Emerging managers hate fundraising. It is a universal truth. “They just don’t get it” or “they aren’t sophisticated” I hear them say. It is true that high net worth individuals are harder to fundraise from just because of the fact that they write smaller checks and are sometimes unfamiliar with how it works. You need to be successful with HNWs before graduating to family offices and then finally to instituations.

Many emerging managers struggle with the misconception that high-net-worth individuals (HNWs) must invest in venture capital, particularly in their specific flavor, to achieve success. However, the actual numbers regarding VC fund performance reveal that it is not as outstanding as believed. It is important to understand that HNWs have alternative avenues for success and should not feel obligated to invest in VC.

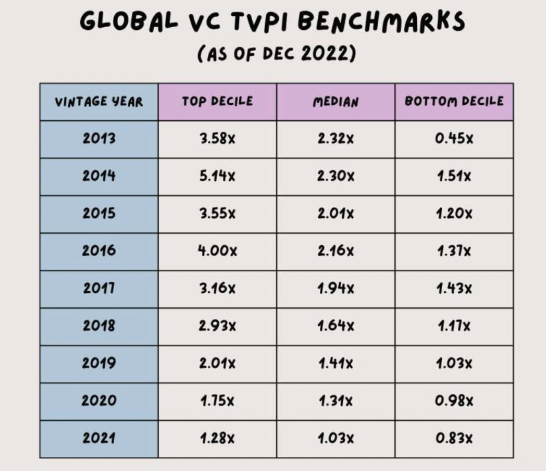

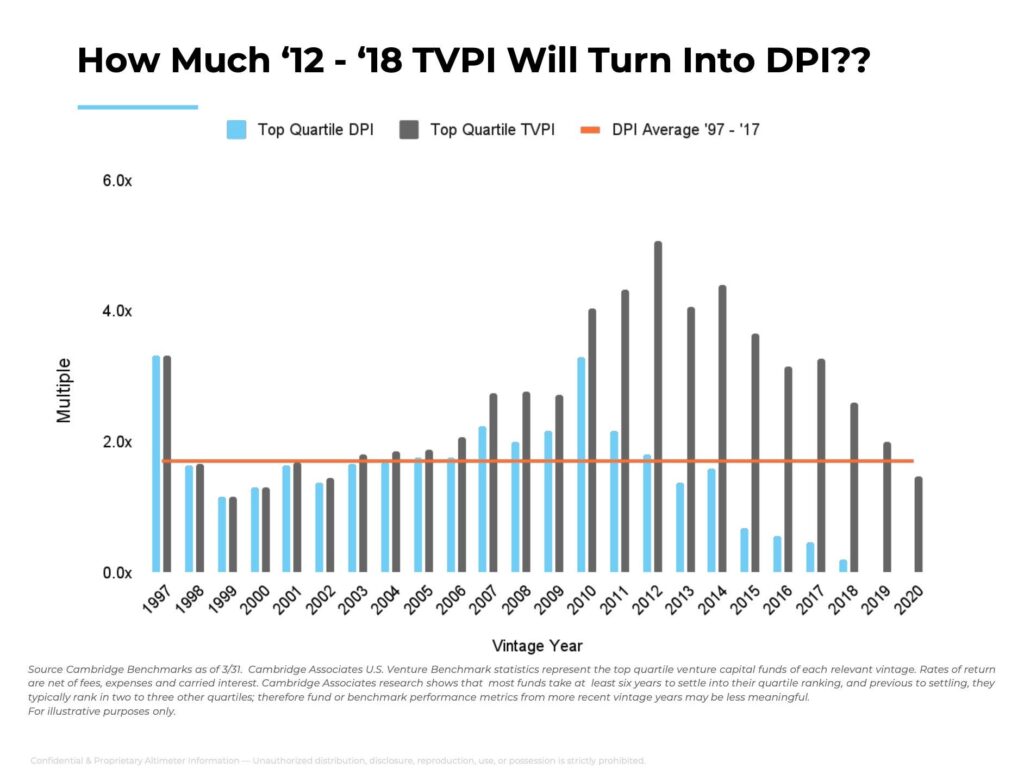

The data above presents the current fund vintages TVPI, which includes both distributions and unrealized values. Furthermore, we will explore the DPI (total disbursements) of top quartile venture funds in relation to their TVPI. Notably, as funds mature, these numbers tend to balance out due to the inflated unrealized marks towards the end of the fund’s lifespan, which can extend up to 12 years. In essence, one may initially believe they are making 3.5 times their investment in a fund, leading to excitement and subsequent reinvestment in multiple new funds. However, the reality often reveals that the cashed-out value of the first fund is actually only 2 times its original worth. This phenomenon can be considered the hidden truth of venture capital. In retrospect, it may seem that investing in the Magnificent 7 Stocks would have outperformed all VC funds, while also avoiding high fees and the risk of illiquidity.

Most high net worth individuals are unaware of this information, which does not explain why they do not invest. Although, it strengthens the case for not investing. The best-performing funds with a proven track record of high distributions to paid-in capital are typically inaccessible to high net worth individuals. These funds are usually reserved for large pension funds and endowments.

So why do HNWs not invest? It is simple. They do not trust the manager, and why should they? Generally they do not know the person until they are asking them for money anyway. That number is often pretty substantial. So what is the solution?

I’m uncertain if there is a definitive answer. Personally, I don’t manage dedicated VC funds. The method in which I invest doesn’t provide me with the necessary protections and sizable positions compared to the fund size I could raise. I don’t want my strategy to be dictated by the fund size; instead, I want my strategy to determine how I raise funds.