When you are an early-stage investor, you see pattern recognition in the technology landscape. What I mean by pattern recognition is that you start to see a recurrence of companies that are attacking a specific problem. Let us think of the problem these companies are trying to solve as the Death Star. A prominent, seemingly impenetrable ominous force that can destroy planets. These problems have to be big enough to attract venture dollars, and the solution to this problem is fuzzy and not solved.

It is increasingly important to understand why, in the latter of 2022 that these monolithic problems haven’t been solved. Are they as big of a problem as the founders state they are? Is it maybe priority 3 or 4? These are questions that must be well-defined by an investor and founder.

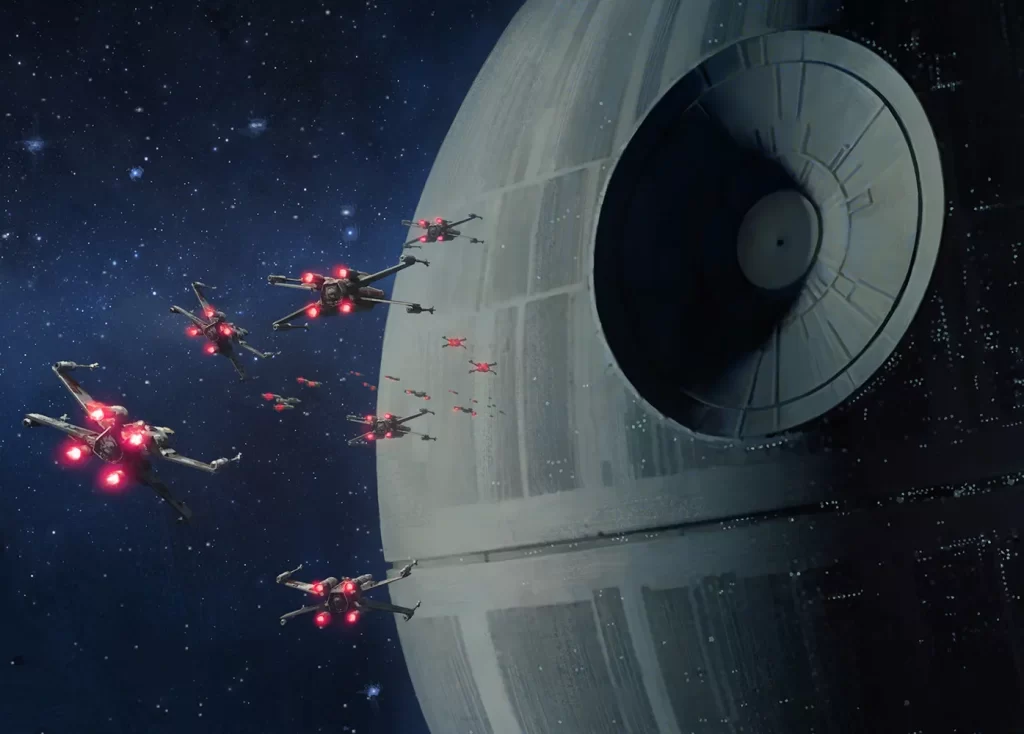

The next item to understand is who is also set out to solve this problem; what companies and business models are in the space? Again, using the star wars analogy, this can be presented as the rebel force sieging an attack on the death star. So there are x-wings, tie fighters, etc.

The final question is, are you the captain, and do you have the ship that will fire the proton torpedo in the exhaust port that will cause the chain reaction to destroy the death star? This is part of the analogy. I don’t think it is relevant, as it usually takes more than one company to remove a problem.

The point of these comparisons is that when looking at a company, it is essential to be aware of all the different competitors and business models trying to solve it. The process is very complex, and it is kind of like playing 3D chess.