitive compensation packages.

Incorporating new technologies can be difficult for companies in the aerospace and defense sector. Incorporation requires substantial capital and time, and by changing how things are done, staff often requires retraining. This can be a monumental task in a field like A&D where everything must be performed precisely and reliably. However, companies could fall behind their competitors if they do not keep up with new tech. Therefore there is a difficult balance in dealing with the changes and costs that come with new tech, while also making sure they stay competitive in a fast-changing industry.

Many suppliers in the aerospace and defense sector have traditionally centered their operations around enduring partnerships with leading prime contractors. However, this model is becoming antiquated due to the inherent risks of over-reliance on a few major players. The Boeing 737 MAX’s production halt showcased this vulnerability, causing significant financial challenges for deeply invested suppliers and machine shops. Further intensifying the situation is the fact that a sizable portion of these shop owners, belonging to an older generation, are nearing retirement. This combination of factors emphasizes the pressing need for suppliers to diversify their partnerships and modernize business practices for greater stability in the face of evolving market dynamics.

The geopolitical tensions, including the ongoing conflict in Ukraine and China’s territorial ambitions towards Taiwan, add an element of unpredictability to the future of material flow for manufacturers in the aerospace and defense sector. These situations can impact global trade routes, availability of raw materials, and supply chain stability. Furthermore, manufacturers are tasked with continually reassessing their supply chain strategies to mitigate potential risks.

Supply Chain Breakdown

Tier 1 (Primes): These are the major aerospace and defense companies that have direct contracts with the end-users, usually governments or major airlines. They are responsible for the assembly and integration of final products. Examples include Boeing, Lockheed Martin, and Airbus.

Tier 2 (Major Systems Suppliers): These companies produce and supply major systems and subsystems (Class A parts) directly to the prime contractors. For instance, a company that manufactures the entire jet engine or avionics system would be a Tier 2 supplier.

Tier 3 (Sub-Systems Suppliers): These suppliers provide components and parts that make up the larger systems and subsystems (Class B parts) delivered by Tier 2 suppliers. An example might be a company that produces landing gear components or specific electronics for avionics.

Tier 4 (Component Suppliers): These companies manufacture individual components or parts (Class C parts), such as fasteners, bearings, or specific machined pieces, that are then supplied to Tier 3 or Tier 2 suppliers.

Tier 5 (Raw Material Suppliers): These are companies that provide raw materials, such as metals, polymers, or composites, used in the manufacturing processes of the higher tiers.

The Problem

Supply Chain Disruption

COVID-19

The COVID-19 pandemic caused a halt in air travel, resulting in a lack of demand for suppliers’ products. As a consequence, suppliers were struggling to cover operational expenses with minimal income, which led to bankruptcy for some businesses. Major suppliers like Boeing are vital in providing crucial materials to Chinese commercial aircraft companies. However, the Chinese air industry is currently operating at only around 29.4% of its pre-pandemic levels, indicating a significant decrease in air travel demand. The slow rebound of the industry has hampered its recovery process.

ECONOMIC

Suppliers in the aviation industry have been experiencing lower-than-expected profits due to high inflation rates. The increased costs of raw materials, production, and other operational expenses have put pressure on their profit margins. Furthermore, there are projections of an impending economic downturn, which could have a negative impact on the demand for aircraft and commercial air travel. During an economic downturn, consumer spending tends to decrease, and businesses may cut back on travel expenses, leading to reduced demand for aviation services. These factors highlight the potential challenges that suppliers and the aviation industry may face in the near future.

GEOPOLITICAL

The ongoing war in Ukraine combined with low supplier diversity has resulted in challenges for suppliers in sourcing raw materials, particularly those originating from the region. Materials such as neon gas, titanium, nickel, copper, and steel, which are crucial for the aerospace industry, have experienced irregular supply due to the conflict. The Ukraine/Russia region is a significant source of global aerospace titanium, accounting for approximately 50% of its production. Additionally, Russia supplies around 90% of the neon gas used by U.S. companies. The disruption in the supply chain caused by the conflict has implications for the availability and cost of these essential materials, potentially affecting the aerospace industry’s operations and production.

