Last week when I was in Miami, I had drinks with two of my favorite investors, Mark Groner and Jason Smith of Sopris Capital. Jason asked me off the cuff if I would ever consider specializing in investing in specific industries or verticals. The genesis of this question makes sense as Sopris Capital is highly specialized in healthcare investing both on the software and services side. In addition, their deep network and knowledge within healthcare have allowed them to become top decile venture performers.

My response was that I always envied their deep industry expertise, but my background has not lent itself to becoming an expert in anything in particular. Jason’s quite insightful response stated that that way of thinking is a circular reference. Further, if I never did specialize, then I would never specialize. I could not argue the logic.

Thematic investing I had always dreamed of investors much smarter than myself. I envisioned the cerebral ivy league investor frantically drawing graphs on a whiteboard to uncover emerging trends on which they wanted to place bets. Thematic investing was first marked by the founders of Accel – stating that one of their core values was to have a “prepared mind” for selecting companies.

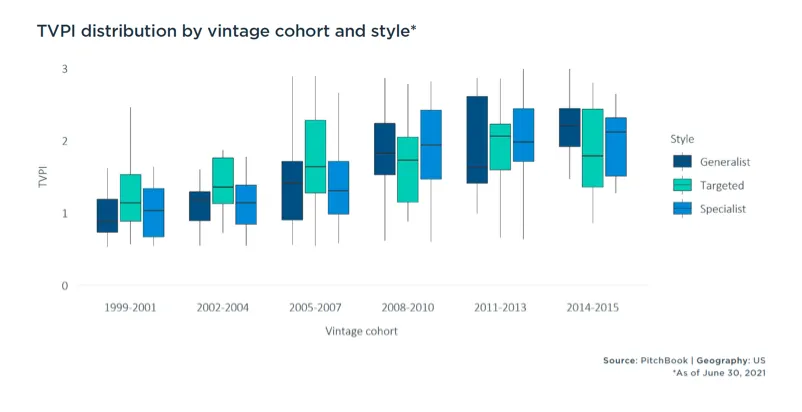

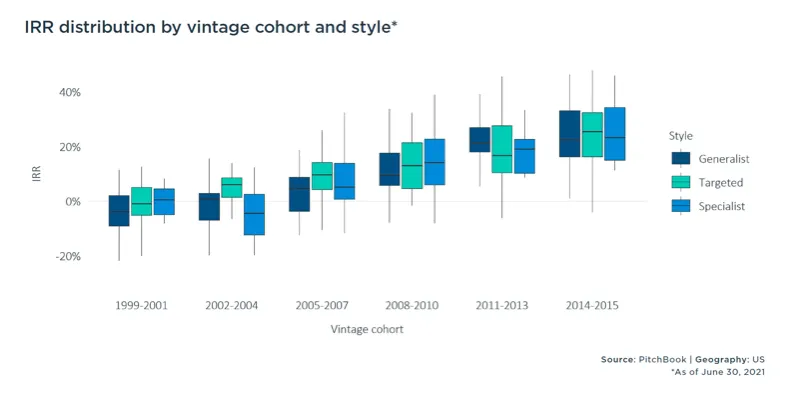

I have seen data that provides a counterfactual on the necessity to specialize. For example, in a study covered by Pitchbook, they used a sample size of 451 funds between 1996-2015 to compare the performance of generalists and specialists. In addition, Accel’s history is well documented in the book “The Power Law” by Sebastian Mallaby. They discussed that Accel’s specialization strategy did not fair better or worse than any other generalist fund in the early days.

My end conclusion is that specialization prevents one from making mistakes. Furthermore, it gives you the proper pattern recognition to select companies and accelerate post-investment through one’s network. The only drawback is that not investing in companies outside of your specialty might have an opportunity cost.

At the end of the day, I would say that I would rather be somewhere between a specialist and a generalist.