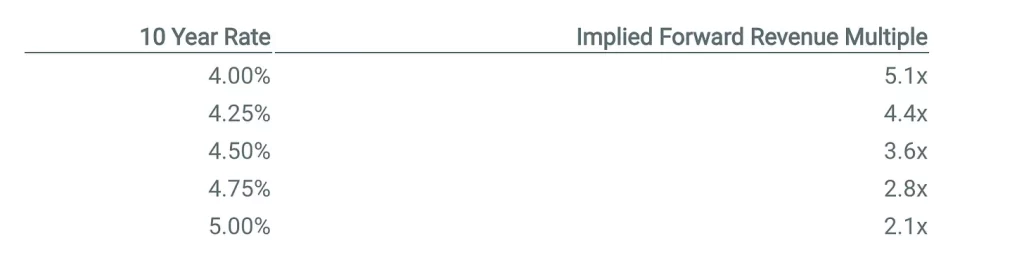

Tomasz Tunguz wrote a great article on the correlation between tech multiples and rising interest rates. He used the 10-year treasury as a proxy, which would be the antithesis of the growth market. The article can be found here. He stated that 2.1x NTM revenues if the 10-year treasury reaches 5%. It fell to 3.3x in 2016, by the way.

I am starting to feel like there can be some great opportunities within the next 6-12 months. Companies that have their eyes on economics with good retention numbers can accelerate in an environment like this. Chamath said something great in this week’s All in Podcast. The best returns were the funds that were incepted in downturns. You will write a check with a shaky hand, but if you pick right, you will be handsomely rewarded.