This week I flew to Phoenix for DWP Capital‘s annual investor dinner. I was completely humbled at the amount of high quality people that have come together to support me over the last three years after leaving Canal Partners. I have a lot to prove being on my own and that is not lost on me as an emerging manager. Below are some key factoids that I have learned through my screening of 250’ish deals this year.

Three Types of Early Stage Risk

There are fundamentally three risks in early stage investing. You can only mitigate and underwrite two of the three risks. You can never cover all three.

Management Risk:

Does the team possess the expertise to effectively execute a vision? The only definitive approach to ascertain whether the management team is adequately de-risked is if they have previously developed and brought a product to market, preferably on multiple occasions.

Oftentimes, founders hold the belief that their management team is exceptional, when in reality, this is often not the case.

Product/Market Risk:

Is the product stable and gaining acceptance in the targeted market to generate value? Firstly, having a functional product and a market willing to make purchases are prerequisites. This foundation is reinforced by the financial well-being of customers, their inclination to make purchases, and a market that exhibits sustained growth.

Pricing Risk:

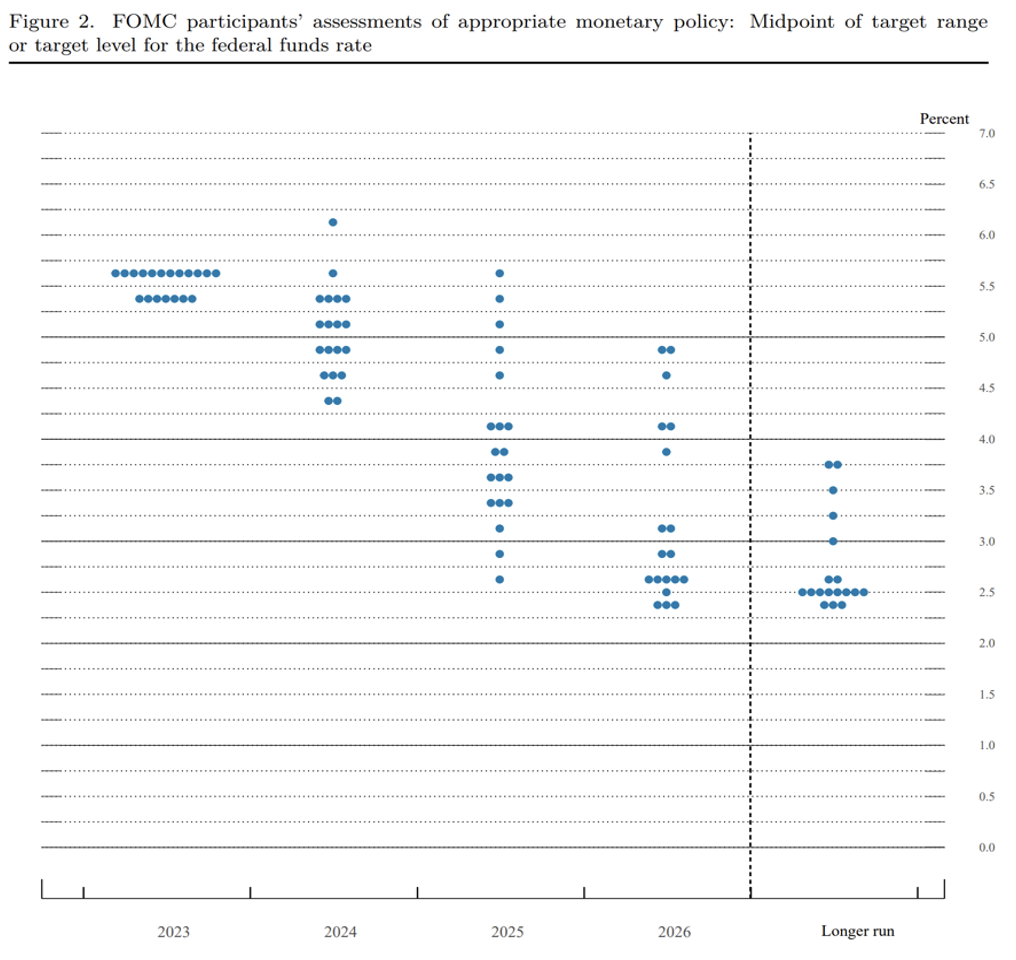

Are you entering at a price that justifies your desired risk-adjusted return? Occasionally, you may place your bets on a promising company only to find out it doesn’t yield a good investment. Valuation matters.

I generally never take price risk and am usually taking on management risk. This strategy is very difficult but I feel like the best management teams always flock to the tier one firms.

