One of the biggest positive founder/company heuristics that was taught to me in my early days of venture investing was how big a company has gotten in correlation to how much capital it has raised. It was a litmus test to how gritty the founder was, as well as how much desire the product had in market. In theory- this company’s efficient growth would continue and be amplified after investment. This later has proved to me not to be true, for a multiple of reasons, that I will cover in another post.

The idea of this post however is to discuss the bootstrapping phenomenon everyone is talking about. These mystical founders that are able to grow their company significantly without capital. I would first like to clarify that the definition of bootstrapping has changed in my time as investor- where it used to mean zero funding it now means light institutional funding. Whatever, the bottom line is, bootstrapping is what all the cool kids are doing.

The bootstrapped founder sounds sexy doesn’t it? People often discuss bootstrapping as if it’s an effortless choice compared to seeking funding. However, let’s not overlook the numbers. Hiring a skilled developer, unless you possess those skills yourself, would cost you at least $150,000. That could be

- One 150k customer

- Ten 15k customers

- 150 1k customers

- or any other variation

Being able to find build a product, find market fit, sell, and implement into a customer base is something that you will either have to do alone or with some contractors. In order to accomplish this you would need to have huge market pull for your product. It would literally need to be flying off the shelf effortlessly. This isn’t most businesses. The other way to bootstrap companies is to just accept that your growth is going to be slower over time. This is also okay.

What people do not tell you is that sometimes bootstrappers lose. They build their companies – have a great run till about $1-3 million and then another company that does exactly what they do comes in and raises capital. They are then able to build more functionality and lower the price using investor subsidy. They will force you out of the market and then raise the prices back up. It happens all the time.

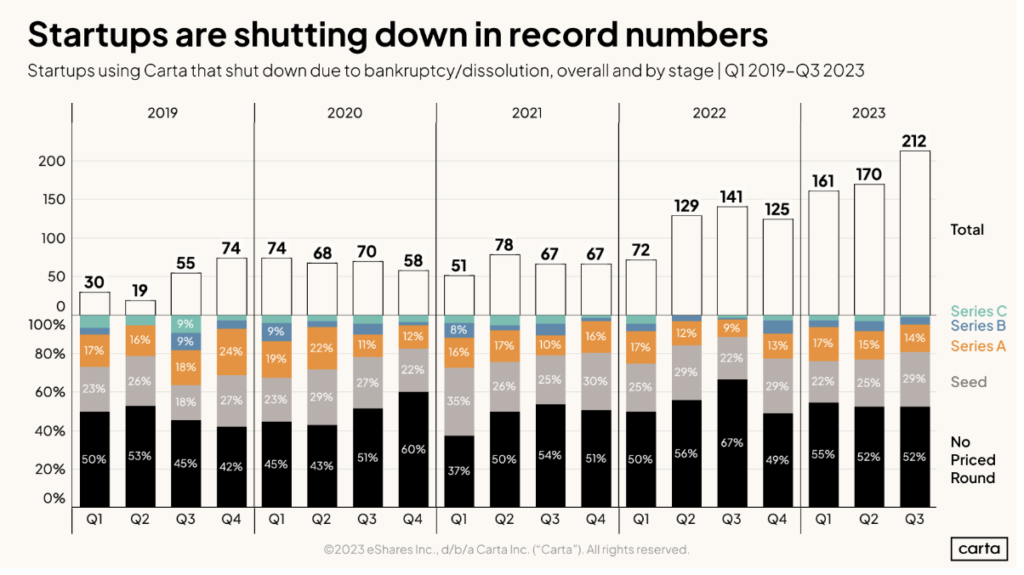

The key is to really understand the probability of this happening. The bigger the market opportunity the higher the chance that it will receive venture funding. That’s why I encourage founders to focus on a narrow niche and raise the minimum amount of capital until they achieve $5M+ in ARR. At that point, real market secondaries can step in and help mitigate the risks for founders, safeguarding their life’s work. This is only possible by taking early-growth equity.

In wrapping up, the journey of the bootstrapped founder, while draped in a cloak of coolness and independence, is not without its thorns. It’s a path that demands a mix of market savvy, a bit of luck, and a product so irresistible it practically jumps into customers’ laps. But let’s be real: this isn’t the story for most. The narrative often skips the gritty chapters of potential market ousting by better-funded rivals. This isn’t to rain on the bootstrap parade; it’s just a splash of reality in an often overly-romanticized tale. The smart play? Carve out your niche, keep your funding lean and mean, and aim for that golden 5M+ in ARR. Here’s where early-growth equity waltzes in, offering a lifeline to secure your hard-earned success without selling your soul (or equity) to the venture capital devils. Remember, in the world of startups, sometimes the tortoise’s strategy—steady, calculated growth—wins the race, especially when it’s turbocharged with a dash of early-growth equity.