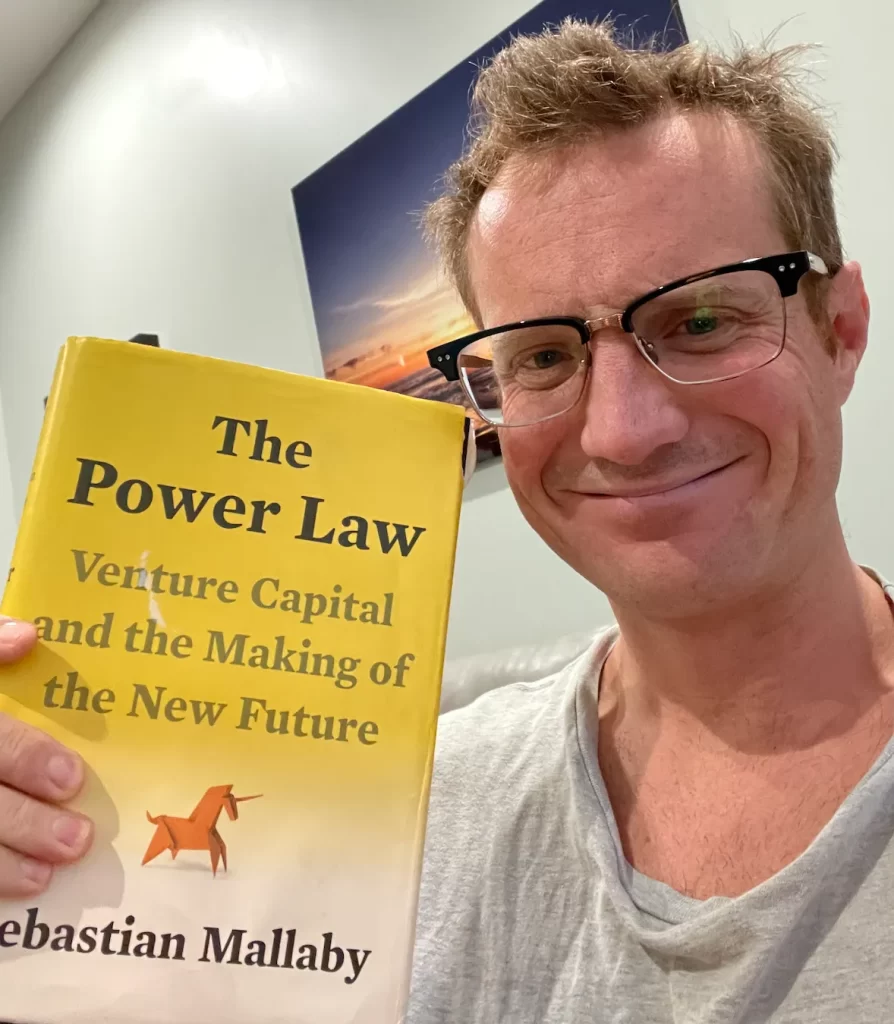

I just finished Power Law by Sebastian Mallaby, the complete story of venture capital. The book reaches back to the days of Arthur Rock and the liberation of the “Tretarious Eight,” who left their safe jobs at Shockley to start Fairchild Semiconductor.

The book was very informative to me as it gave me the history of all the significant VC firms and how the founders molded them into how they even invest today. Sequoia, Kleiner Perkins, Accel, Benchmark, Founders Fund, YC, SoftBank, Tiger Global, and a16z were all covered. It is interesting to see how it was a fight to differentiate themselves to founders even back then.

These investors and firms have made legendary impacts on the world and have generated billions of value for investors. But, interestingly, they all had different philosophies on how to interact with management teams.

Benchmark and Sequoia were known to want to replace founders with properly trained CEOs. On the other hand, the Founders fund and YC believed in backing the founders no matter what. Tiger Global and SoftBank believed in zero governance, no board representation, and stuffing as much capital into the companies as possible. Some of these firms are specialists, and some of them are generalists.

All of these firms have been correct, and they have been wrong. What is apparent is that there are plenty of ways to make money in this business. Bill Gurley said a deal happens when a market buyer meets a market seller. So what matters is that whatever you are selling your limited partners and your founders is the truth.