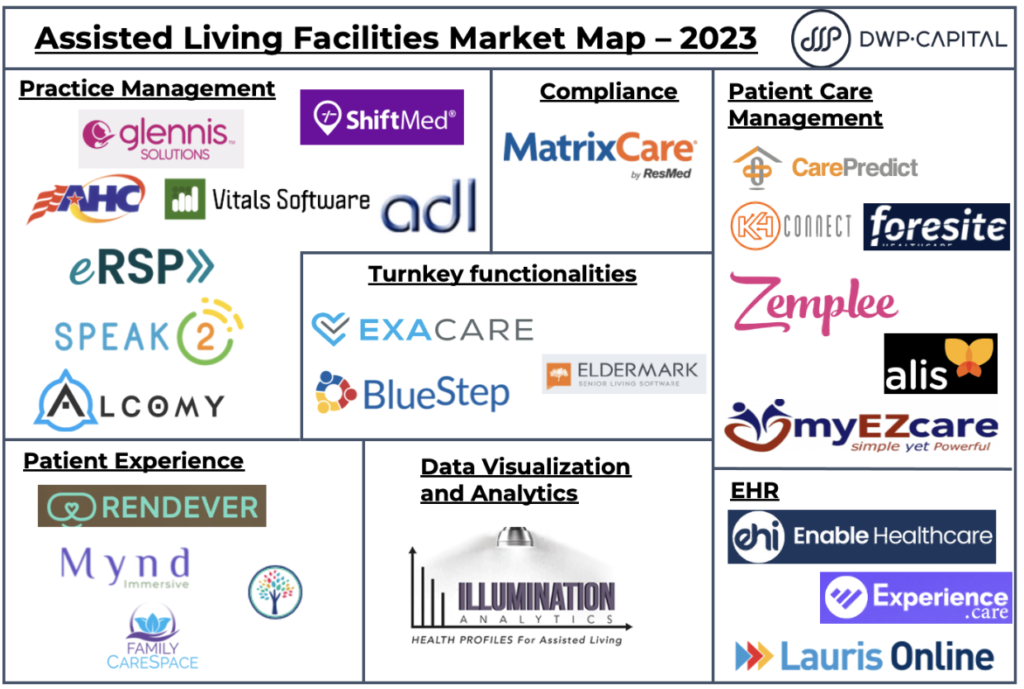

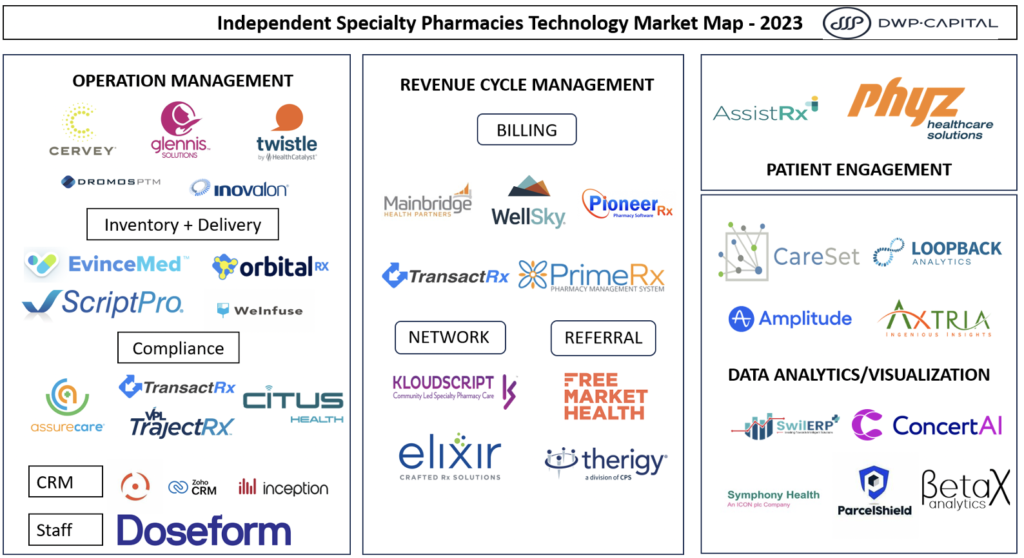

Platforms > Best In Class

- Software budgets are contracting (as of today).

- Software buyers are decision fatigued.

- Downstream capital wants platforms but will settle for bolt-on solutions.

- Identifying early-stage companies need to have platform potential.

- Mission critical/Workflow Embedded is a essential

Startups Die from Self-Destruction vs. Market Forces

- Understanding founders relationship with burn is paramount.

- Picking winning founders is the hardest skill and is often a lagging indicator.

- The grittiest founders are able to preserve enterprise value and return 1-2x on the downside.

Investing like any other trade requires years of mastery and I incredibly fortunate in my ability to continue to learn and grow with the help of my investing partners. Here is to another great year!