Market share of materials: indicating heavy reliance on the civilian market

Software Stack:

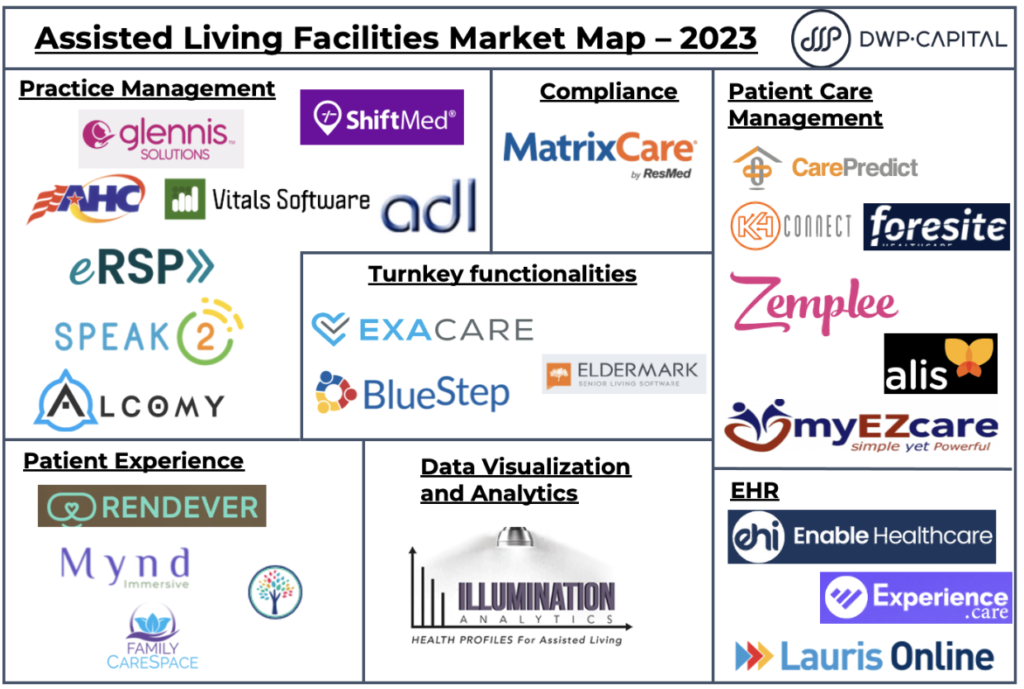

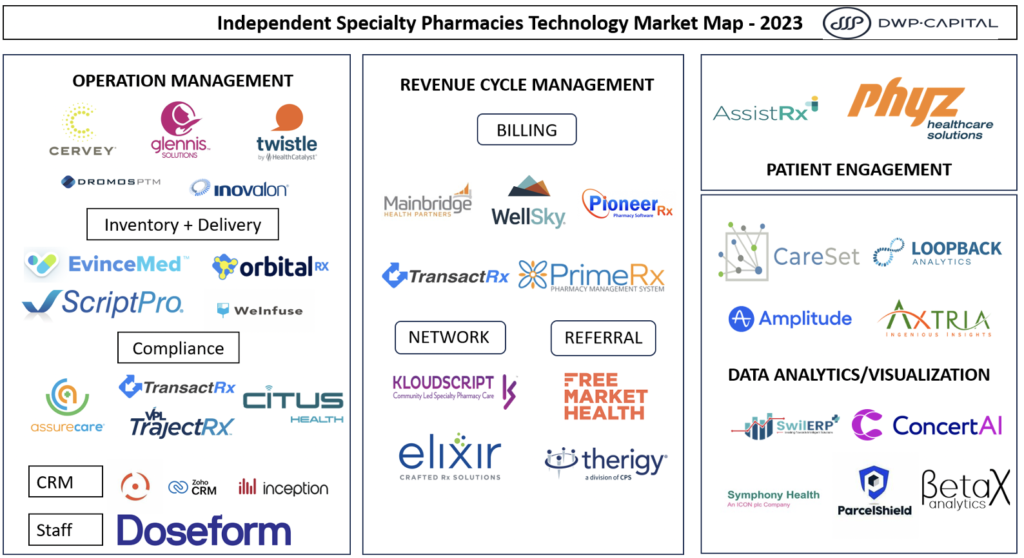

The aerospace and defense industry’s continual expansion and evolution are driving demand for new technological solutions. These solutions are systematically organized into sections due to their mainly horizontal, platform-based nature, each with specific capabilities aimed at addressing key challenges in the A&D market space. Per the above market map, these capabilities are grouped into three main sectors: ERP/data visualization for overall supply chain coordination, materials management for product creation and compliance, and risk management for enhancing security and predictive functionalities. This platform-based approach not only caters to the unique complexities of the A&D industry but also allows for the adaptability of these software tools in other industries, underscoring the widespread applicability and relevance of these technological innovations.

ERP / Data Visualization

The main software platform in the aerospace and defense supply chain, represented by Enterprise Resource Planning (ERP) software, acts as a comprehensive platform for overseeing every aspect of the supply chain. ERP software integrates various functions, such as procurement, manufacturing, accounting, inventory control, quality assurance, and compliance, providing extensive data visualization and management capabilities. This unified approach enables organizations in the aerospace and defense industry to coordinate efficiently across all stages of the supply chain, promoting quicker decision-making, agility, and alignment with the industry’s high standards for precision, quality, and timeliness. SAP and NetSuite are the current leading providers of these solutions.

Materials & Project Management

Materials and project management software encompass a wide range of essential functions, including compliance and quality management and mapping required materials for projects. Solutions include Product Lifecycle Management (PLM), Maintenance, Repair, and Overhaul (MRO), Quality Lifecycle Management (QLM), Manufacturing Execution System (MES), Material Requirements Planning (MRP), and data visualization enhancements. These