DWP Capital’s Deal Sourcing Extravaganza

I am sitting in the Phoenix airport, getting ready for a three-day trip to San Diego. San Diego is one of the main geographies I cover for DWP Capital deals. The three main reasons I have covered San Diego as a primary market is:

1) We have had success there with a previous investment in PetDesk. This investment gives us credibility with the local tech ecosystem. (We also have an abysmal failure in San Diego, which is always fun to talk about).

2) My summer house is in Carlsbad. It makes it pretty easy to cover a market when I am there for a quarter of the year.

3) There is an opportunity to be a significant seed player due to our check size and speed.

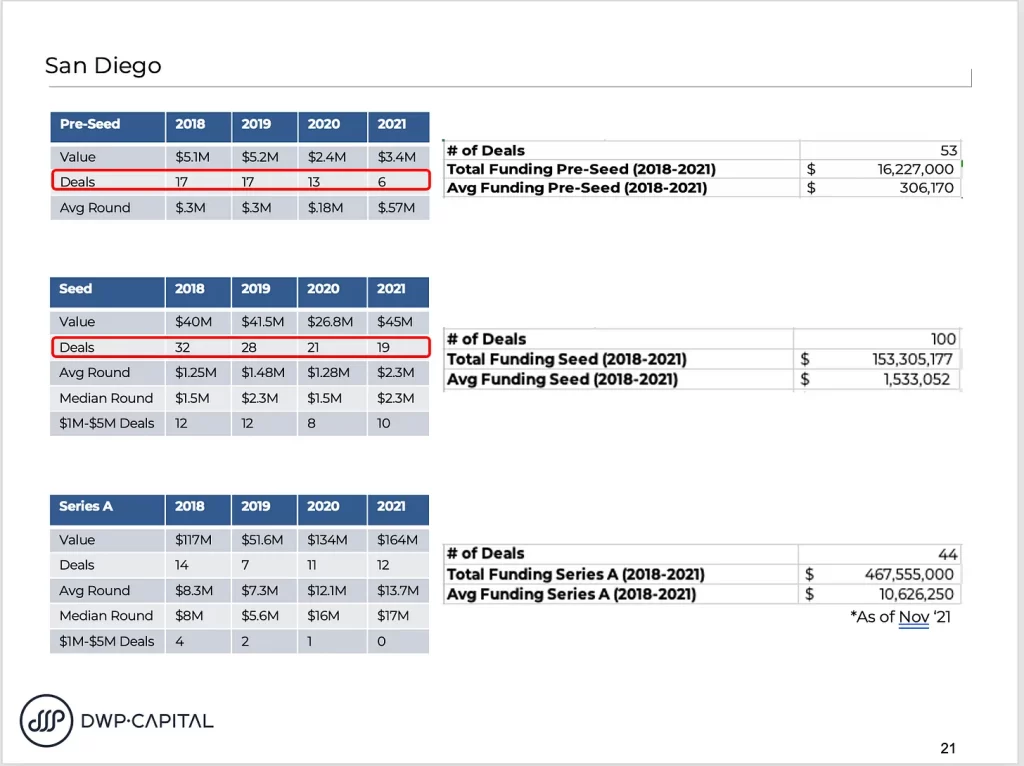

The chart below is data taken from Crunchbase in October 2021.

The median seed round is $2.2M as of the previously listed data, and we can write checks from $1-$3M; we can offer quicker, easier money to fill up around. This selling proposition is a theory and hasn’t been put to the test in competitive situations yet, but I am feeling optimistic about it from early conversations.

I’ve got 14 meetings scheduled over these three days, and that is after three cancellations due to COVID. Entrepreneurship is alive and well in San Diego. Hit me up if you want to grab a quick coffee or chat!