capabilities can either present themselves as modules of ERP or as separate companies altogether. These tools ensure that products meet stringent regulatory standards and quality requirements, enable precise machining, and streamline design and maintenance processes. By integrating these aspects, the software plays a vital role in achieving perfection in both the end product and the timeline of its creation. In an industry that demands absolute precision and adherence to regulations, materials management software is indispensable in aligning processes, enhancing efficiency, and ensuring safety and quality. Examples of these providers include SyncFab, Duro, and Jaggaer which each offer well-rounded solutions.

Risk Management

Risk management and assessment in the aerospace and defense supply chains have been revolutionized by the integration of artificial intelligence and machine learning. These technologies enable continuous monitoring, identifying potential current or future issues, and enhancing supply chain security and stability. They also help address labor shortages by allowing more efficient allocation of human resources. Furthermore, the utilization of blockchain technology has bolstered secure file sharing, encrypting sensitive documents to ensure security within the supply chain. Together, these advancements contribute to more precise, transparent, and resilient operations in an industry where such attributes are essential. Solution provider examples in this sector are Fortress, Interos, and Cocoon Data.

Conclusion:

The aerospace and defense industry is witnessing substantial growth, that’s being magnified by unfolding and expected world events. Within this thriving market, the key avenues of opportunity include enhancing supply chain management and finding solutions to labor shortages. The labor shortage of skilled manufacturers does not have a clear solution as of yet, accordingly, the incorporation of artificial intelligence and machine learning technologies is emerging as a significant game-changer in this field, contributing to innovation and operational efficiency. All in all, early investments in these technological advancements could prove highly profitable, as they offer the potential to capitalize on the fast-paced evolution of this sector.